OBSERVATIONS

- Markets traded down last week as the S&P 500 fell 0.4% and small cap stocks (Russell 2000 Index) declined 1.5%, while the yield on the 10-year Treasury fell 11 basis points to end the week at 4.40%.[1]

- Small business optimism rose in May for the first monthly increase in 2025. The NFIB Optimism Index rose to 98.8, nearly in line with long-term averages, reflecting headlines in the past month over progress in tariff negotiations. Still, the NFIB’s Uncertainty Index remains among the highest readings ever for the data which dates back to 1975.[1]

- Headline inflation (CPI Index) rose modestly in May to 2.4% year-over-year (YoY), which is just above April’s 2.3% YoY increase. Core-CPI, which removes volatile food and energy prices, was 2.8% YoY in May, unchanged from April. Both data points were in line with expectations.[1]

- Inflation at the wholesale level (Producer Price Index) was also broadly in line with expectations, increasing 2.6% YoY just above April’s 2.5% YoY figure. Core-PPI—removing food and energy prices—was 3.0% YoY, which was down from April’s 3.2% YoY core-PPI figure.[1]

- Initial unemployment claims came in higher-than-expected last week at 248k new claims—the same number of claims as the week prior—but initial claims remain low and are roughly on-par with the number of claims from the same week last year.[1]

- The University of Michigan Consumer Sentiment Index increased for the first time in six months to 60.5 in June up from May’s 52.2 reading, but remains below its long-run average of about 84.5.[1]

EXPECTATIONS

- US-China trade talks last week yielded an agreement to curb export controls. For China’s part, they agreed to remove barriers for key exports such as rare-earth minerals and specialized magnets which are essential for numerous high-tech products including electric vehicle production. The US agreed to remove some unspecified trade “countermeasures” but the 55% tariff rate on most Chinese exports is likely to remain even after the trade talks conclude.[2]

- The US Federal Reserve meets next week, and markets are widely expecting the Fed to take no action. However, the Fed’s update to its “Summary Economic Projections”, which provides individual Fed member forecasts of potential Fed rate actions, could reset expectations on likely Fed decisions in the final six-months of 2025.[1]

- Israel launched a missile attack on Iran, targeting several nuclear enrichment facilities last week, which killed several high-ranking military officers and scientists working on Iran’s nuclear program. Iran has vowed to retaliate, and the escalating conflict has pushed up oil prices (WTI) over 10% this past week.[1]

