OVERVIEW

U.S. financial markets finished 2025 in rather lackluster fashion, for in December the S&P 500 squeaked out a 0.06% gain, while the Bloomberg Aggregate Index was down 0.15%; but, for the entire year, investors were rewarded with solid returns (S&P 500 +17.9% and the Bloomberg Aggregate Index +7.3%).1 Due to the 43-day government shutdown, the release of economic data continues to be delayed and what is reported is confusing and difficult to interpret. In general, the U.S. economy appears to be stable—although inflation is higher than the Federal Reserve desires, the trend has been for lower levels of inflation and while the “no fire, no hire” labor market is worrisome, the 4.6% unemployment rate1 is still at the low end of jobless figures over the past 50 years. The recent softness in the labor markets gave the Fed the ammo it needed to cut its main policy rate by 25 basis points (bps) to a range of 3.5% to 3.75%. However, Fed Chair Powell emphasized in the press conference that the central bank is likely to adopt a “wait and see” approach as it heads into 2026.1

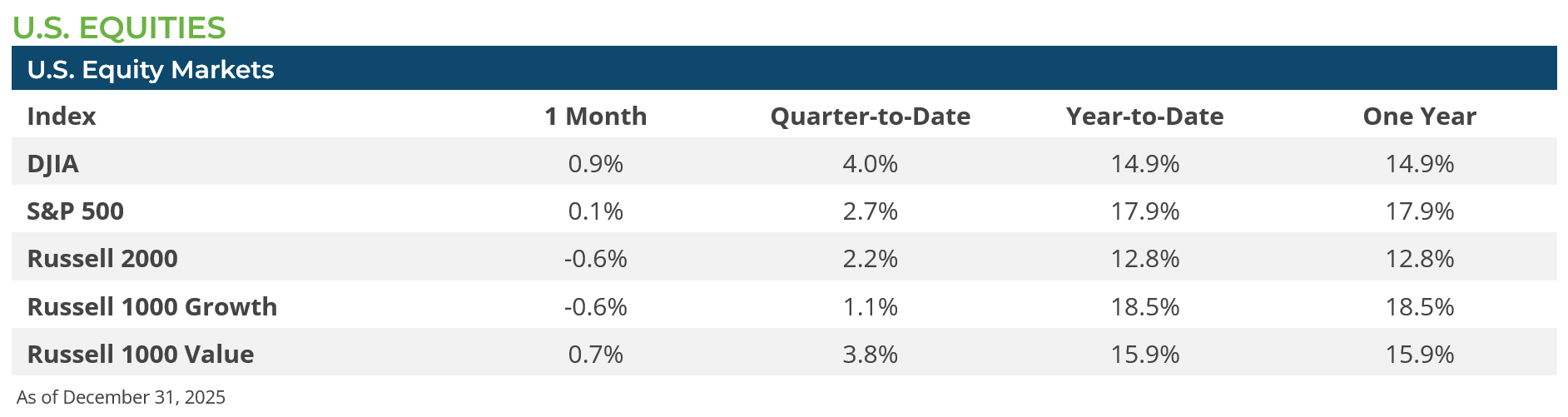

US stocks had a relatively quiet December. After making gains in the first few weeks of the month—and setting three new record highs—the S&P 500 slid in the final trading sessions and ended December barely unchanged (S&P 500 gained 0.06% or 6 basis points).1 The all-cap Russell 3000 index lost 0.02% (2 basis points), while the large cap Russell 1000 Index was unchanged on the month—including dividends.1 In contrast, US small caps (Russell 2000 Index -0.6%) and mid-caps (Russell Midcap Index -0.3%) lost ground in December.1 Despite the muted monthly returns, the S&P 500 returned nearly 18% for the full year and entered 2026 only 1.3% off its most recent record high set on 24-December.1 Similarly, the trends apparent earlier in the quarter continued into December. For instance, the value factor beat the growth factor in December as well as for the entirety of Q4 (Russell 1000 Value Q4 +3.8% vs. Russell 1000 Growth Q4 +1.2%).1 However, for the full year, large-cap growth-oriented stocks outperformed their value-oriented peers. December was mixed in terms of sector performance with six out of eleven sectors declining and only five making gains led by Financials (+3.1%) and Materials (+2.2%).1

