The Power Shift: Women and Wealth in the Modern Workforce

As the financial landscape evolves, so too does the face of wealth. Women are increasingly earning more, inheriting more, and leading more households’ financial decisions than ever before. This shift represents one of the most significant demographic and economic transformations of our time — but it also comes with unique financial challenges.

The Rise of Women in Wealth

- 70% of intergenerational wealth is expected to be transferred to women in the coming decades¹.

- 16% of U.S. households already have women as primary earners¹.

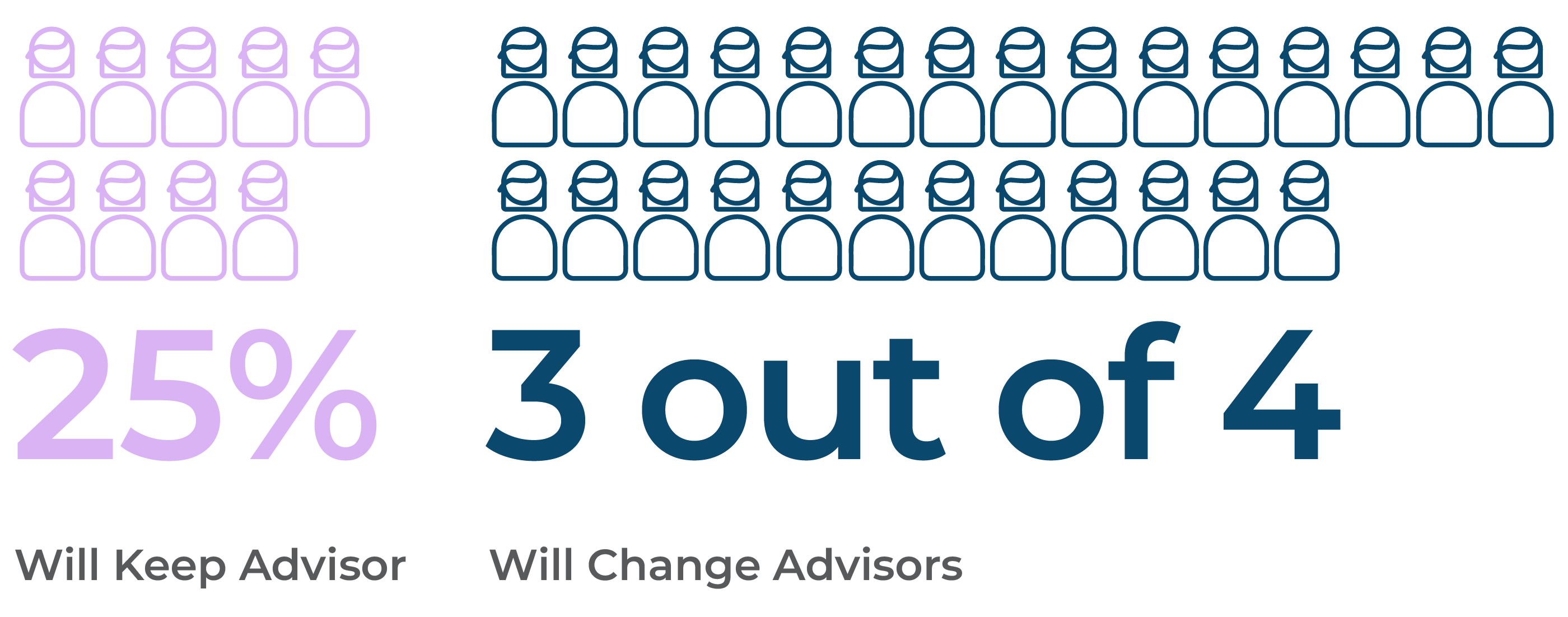

- Nearly three out of four women change financial advisors within one year of being widowed or divorced¹ — seeking advisors who understand their goals and perspectives.

Women now occupy a powerful role in shaping family wealth. Yet, systemic disparities continue to affect financial outcomes—from wage gaps and career interruptions to longer life expectancy that stretches retirement resources.

Persistent Financial Gaps

Despite progress, women face measurable headwinds that underscore the need for personalized, proactive financial planning:

- Women aged 65 and older experience a poverty rate of 11.0%, compared to 8.5% of men².

- Under the Supplemental Poverty Measure, the gap widens further to 12.4% vs. 10.2%².

- Women retire with approximately 30% less in median retirement assets than men³.