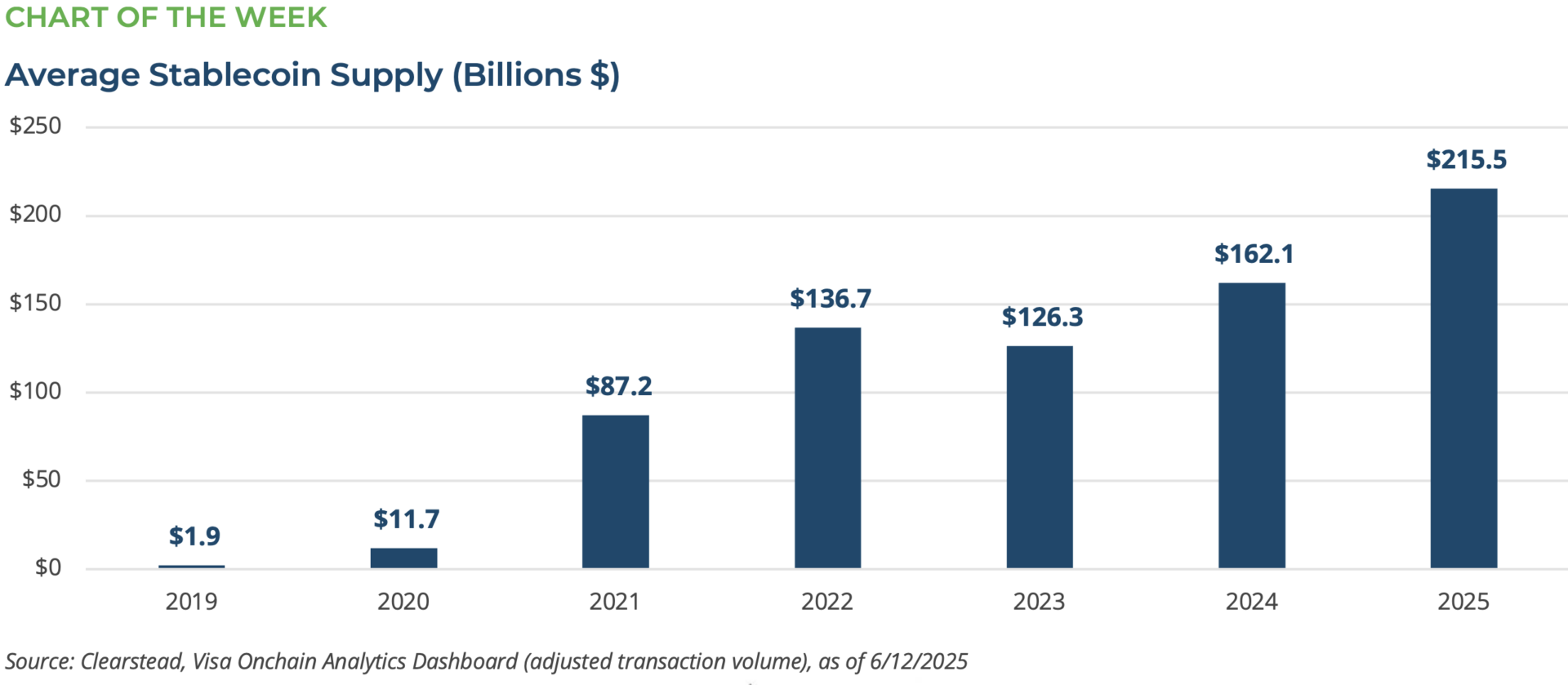

ONE MORE THOUGHT: The Continued Adoption of Stablecoins.[3]

Stablecoins are a form of cryptocurrency, typically pegged to a specific reference asset such as the US Dollar — a myriad of other stablecoins also exist backed by the Euro, Yen, Swiss Franc and Gold, as examples. As a form of digital currency, stablecoins are issued and exist under the assumption of retaining value relative to the underlying reference asset such as the US Dollar. This feature has allowed stablecoins such as USDC and USDT to generate significant uptake in money movement (e.g., payments and remittances) given these stablecoins are backed 1 to 1 by the US Dollar. As of today, stablecoins as digital currencies should not be confused as being digital money market instruments and are not subject to the SEC’s 2A-7 rules under the Investment Company Act of 1940 (the primary regulation for money market funds). That said, in the case of USDC and USDT, reserve transparency is something that both stablecoin issuers appear committed to, with the latter producing quarterly reserve statements while the former discloses holdings weekly followed by monthly audited reserve statements. Today, stablecoins account for $215bn in value while transfer volume (adjusted) in the last 12 months exceeded $7.2 trillion — helping the unbanked and underbanked manage payments and remittances while avoiding traditional legacy infrastructure such as ACH and SWIFT. This technology represents the future of money movement, reducing time and friction among other benefits, and is likely to gain significant additional traction with the signing of the GENIUS ACT (Guiding and Establishing National Innovation for U.S. Stablecoins) which is currently in process in DC — we would expect any regulation to evolve over time just as money market reform has evolved over a fifty year period for example. Further regulatory clarity for the broader cryptocurrency industry is baked into the Clarity Act (Digital Asset Market Clarity Act) and progress in both bills are likely to support continued investment and adoption throughout the digital asset markets.

[1] Bloomberg LP, 6/6/2025

[2] https://www.wsj.com/economy/trade/u-s-and-china-agree-to-get-geneva-pact-back-on-track-695eb5f5?mod=article_inline

[3] https://visaonchainanalytics.com/transactions (adj. transaction vol), World Economic Forum, CoinLedger, House Committee on Financial Services;

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.