Importance of Private Markets | ClearAccess® Advantage

The primary goal in investment management is to maximize the probability of success given a specific set of investor objectives. Confining clients’ investment access exclusively to public market opportunities may limit their ability to achieve this goal. In a recent Adams Street survey among limited partners (LPs) and financial advisors (FAs), when asked whether they expect public or private markets to outperform over the long run, 85% selected private markets.[1]

Private markets investments refer to investments in private assets or securities that are not listed on public exchanges, including ownership stakes in privately held companies, real estate, infrastructure, or private debt investments. Private market asset classes include private equity (buyout, growth equity, venture capital), private credit (direct lending, asset-backed, opportunistic), real assets (real estate, infrastructure, natural resources), and hedge funds (absolute return, diversified growth). Within these private asset classes, financial sponsors create funds consisting of a number of investments, sourcing capital commitments from limited partners (LPs) to invest with the goal of generating positive returns. Clearstead’s capital market assumptions predict private equity to deliver 9.6% annualized returns from 2025 to 2035, with private credit returning 9.0% and private real estate 7.6%. That compares with 5.6% for domestic large cap equity and 4.9% for core fixed income over the same timeframe.[2]

Growth

BlackRock anticipates significant growth in private markets over the next 10 to 15 years. This expansion is expected to be fueled by rising allocations from the private wealth channel, the continued emergence of private credit and infrastructure strategies, consolidation within wealth management, and greater transparency among financial sponsors. Industry projections suggest that global private markets—currently valued at $13 trillion—could surpass $20 trillion by 2030, signaling a promising future for the asset class.[3]

