Overview

August started with a bang with the August 1st release of the latest jobs report showing that hiring slowed significantly over the summer. In July, the economy created only 73k new jobs—expectations were for about 100k new jobs—but May’s final job creation number was revised down to only 19k jobs and June’s jobs figure was revised down to 14k new jobs and the unemployment rate moved up slightly to 4.2% in July.[1] From then on, all eyes focused on the Federal Reserve – first, to hear Chairman Powell’s Jackson Hole speech and second, President Trump’s efforts to control the Federal Reserve. Despite an uptick in consumer and wholesale inflation, markets looked through the inflation data and focused on the weak employment data and started pricing in a series of Fed Funds rate cuts.

Equity market trading in August remained calm as numerous signs of investor complacency have emerged despite the uncertain macroeconomic environment. While H1-2025 corporate earnings have been strong and the US economy, thus far, has shown resilience, the full impact of the US’s new tariff policy is still not known. Nonetheless, investors in US equity markets seem to have fully discounted the likelihood of any worst-case scenario vis-à-vis tariffs. Furthermore, at present they seem to be gripped with the notion that interest rate cuts are imminent, tariff impacts are largely negligible, and US consumers can keep spending. In general, fixed income markets posted solid returns during the month. Short-term interest rates significantly reacted to the anticipated Fed cuts as the 2-year U.S. Treasury yield declined by 34 bps (3.96% to 3.62%) during the month. But trillion-dollar U.S. budget deficits and pressures on Fed independence weighed on the U.S. Treasury 30-year that rose 3 bps (4.90% to 4.93%) from July’s closing level.[1]

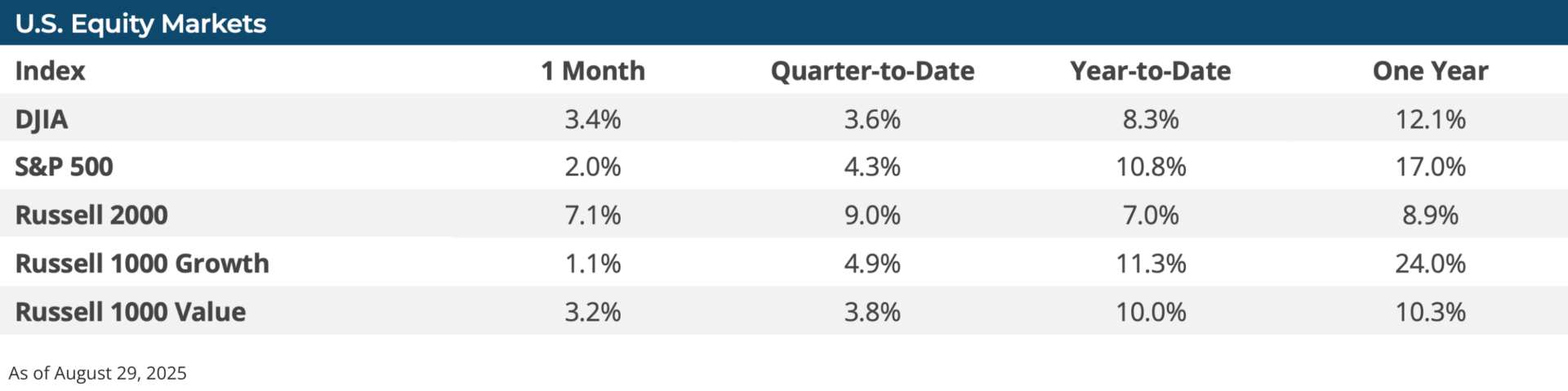

August was broadly positive to US equities. US equities were led higher by US small caps (Russell 2000 Index) which gained 7.1% in August, while mid-caps (Russell Mid-Cap Index) and large caps (Russell 1000 Index) gained about the same at 2.5% and 2.1% respectively. Small caps stocks were buoyed, in part, by the idea that a forthcoming Fed rate cut in September could lead to easier financing conditions in the months ahead. Despite the month starting out with a weak jobs report, positive investor sentiment dominated the month. The S&P 500 managed gains in each of the first three weeks of the month, hit four all-time record highs, and only saw one negative weekly return (-0.1%) in the final week of the month. Nearly every sector managed gains in August, led by Materials (+5.8%), which is an interest rate sensitive sector, and also benefitted, in part, due to the expectation of lower interest rates in the future. The only sector to decline during the month was the Utility sector, which saw some profit taking and investors moving away from the defensive stocks, such as utilities, and into more cyclical, risk-oriented stocks. Overall, more value-oriented stocks (Russell 1000 Value +3.2%) outperformed their growth stock peers (Russell 1000 Growth Index +1.1%).

