Introduction

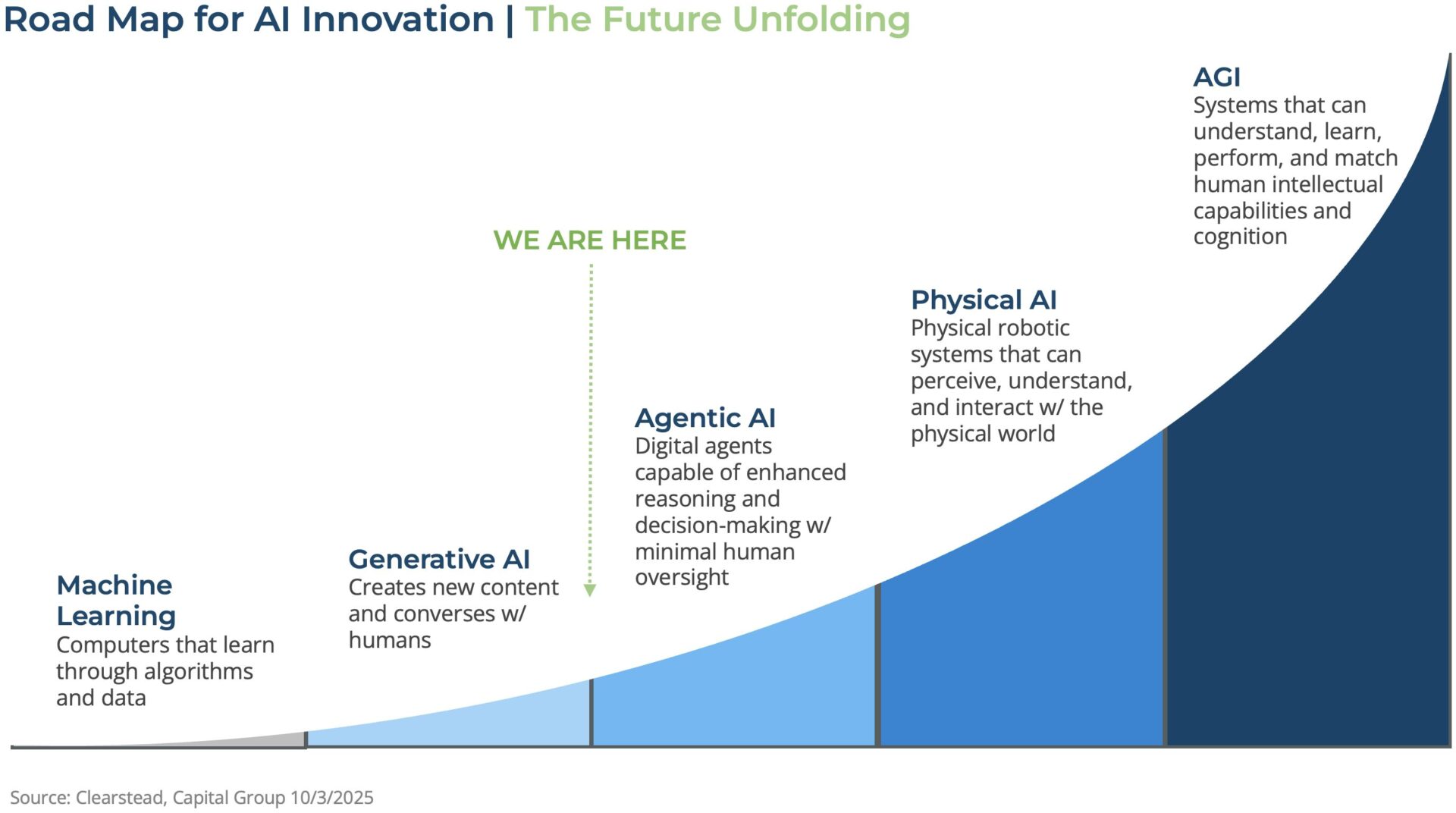

It appears highly likely that we are amid a transformative shift in the US (and most likely global too) economy as AI begins to reshape how companies and households function. As generative AI—the ability of AI models to create content—and Agentic AI—the ability of AI models to autonomously help with specific tasks—are making advances, companies are racing to hone the real-world applications for these tools as well as make deep investments in AI infrastructure and model development capacity. The next stage will be Physical AI, in which generative and agentic AI models are integrated into simple (at first) and then more complex (eventually) robots which can provide a myriad of tasks that, in the past, were only within the purview of humans. At this point, labor markets, financial markets, and national security are expected to be forever altered. The AI-enabled future holds both opportunities and challenges, as well as risks and rewards.