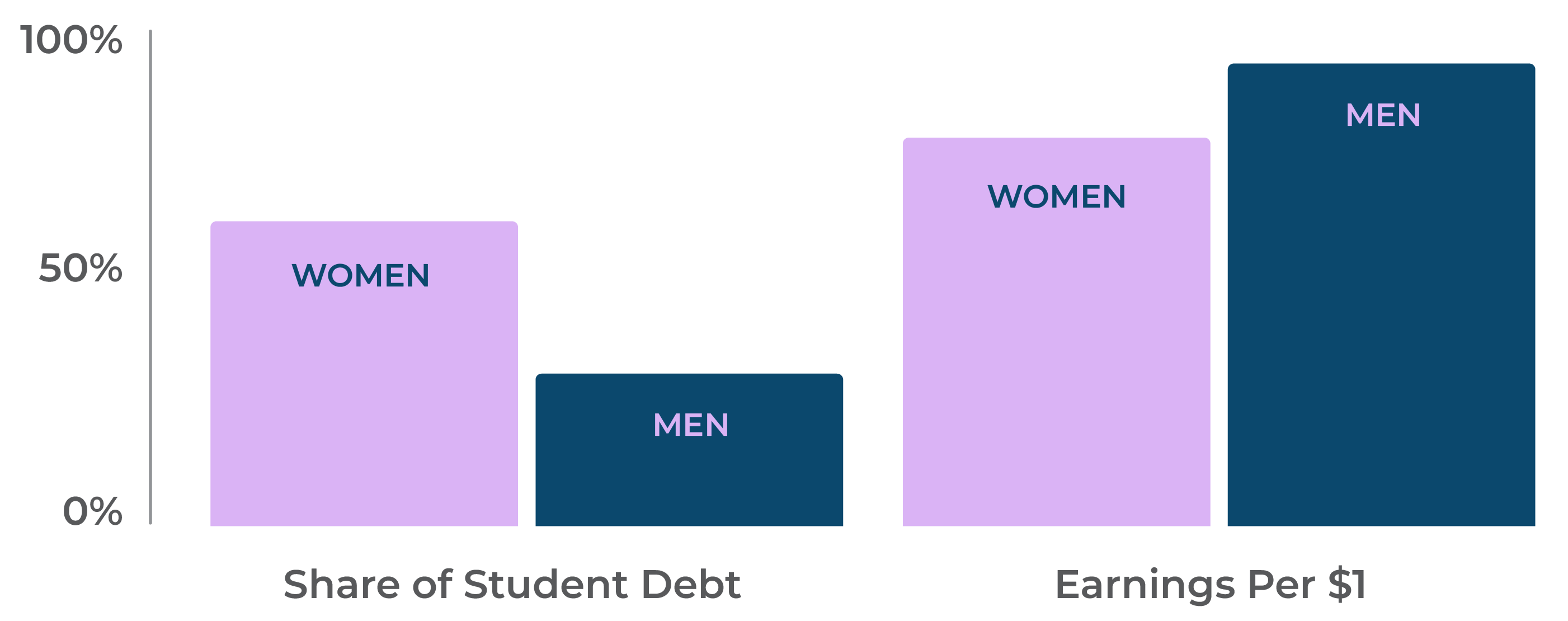

- Women carry two-thirds of all student debt (66%), while earning only 83 cents per dollar compared to men⁴.

- Wage disparities are greater for women of color—Black women earn 66 cents, and Latinas earn 58 cents per dollar earned by men⁴.

This dual reality—of growing opportunity but persistent inequity—highlights why financial planning for women is essential to building sustainable wealth, confidence, and independence.

Why Financial Planning Matters for Women

A strategic financial plan does more than manage assets—it supports women through every stage of life:

- Longevity planning: Women live longer and are more likely to become sole financial decision-makers later in life.

- Retirement readiness: Structured planning helps ensure financial security through longer retirement horizons.

- Wealth transfer: Women are increasingly at the center of estate and legacy planning.

- Investment approach: Many women prefer goals-based, risk-aware investment strategies that align with their values.

- Advisory relationships: Establishing trusted advisory partnerships early helps women stay engaged and confident in financial decisions.

A Resource to Help Women Take the Next Step

To help provide more details on the importance of financial planning for women, we’ve created a comprehensive guide. Download our whitepaper, The Power Shift: Women in the Workforce, to read more about the nuances of financial planning for women and access a checklist of key planning considerations.

Inside, you’ll find:

- A deeper analysis of the economic trends shaping women’s wealth

- Real-world planning scenarios and strategies

- A Financial Planning Checklist that covers:

- Personal and family considerations

- Retirement readiness

- Wealth transfer and estate planning

- Investment approach

- Managing debt and cash flow

- Protection and insurance

- Building a strong advisor relationship

Financial empowerment begins with knowledge. Understanding your financial landscape today helps shape a confident and independent tomorrow.

Sources:

- McKinsey & Company, “Women as the Next Wave of Growth in U.S. Wealth Management”

- U.S. Census Bureau, 2023 Current Population Survey

- Transamerica Center for Retirement Studies, 2024

- American Association of University Women (AAUW), 2024