OVERVIEW

In the June Market Minute, we expressed caution concerning AI-stock earnings, another adverse pivot on U.S. tariffs, and the ability of Congress to pass a budget bill; fortunately, the July news on these topics has been positive for investors. About 34% of the S&P 500 have reported and, thus far, 80% of firms have reported a positive earnings surprise, which is above the 5-year average (77%) and 10-year average (75%).1 Both Meta and Microsoft reported better-than-expected earnings as they have both been investing heavily in AI infrastructure in recent years, and the companies said they expect to continue to spend billions on AI capital expenditures. President Trump has announced trade deals with Japan, the U.K., and the European Union, while deals with the country’s major trading partners (Mexico, Canada, and China) have yet to be finalized, negotiations are taking place, and the indications for a positive outcome are prevalent. After narrow votes in both the Senate and the House, Congress passed the One, Big, Beautiful tax and spending bill before the President’s 4th of July deadline. The President subsequently signed the tax bill on the 4th of July holiday providing for sweeping changes to U.S. tax policy. While passage of the tax law was contentious and it will unambiguously add to the overall national debt over the next decade, the new law also front-loads several provisions that should be supportive of economic growth and household spending.

The combination of the positive outcomes to the above-mentioned issues and solid economic data (stable employment, mild inflation, and higher than expected GDP growth) U.S. equity markets continued to reach new all-time highs. While interest rates rose during the month, they continue to trade in a relatively narrow band and the Bloomberg U.S. Aggregate index, a broad-based measure of the U.S. fixed income market, remains in solidly positive territory year-to-date.

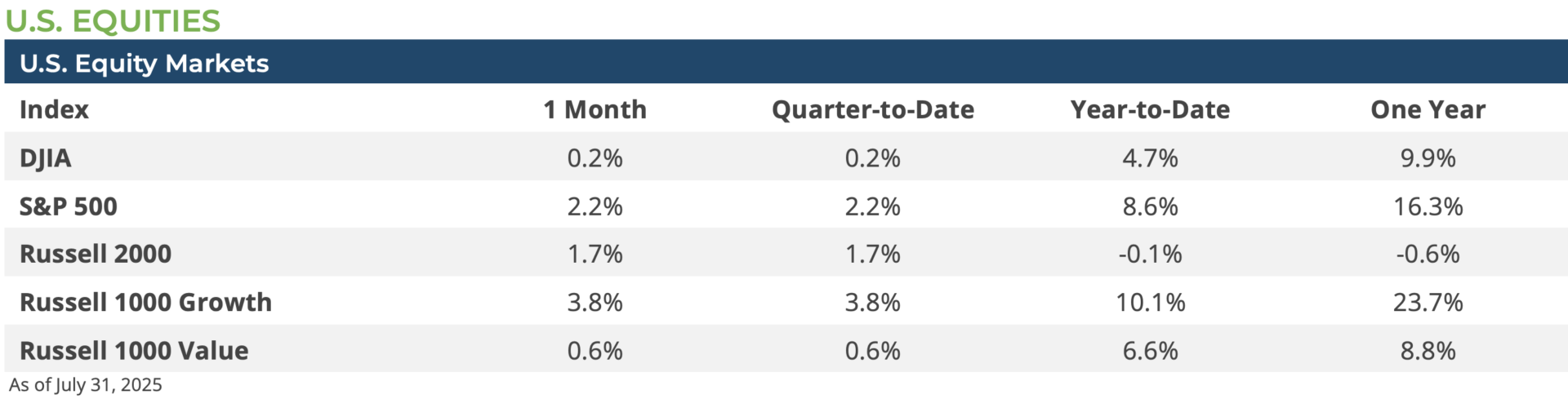

July was good for US equities and the S&P 500 set its 22nd record high of the year in the final week of July and gained 2.2% for the month. Once again, S&P 500 returns were defined by the performance of the so called Magnificent 7 (Mag 7) stocks—Alphabet, Apple, Amazon, Meta, Microsoft, NVIDIA, and Tesla—which gained 5.8% compared to the S&P 500 ex Mag 7 which gained only 0.2%. However, mid-cap stocks (Russell Midcap Index +1.9%) and small cap stocks (Russell 2000 Index +1.7%) largely kept pace with the S&P 500 during the month. Most sectors made gains in July except Healthcare, which was weighed down by mega-cap healthcare firm UnitedHealth, which declined more than 20% during the month, and Consumer Staples sector, which declined 2.4% as concerns mount over tariff-induced margin pressures build for a broad array of consumer staples firms.

