Overview1

Equity markets have experienced notable volatility in recent days and weeks as the new administration continues to execute policies related to government spending and tariffs.

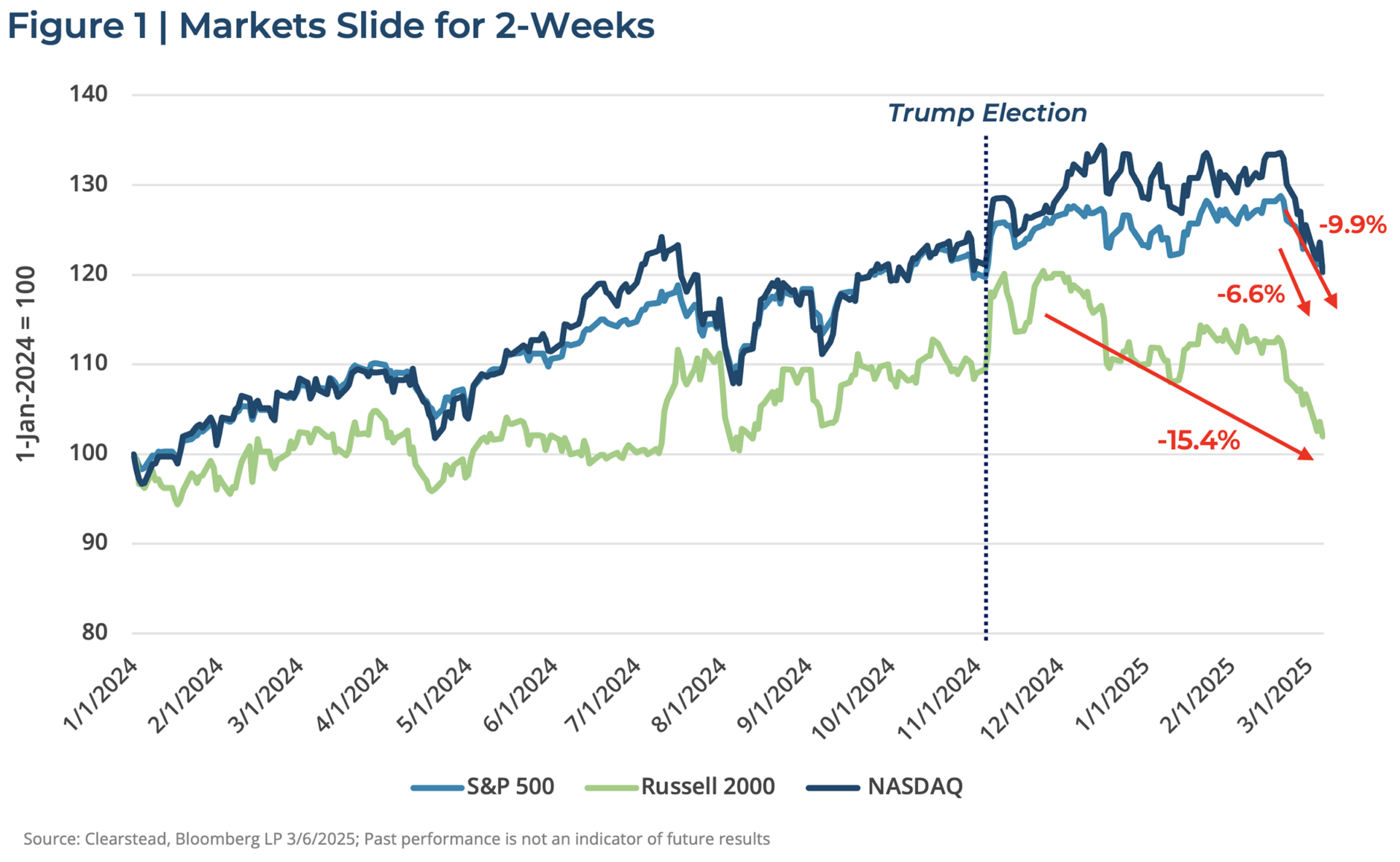

As of the close of March 6, 2025, the S&P 500 has declined -6.6% from its all-time high reached on February 19, 2025. Small cap stocks (Russell 2000 index) have declined -15.4% from its most recent peak on November 24, 2024 (see Figure 1).

Meanwhile in bond markets, the 10-year US Treasury has faced similar volatility as yields have fallen from its 2025 high of 4.79% to 4.28%—though remains in a broader trading range of 3.75% to 4.75%. High yield bond spreads have widened out modestly as equity markets have sold off, though remain well below long-term averages.

A few thoughts from us about the reasons behind the sell-off as well as near-term expectations.