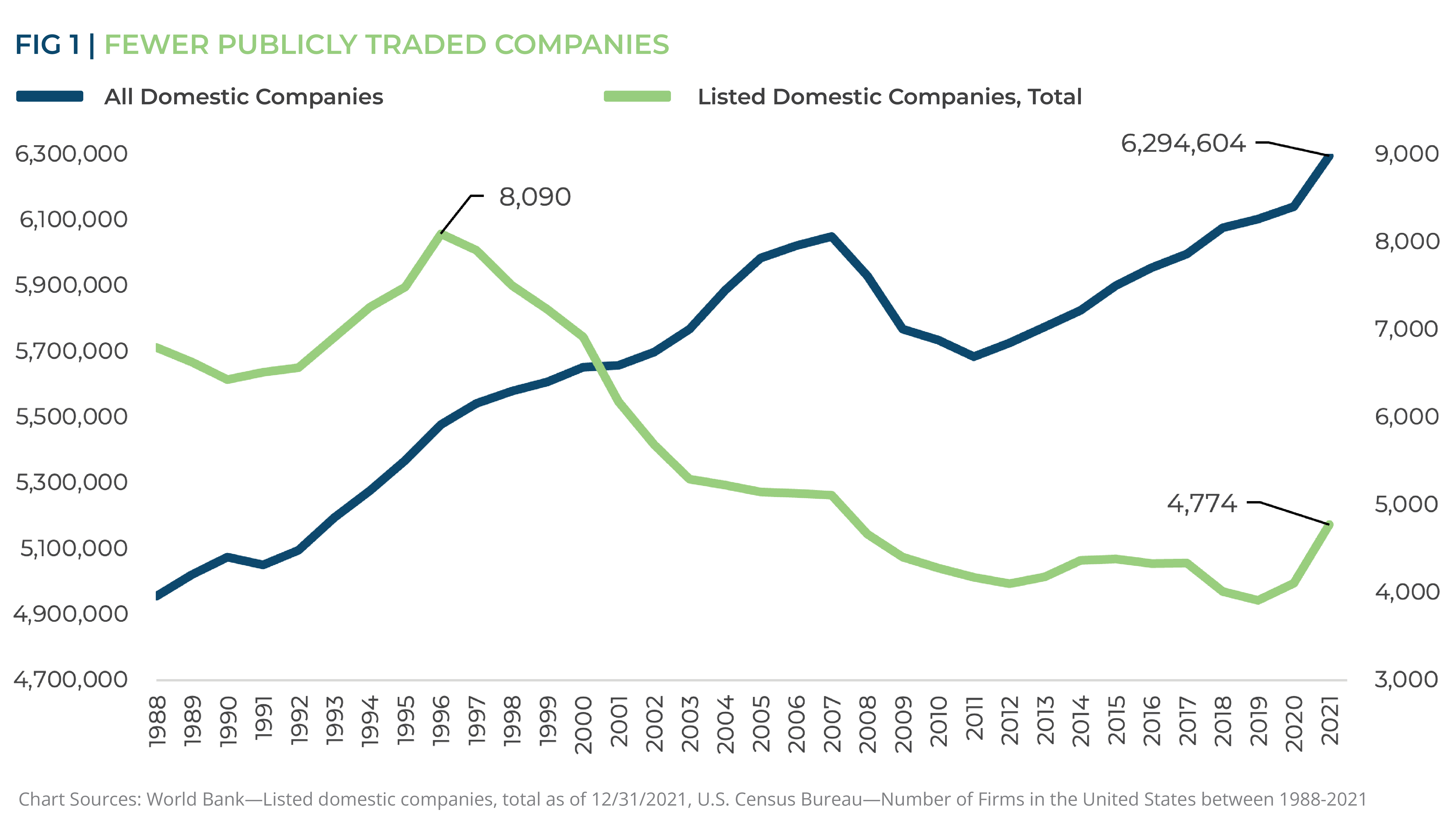

This trend reflects a broader shift among wealth and asset management firms, which are increasingly focusing on private market offerings as their accessibility increases. With rising capital availability in private markets, more companies are opting to remain private, benefiting from greater control, reduced regulatory burdens, enhanced confidentiality, flexible decision-making, and selective investor engagement. As illustrated in Figure 1, the number of public companies has nearly halved over the past three decades, while private companies have grown substantially.

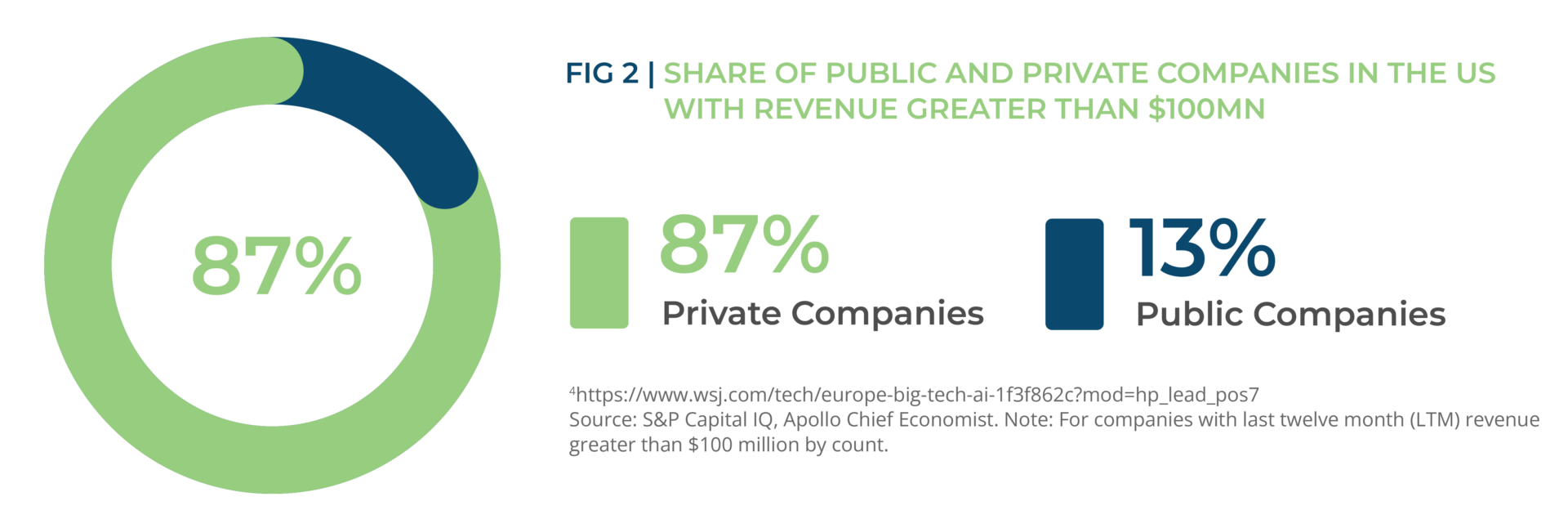

Additionally, 87% of firms with revenues over $100 million remain privately held, and in the U.S. alone, 690 private companies have reached valuations exceeding $1 billion, collectively representing $2.53 trillion in value.[4]

With such rapid growth, investors often wonder what additional advantages exist for investing in private markets and what they should be aware of when considering adding alternative investments to their portfolios.

In this whitepaper, we share additional details about:

- Potential advantages of private markets — diversification, value-creation opportunities, and cheaper valuations

- Private market considerations — manager selection risk, minimum qualifications, operational burden, and illiquidity risk, among others

- Our ClearAccess® Platform, which simplifies investing in alternative investments

Fill out the form below to download the full whitepaper and continue reading.

———

[1] https://www.adamsstreetpartners.com/insights/2025-global-investor-survey

[2] Geometric returns are 10-year forward expected return derived from fundamental building block methodology, using Clearstead’s Return Methodology for each index. The building blocks are statistics from actual point-in-time data as of 12/31/2024 from Bloomberg and assumptions from Clearstead. Clearstead’s Capital Market Assumptions are proprietary and Clearstead is making no representation that these return assumptions can or will be achieved. Past performance is not an indicator of future returns.

[3] Preqin, September 2024

[4] https://www.wsj.com/tech/europe-big-tech-ai-1f3f862c?mod=hp_lead_pos7; Source: S&P Capital IQ, Apollo Chief Economist. Note: For companies with last twelve month (LTM) revenue greater than $100 million by count.