OBSERVATIONS

- Markets surged last week as President Trump expressed optimism for negotiating a trade deal with China, with the S&P 500 gaining 4.6% and small caps (Russell 2000) gaining 4.1%, while the yield on the 10-year Treasury lost 9 basis points to end the week at 4.24%.[1]

- New home sales increased to 724k (annualized rate) in March, which was above expectations and a 7.4% increase month-over-month (MoM) from February’s new home sale rate of 674k and 6.0% higher than in March-2024.[1]

- Meanwhile, existing home sales fell 5.9% MoM to 4.02 million (annualized rate). Compared to existing home sales last year, home sales were down 2.4% in March year-over-year (YoY).[1]

- The IMF released its April economic projections for the remainder of 2025 and 2026. In January, the IMF had forecasted the US economy would grow by 2.7% in 2025 and 2.2% in 2026, but lowered their new growth estimates to 1.8% for 2025 and 1.7% for 2026 due to an increase in global tariff rates—largely as result of the US’s new trade policy—which are likely to reduce global trade and raise the price of traded goods.[1]

- Durable goods orders surged 9.2% MoM, but excluding transportation—autos and planes—durable goods numbers showed no change (0.0% MoM) and capital goods orders grew only 0.1% MoM.[1]

- Initial unemployment claims remain low and show little signs of a weakening labor market, increasing 6k last week to 222k new initial unemployment claims.[1]

EXPECTATIONS

- The Trump Administration signaled last week that it was optimistic that it could eventually strike a deal with China to reduce the current tariff levels (145% for most Chinese imports) and the administration was considering an interim step—assuming China would reciprocate—of reducing the tariff rate for select goods to less than 65% in a bid to deescalate trade tensions with China ahead of more formal bilateral talks.[1]

- With 36% of the S&P 500 having reported, Q1 earnings season is still looking lackluster. At this point, 73% of firms have reported a positive earnings surprise which is behind the 10-year (75%) and the 5-year (77%) averages for earnings beats. Thus far Q1 earnings are tracking towards 10.1% YoY growth.[2]

ONE MORE THOUGHT: Fed’s Beige Book Shows Concern Over Economic Growth[3]