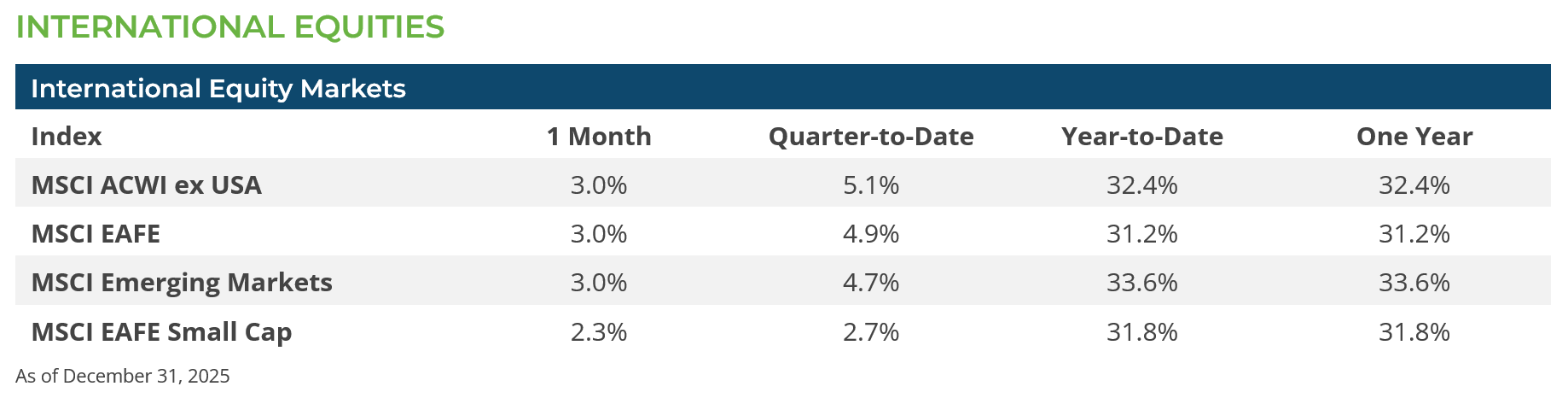

In contrast, non-US equities made strong gains in December. Both International developed stocks (MSCI EAFE Index) and emerging market stocks (MSCI EM Index) gained 3.0% in December.2 Within the emerging market index returns was a wide variation with Chinese (MSCI China Index -1.2%) and Indian equities (MSCI India Index -0.5%) losing ground, while South Korean (MSCI S Korea Index +12.7%) and Taiwanese equites (MSCI Tiawan Index +5.8%) made strong gains.2 December’s non-US equity returns were helped modestly by the US dollar weakening against a broad basket of foreign currencies during the month.2

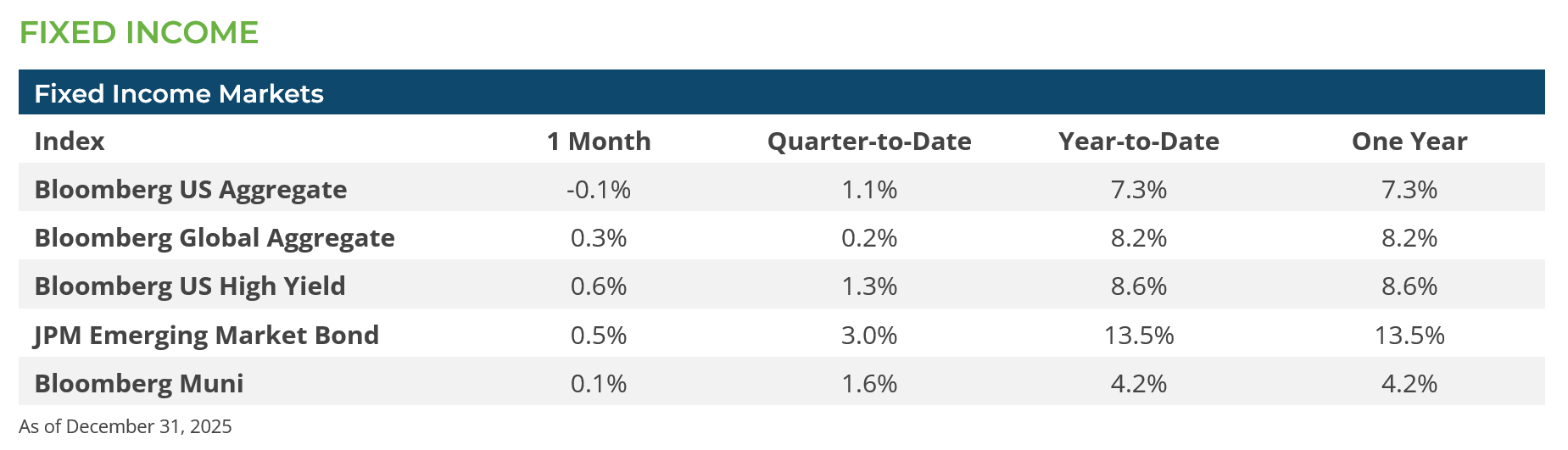

The month started with interest rates trending higher, but, by the second week, it appears fixed income participants were ready to call it a year and settled into a rather quiet finish to the year. U.S. Treasury 10-year bond yields rose from November’s closing level of 4.02% to 4.19% on December 9th but then went sideways to close the year at 4.17%.1 Corporate spreads continued to be well behaved—the Bloomberg High Yield Option Adjusted spread was virtually unchanged (266 bps on December 31st vs. 269 on November 30th)1. Much like what was witnessed throughout the fourth quarter, fixed income returns were driven by interest rate movements and the Bloomberg Aggregate’s return of -0.15% reflected the mild rise in rates that transpired early in December.

The municipal bond market continued to see strong investor demand and favorable credit fundamentals, but much like the Aggregate index, returns were reflective of the drift higher in interest rates. The Bloomberg Municipal Bond Index’s return for December was +0.09%.

CONCLUSION & OUTLOOK

The 2025 financial markets were characterized by strong equity gains pushing stocks to near record highs despite volatility from shifting policies (tariffs, government actions) and elevated valuations, while fixed income offered better returns due to higher yields, though risks like inflation and debt remained key concerns. While cognizant of the noise, investors appear to be taking a longer-term view and leaning into the positive momentum supporting the markets.

As we look out over the investment landscape, Clearstead is reminded of the favorable corporate fundamentals and that the consensus estimates for next year’s corporate profits look solid and a broader set of companies look likely to prosper. U.S. Treasury 10-year yields remain in a range we have witnessed over the past two years. Global liquidity is not under stress, and the US labor market, while not robust, remains stable. Our baseline outlook is that, absent a significant negative shock, the market environment is favorable for investors. Bull markets can persist for multiple years and are typically derailed when euphoria and leverage give way to reality and tighter liquidity. At present, there does not seem to be egregious levels of investor complacency, and the fundamental backdrop to next year’s investment landscape should be supportive of further gains.

Subscribe to our weekly Research Corner and other market commentary so you don’t miss our updates.

[1] Bloomberg LP

[2] MSCI Global Index Lens

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.