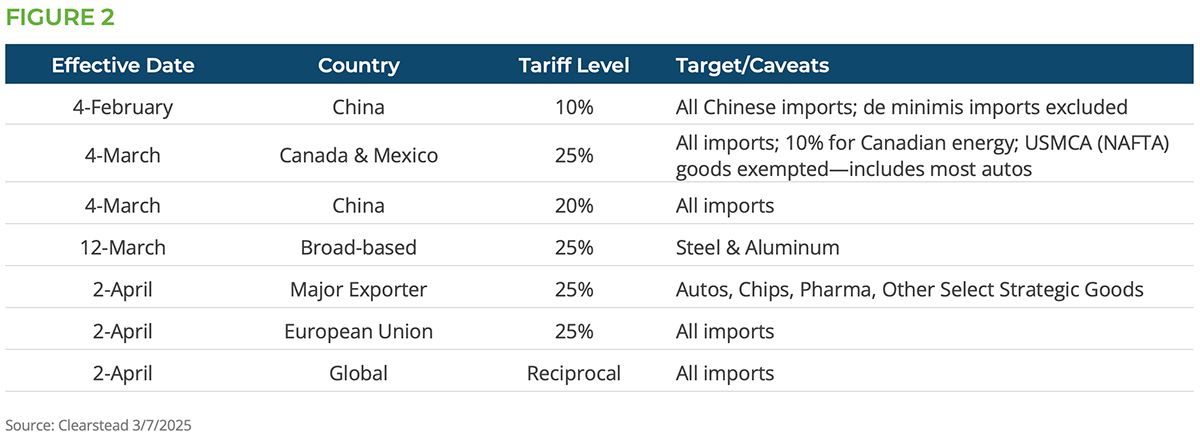

- The combination of Trump’s tariff implementation on Canada/Mexico/China along with some aspects of DOGE agenda has been the catalyst for a sell-off over the past few days, including today (see Figure 2).

- Investor sentiment in the US has taken a hit over the past few weeks, as have numerous sentiment indicators related to the US economy—such as the Conference Board, PMIs, and AAII Bull/Bear survey.

- One model of GDP growth (Atlanta Fed GDPNowcast) is suggesting sharply negative growth in Q1—as of now we do not think that is likely, but numerous indicators suggest a more cautious consumer and building evidence that the corporate sector is increasingly skittish around capital expenditures plans for spending—so expect slower growth in H1-2025 than what we anticipated pre-inauguration.

- Much of what we have seen by way of policy has been counter cyclical, though it is important to note that these are important pieces to partially fund an eventual pro-cyclical tax policy.

- Markets may have assumed that there would be a “Trump Put” (President Trump is well-known for using the S&P 500 as barometer of his economic policies) when it came to US equities, but sentiment may be shifting that the Trump administration is more willing to suffer some near-term market disruptions in order to advance their trade and tax agendas.

- We think the net of today’s headlines combined with an eventual tax bill are still likely to be pro-growth. But markets will need to navigate a volatile path until full scope of the Trump administration’s economic policies are implemented.

- Volatility is likely to remain a fixture for equity markets as they adjust to policy headlines.

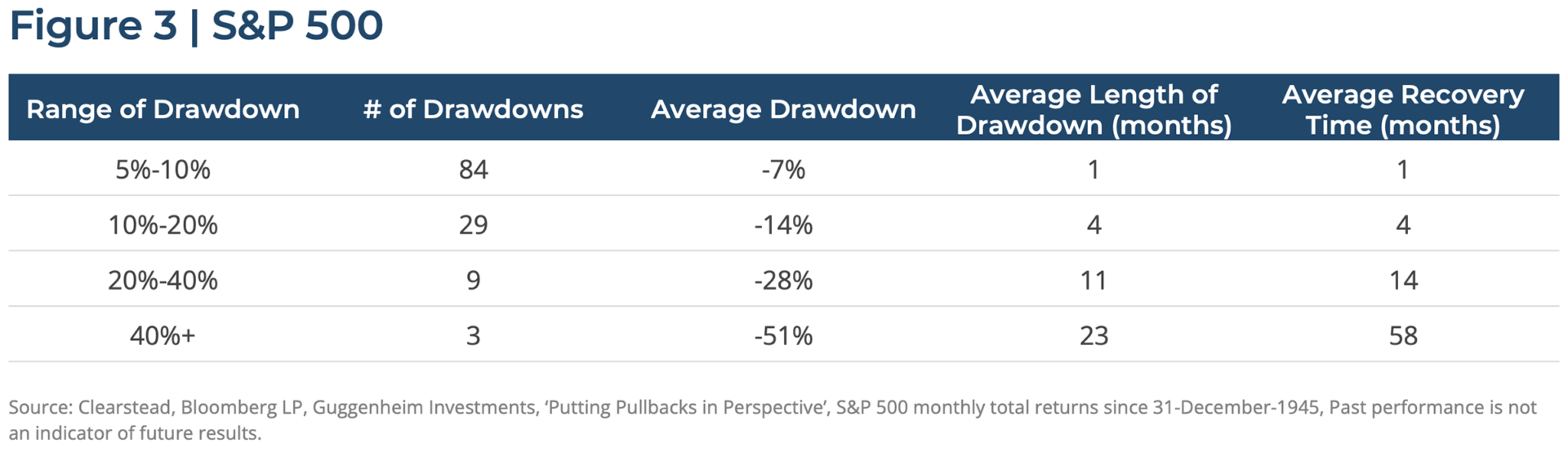

- We would like to reinforce that declines for public markets, and volatility in general, are features not bugs of markets (see Figure 3).

The Trump Administration’s economic policies are moving quickly and Clearstead is actively monitoring these developments, and we will provide additional updates as needed.

Sources

[1] Bloomberg LP as of 3/6/2025