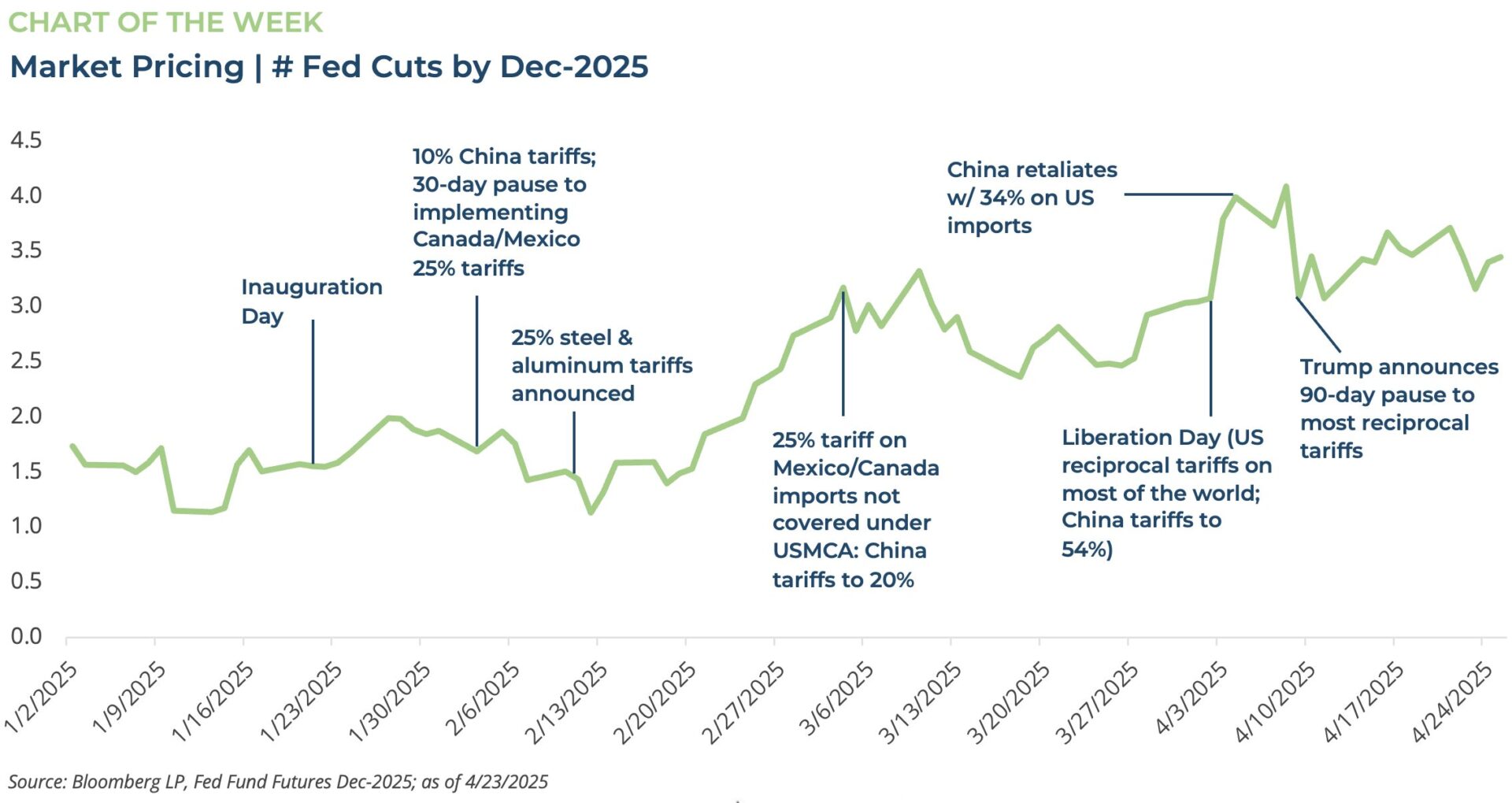

The Fed’s Beige Book is a qualitative assessment of the US economy by Fed district. In the latest Beige Book released last week—the Beige Book is compiled and released about every six weeks or eight-times per year—it showed that on balance the US economy was stable in late March and early April. In five of the Fed districts, businesses generally noted slight growth, whereas three Fed districts noted no change in economic activity and four Fed districts noted modest declines in economic conditions. The Beige Book however did note that uncertainty “around international trade policy was pervasive” and that the “outlook in several districts worsened considerably” as the prospect of higher tariffs increased. In a similar way, just as uncertainty around tariffs weighed on the economic assessments in the Fed’s Beige Book, markets have been trying to gauge the economic impact of these tariffs on the economy and the Fed’s likely response. When Trump was inaugurated—see Chart of the Week—the Fed Funds Futures were pricing in about 1.5 Fed rate cuts of 25 basis points by the end of 2025. However, by early March as tariffs on Chinese imports increased to 20% and the tariffs on Canadian and Mexican goods not covered under the USMCA trade agreement increased to 25%, markets began to expect the Fed to cut interest rates three times by Dec-2025. This is presumably because the tariffs would likely cause growth in the US economy to considerably weaken. In the days that followed Trump’s reciprocal tariff announcements on “Liberation Day”, markets priced in four-25-basis point cuts by year’s end. In early April, many economists began to judge that a US recession was becoming their baseline scenario due to a sharp slowdown in global trade and an increase in prices for traded goods. Recall that Clearstead’s analysis showed that Trump’s reciprocal tariffs had taken our average effective tariff rate to the highest level since 1909. However, on April 9th President Trump announced a 90-day delay in the implementation of the reciprocal tariff regime and the prospect of a looming US recession seemed to diminish. As a result, markets reduced their expectations for Fed actions this year to three rate cuts. Nonetheless, a few Fed officials have already signaled they may support cutting rates in June if there are clear signs of labor market weakness. Only time will tell if the myriad bilateral trade talks countries are having with the US will bear fruit. Should these talks not fundamentally lower the average tariff rate for US imports, the US could, indeed, see a recessionary environment in H2-2025 and the expectations for more Fed cuts would likely increase once again.

[1] Bloomberg LP, 4/25/2025

[3] https://www.federalreserve.gov/monetarypolicy/beigebook202504-summary.htm

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.