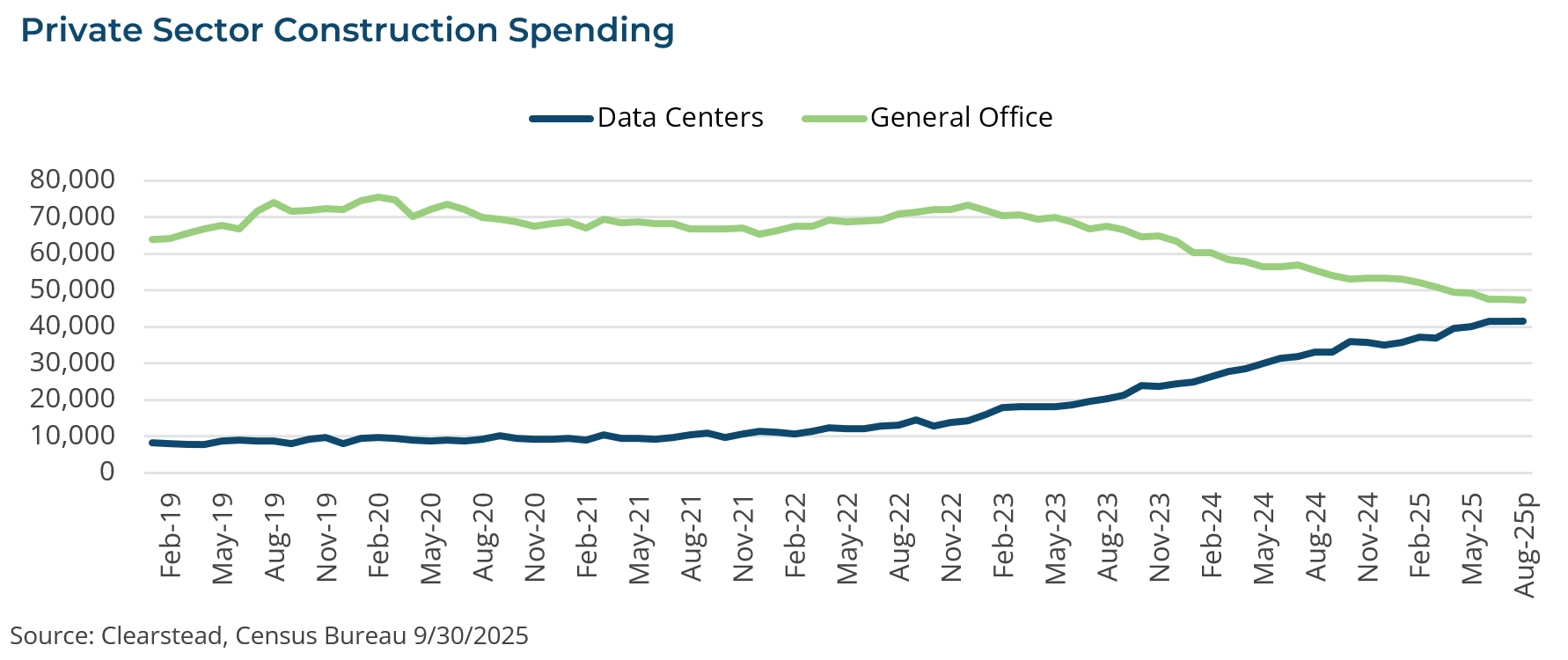

More immediately, many have asked if the US equity markets are in an AI-induced bubble akin to that of the late 1990’s—see the October Market Perspective for our discussion of the topic. There is no doubt that a tremendous amount of capital is being spent to develop data centers—investments in land, buildings, chips, servers, and the electricity to power them—which in turn will be used to create new and more powerful AI models. A recent McKinsey report suggests upwards of $7 trillion could be spent globally between 2025 and 2030.[1] Meanwhile, many of the biggest hyper-scalers—AI-oriented companies financing data centers—such as Microsoft and Google have been regularly increasing their planned spending on data centers. This raises several questions. One is whether all the ongoing and planned construction in data centers can be profitably absorbed by the market. In other words, could AI data centers become overbuilt and the profitability of those making these investments face a nasty hangover. In addition, in recent weeks, some hedge fund managers have made the case that many hyper-scalers are overestimating the lifespan of their investments in data centers which is resulting in lower depreciation expenses and, therefore, flattering their earnings profiles. Lastly, many analysts are watching for signs to see whether AI-oriented investments being made in this space—which, in past quarters, has been primarily funded out of the enormous profitability (free cash flow) of the largest US tech firms—will increasingly be funded by borrowing and leverage. Indeed, Oracle, which has announced plans to lever-up to make AI-oriented investments, has seen the market’s pricing of the risk associated with its bonds increase considerably since the announcement.[2]

Markets are not perfectly efficient. In theory, markets digest all publicly available information and price individual securities commensurate with their profitability, risk-profile, and size. In reality, it is difficult for market participants to assess the value of firms in the middle of large-scale technological transformations. Growth for the perceived winners can look parabolic and history has many examples of bubbles forming. Similarly, as we highlighted in our October note, the internet did power the information superhighway and ultimately