While the S&P 500 ended July near record highs, there are signs of exuberance building within US equity markets. July saw a resurgence of meme stocks surging in trading volume. Heavily shorted stocks such as GoPro, Kohls, and Krispy Kreme saw their shares soar over 100%, 60%, and 40% respectively at different points during the month as retail investors piled into these crowded trades. At a more basic level, the VIX Index—the so-called fear gauge—traded below 15 and came within a whisker of a year-to-date low in late July. The good news of July—positive trade deals, less fiscal uncertainty, a stable economy, and good earnings—are building investor complacency in the equity market.

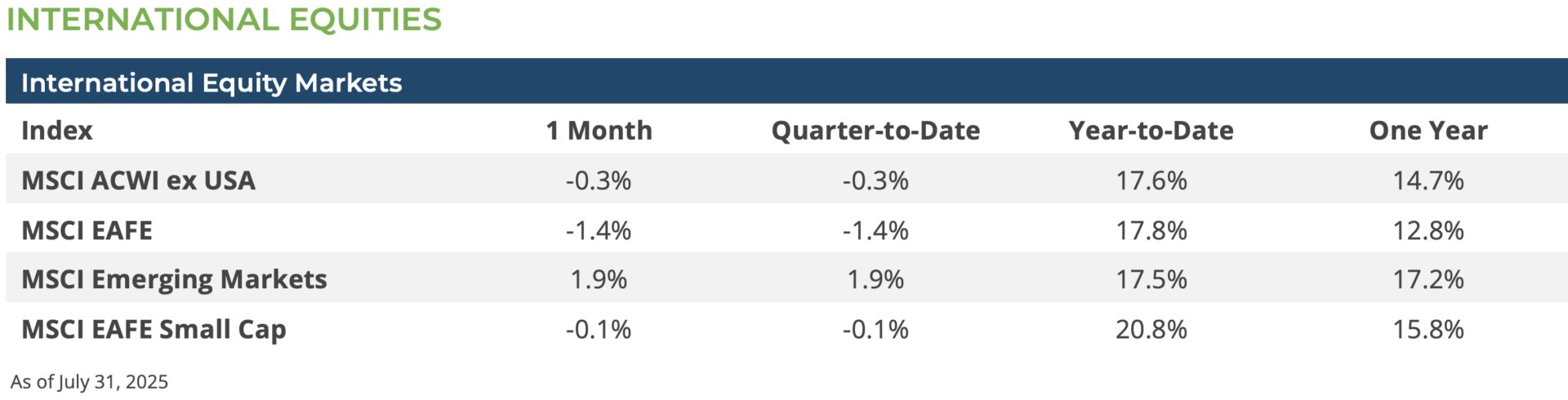

International equities lagged US equities in July in large part due to the strengthening of the US dollar, which gained ground against a broad basket of foreign currencies. International developed market equities fared the worst (MSCI EAFE Index -0.4%) for the month while emerging market equities (MSCI EM Index +1.9%) largely kept pace with US stocks. Emerging market equities were buoyed, in part, by Chinese stocks (MSCI China Index +4.8%) which made steady gains in July as trade tension with the US eased and economic data for Q2 proved to be stronger than initially anticipated. Unlike in the US, international value-oriented stocks outperformed their growth peers (MSCI ACWI ex US Value Index+1.0% vs MSCI ACWI ex US Growth Index -1.2%) and international small caps stocks outpaced their large cap peers (MSCI ACWI ex US Small Index +0.2% vs MSCI ACWI ex US Index -0.3%).