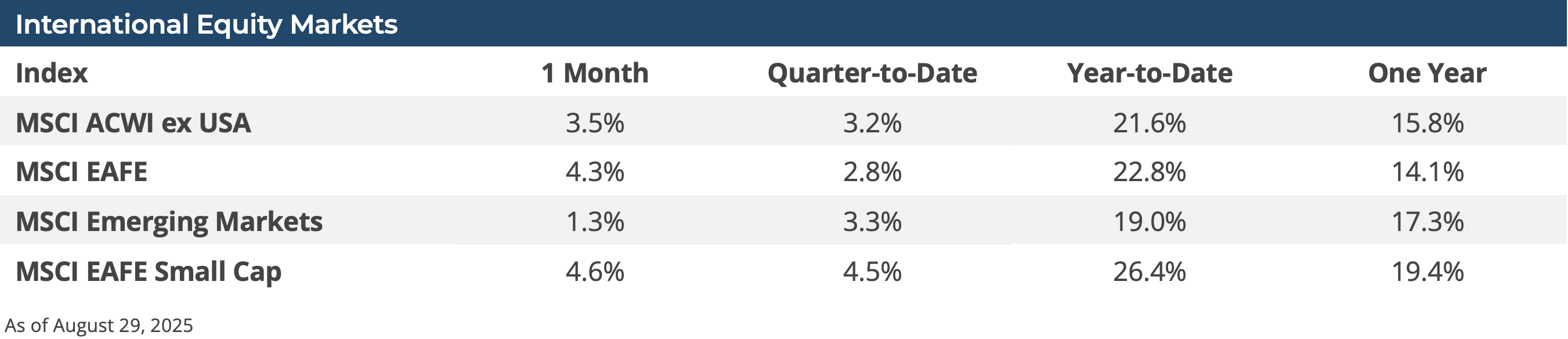

International equities also made gains in August. International developed equities (MSCI EAFE Index) gained 4.3% during the month and their US-dollar based returns were aided, in part, by a weakening of the US dollar against a broad basket of developed market currencies. Similar to the US, international small cap stocks (MSCI ACWI ex US Small Index +4.3%) outperformed their large cap peers (MSCI ACWI ex US Index +3.5%). Emerging market equities also managed gains in August (MSCI EM Index +1.3%), but struggled on a relative basis. While there were strong gains in Chinese equities (MSCI China Index +4.9%) in August, Indian equities sold off (MSCI India Index -2.2%) during the month as the US placed 50% tariffs on the country due to their purchase of sanctioned Russian oil.

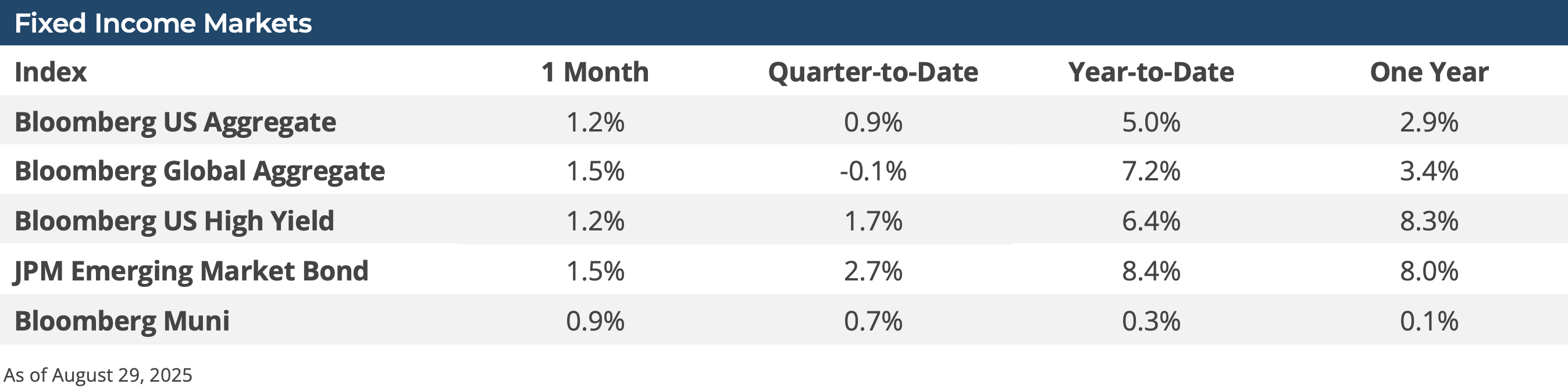

Lower interest rates and sturdy corporate earnings were a perfect combination to deliver solid fixed income returns. Lower interest rates helped the Bloomberg Aggregate Index to post a 1.20% return for the month, while the combination of lower rates and stable spreads allowed the high yield market to deliver a return of 1.25% (Bloomberg U.S. Corporate High Yield Index).

The bond market is in a bit of a dilemma in that the battle between lower short-term rates vs. steady long-term rates at higher levels does challenge investors to be careful where they invest along the yield curve. Short-term rates tend to be driven by Federal Reserve monetary policy, while long-term rates are determined by the market. If bond market nerves are being rattled due to budget deficits and Fed independence it could prove difficult to drive longer-term rates lower.

Conclusion & Outlook

As we said last month with some of the major initiatives of the Trump administration appearing to be behind us (immigration, tariffs, tax and spending bills), we hoped the financial markets could focus their attention on economic data and company fundamentals. But the Trump administration’s attempt to dominate the Fed could have serious ramifications. Markets have always understood that politics would be involved in the setting of fiscal policy, but we took comfort in the fact that the Federal Reserve was an independent agency, free from politics, and that monetary policy decisions would be driven by economic data and what was good for the economy (low unemployment and stable prices).

As budget deficits continue to grow and politicians remain unwilling to raise taxes or cut spending (fiscal policy), Washington is now looking at ways to minimize the interest burden being created by years of fiscal mismanagement. Thus, the Trump administration’s move to get the Fed to lower rates. How this will end is unknown and there is very little historical precedent to guide us as to a possible outcome.

The Federal Reserve’s monetary policy aims to promote maximum employment, stable prices, and—as a corollary—moderate long-term interest rates. There is a natural give and take between the markets and the Fed about the direction of monetary policy, but the focus is on economic matters. We have noted in past writing that markets could once again become volatile this Fall, and now we have one more issue that could roil markets.

[1] Bloomberg LP 7/31/2025

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.