revolutionized retail sales, supply chains, and ushered in a new age of productivity. But most of the ultimate winners from the internet revolution were not the companies that actually powered the gains in US equity market in the final years of the dot.com bubble—see RC 21-Apr. Equally, though, investors do learn from experience, and lessons of the dot.com era have not been forgotten.

Conclusion

As we help our clients navigate the AI debate, we remind them of a few key points. First, markets on balance—while not perfectly efficient—typically weigh the risks and rewards of individual companies fairly well in the long-run. Bubbles can form, but they are usually preceded by a boom that is fretted over and agonized by most market participants—we see lots of this today. Bubbles are often not defined by a few loud short-sellers making headlines, but rather the obvious wisdom that stems from a “no brainer” trade because everyone “knows” there is little downside risk. Ultimately, it’s when leverage meets euphoria that things can get out of hand. So far, most of the investments in data centers have been absorbed by companies with the cash to pay for the lease as well as the downstream customers to drive their profitability. Additionally, the AI buildout is also undoubtedly helping the real economy—construction, power grid development, and power generation—which will also pay dividends down the road for whomever needs electricity and a more robust electrical grid. Lastly, many analysts expect AI may structurally boost productivity for large portions of the US corporate sector over the coming decade. There will be long-run winners and losers, and history suggests that today’s market leaders may not be the ultimate winners (perhaps they have not even been founded yet). However, rather than fret over this incredible wave of innovation, find solace in a diversified portfolio that will benefit from the AI investment theme, but also has exposure to companies that will thrive no matter who ultimately wins the AI race.

[1] https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/the-cost-of-compute-a-7-trillion-dollar-race-to-scale-data-centers (The cost of compute: A $7 trillion race to scale data centers)

[2] Bloomberg LP—Oracle 5-year Credit Default Swaps 10/31/2025

Disclosures: information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.