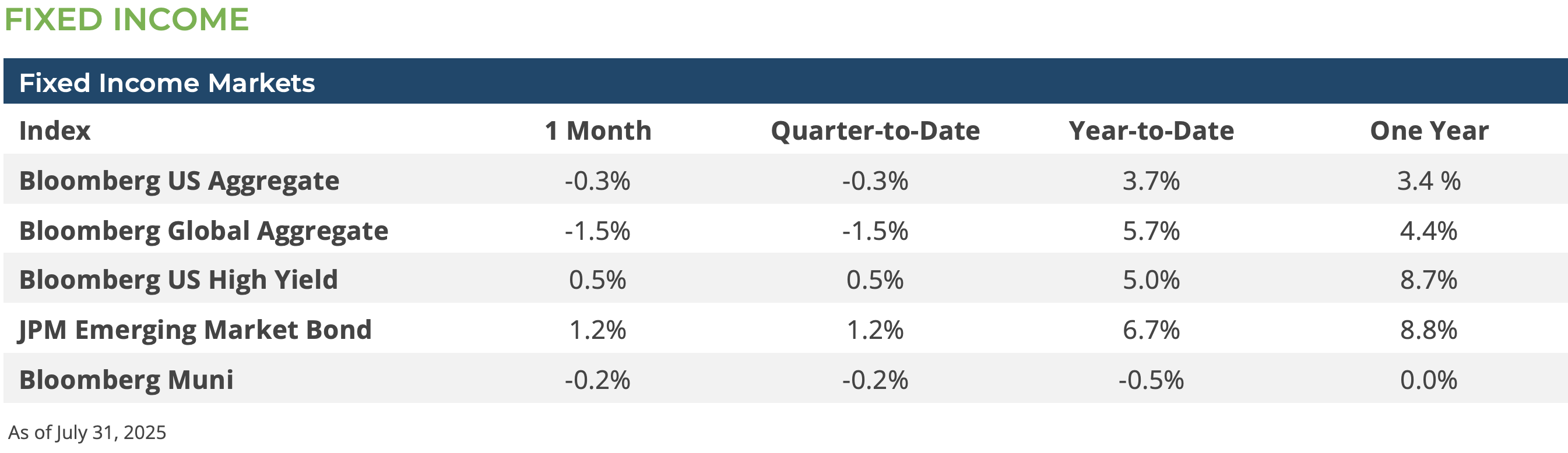

Although there have been periods of volatility in 2025, the fixed income markets appear to be content with the Goldilocks economy (not too much inflation, not too little employment, but in a modest state of growth). U.S. interest rates have declined from where we started the year (U.S. Treasury 10-year yields have declined from 4.57% to 4.38%) while corporate spreads remain stable, a combination that has rewarded the patient investor that does not let the short-term volatility interfere with their long-term investment plan.

Interest rates rose during the month as the economic data, in general, did not support the easing of the Federal Reserve’s monetary policy. During the month, modestly higher interest rates resulted in the Bloomberg Aggregate Index declining slightly (-0.26%), while stable spreads allowed the high yield market to deliver a positive return of 0.45% (Bloomberg U.S. Corporate High Yield Index). Reflecting the rise in rates, Municipal bonds returns were similar to the Aggregate index with the Bloomberg Municipal Index declining by a modest -0.20%.2

CONCLUSION & OUTLOOK

With some of the major initiatives of the Trump administration appearing to be behind us (immigration, tariffs, tax and spending bills), upon their return from the summer doldrums, financial markets could focus their attention on economic data and company fundamentals. By our judgement, the economic data does not foreshadow a more restrictive Fed policy, but neither does it suggest the economy needs any significant easing in monetary policy. Given this, we would not be surprised if the U.S. Treasury 10-year yield ends the year slightly higher or slightly lower than where we stand today at 4.38%. A stable interest rate environment should benefit equity investors, all else equal, but the thorny issue of high valuations could act as an impediment for equity markets. With price/earnings ratios currently priced to perfection, Corporate America needs to deliver earnings that support the lofty valuations. AI may be just the productivity enhancer that solves many fundamental challenges in the long run, but a return to a more volatile environment in the coming weeks and months may be the most likely outcome as we close out the year.

[1] FactSet Earnings Insight, 7/25/2025

[2] Bloomberg LP 7/31/2025

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.