Institutional Guidance for 2025

REVISIT INVESTMENT STRATEGY & GOAL ALIGNMENT

Introduction

As we enter 2025, the investment environment is marked by uncertainty due to persistent inflationary pressures, potential policy changes, geopolitical tensions, and extended US equity market valuations following two strong years of performance for the S&P 500. Clearstead views this uncertainty as an opportunity to revisit investment strategy and confirm alignment with objectives and constraints to ensure that portfolios are built to not only withstand market volatility but also capitalize on opportunities.

The Current Landscape

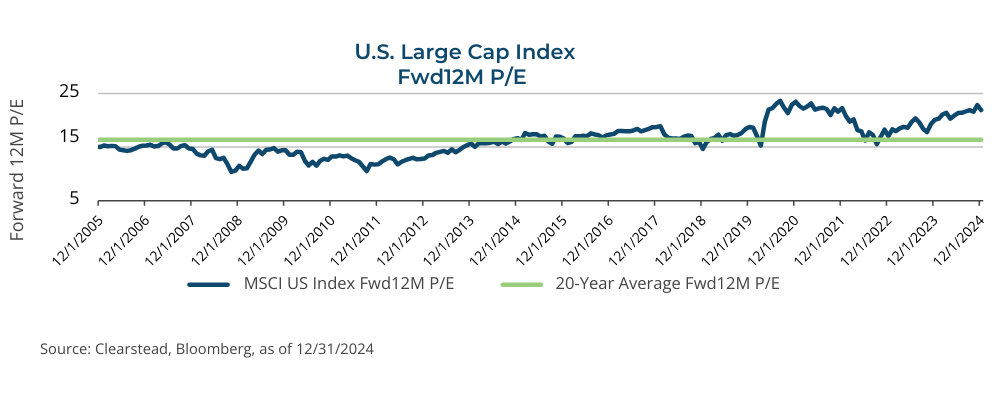

In 2024, the US economy grew above trend, inflation cooled (modestly), and the labor market remained tight. Meanwhile, developed non-US economies, namely in Europe, experienced slower growth and are producing less favorable economic data. Global equity markets generated positive returns in 2024, led by the S&P 500 (+25.0%).[1] Much of the S&P 500 index returns could be attributed to multiple expansion, and heading into 2025, valuations (as measured by the forward price/earnings ratio) were meaningfully above historical averages. It is notable that this is being driven primarily by eight companies in the index, which produced outsized returns over the last two years relative to other index constituents.

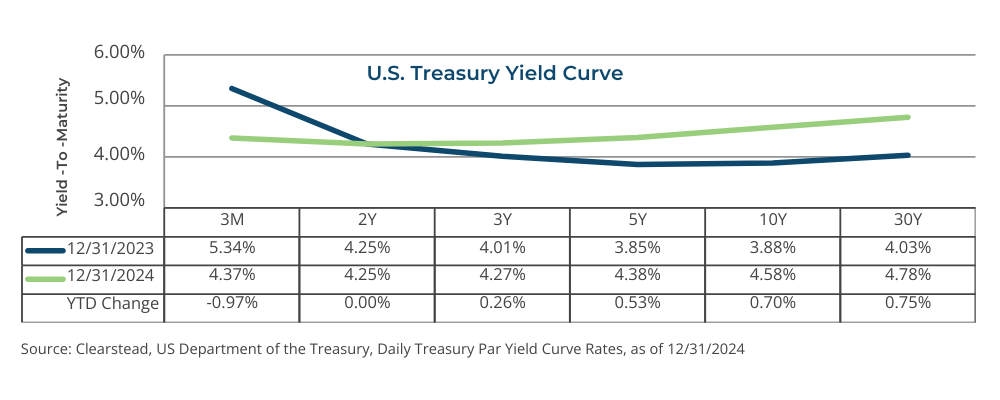

Meanwhile, interest rates were volatile in 2024 but ended the year higher with the 10 Year US Treasury Yield at nearly 4.6%.

Extended valuations and higher yields impact Clearstead’s capital market assumptions (expected returns and risk), which are an important input (but not the only one) for asset allocation and portfolio construction.

Investment Considerations

Many of Clearstead’s clients are long-term investors that may have a perpetual time horizon. This characteristic gives many the luxury of taking on risk, be it via market volatility or illiquidity, to potentially meet their return objectives. However, even for investors with a long-time horizon, it is prudent to periodically revisit their investment strategy to ensure that it aligns with objectives and constraints. For example, is there awareness about cash flow needs from the portfolio, either ordinary or extraordinary? Has the funded status of the pension plan improved to a point that might warrant de-risking of assets? Is the organization or its asset pool in a position to take on illiquidity risk that it either couldn’t or wouldn’t in the past? A collaborative review of strategy does not mean that dramatic change is in store, but we find that it generally leads to productive conversations and optimal outcomes.

Below are examples of strategies that institutions may employ given the current landscape.

Evaluate Cash Needs and Risk Tolerance:

- Risk tolerance is specific to an asset owner and should be evaluated and documented. Risk can be measured in several ways (e.g. volatility, illiquidity, etc.), but Clearstead’s view is that not meeting one’s investment objectives is the biggest risk an investor faces. This can be measured in terms of the amount of return that is needed to offset spending, structuring a portfolio to reduce volatility in light of budgetary, regulatory, or other requirements/goals (e.g. financial statement impact), or ensuring that there is sufficient liquidity in pace to meet regular (or highly irregular) cash flow needs. For example, if an institution has a capital project that will require funding in-part from long-term investments, this might necessitate a reduction in volatility. Another example would be, if a pension plan sponsor has experienced an improvement in funded status because of a combination of higher asset values and lower liability values, they may consider whether the timing is right to create or add to a liability-driven investment allocation and potentially sacrifice future returns to reduce funded status volatility. Discussing relevant developments and revisiting objectives and constraints is an important exercise.

Evaluate Public Equity and Private Markets Exposure:

- With US Large Cap trading at above average valuations at the index level, it may be worth considering the addition of dividend-focused stocks or private markets exposure if either is under-represented in the portfolio. Dividend-paying stocks can be less expensive than the cap weighted index and rely less on growth and multiple expansion and more on income to provide returns to investors. For institutions with the ability and willingness to invest in private markets, we are encouraging them to do so. Clearstead published an article about the democratization of private markets in 2024 (found here). These investments come in a variety of vehicles with varying levels of risk and liquidity – we think they can be valuable tools for investors.

Be Dynamic:

- Being dynamic does not mean trying to time markets through day-trading. However, having a disciplined investment process in place can enable organizations to be nimbler and more opportunistic. Clearstead operates with some level of discretion with many of our clients, allowing us to rebalance and adjust portfolios as appropriate. In times of elevated market volatility, this could offer meaningful benefits. Investment policies should incorporate up-to-date roles and responsibilities that reflect the amount of authority Clearstead and the Investment Committee have to operate between meetings.

Conclusion

While we are cautiously optimistic about what 2025 has in store for the economy and markets, we are also wary of the present risks. It is important for institutions to be willing and able to adapt to a constantly changing landscape. As history has shown us, markets have gone up over time, and especially for long-term investors, it is important to stay invested in the market even during volatile periods. However, there are also ways to manage risk and capitalize on emerging opportunities in a prudent manner; our job is to lead you through the process to make the right decisions for your organization.

[1] Bloomberg, LP

DISCLOSURES: Information provided is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.