OVERVIEW[1]

Equity markets reacted negatively to the reciprocal tariff announcements made by the Trump Administration on the afternoon of 2-April-2025. Markets sold off in Asia and Europe and opened sharply lower in the US, Canada, and Latin America.

While markets had been given ample forewarning of “Liberation Day” whereby Trump would announce reciprocal tariffs on most countries trading with the US, the magnitude of the tariffs announced went beyond what the markets had anticipated and thus today’s sell-off. The sweeping tariffs take the average effective rate for all US imports to over 20% which the US has not experienced since the early years of the 1900s (see Figure 1). Most of the countries tariffed by the US have pledged to retaliate in some fashion and it is safe to conclude a global trade war with the US has begun. While the Trump Administration may be willing to negotiate on the margin, markets and global supply chains are likely going to adjust to a structurally higher average tariff rate.

The imposition of these tariffs along with those the Trump Administration has already announced (see RC 17-Feb) is likely to slow US and global growth for the remainder of 2025. In many cases corporate profits will come under pressure as input prices rise, export markets become harder to sell into, and the US consumer pulls back in the face of potential—one time—upward move in the prices for many goods. Goldman Sachs estimates that for every 5 percentage-point increase in tariffs, corporate earnings for the S&P 500 are reduced by about 1-2 percentage-points.[2]

The Trump Administration’s economic policies are moving quickly and Clearstead is actively monitoring these developments, and we will provide additional updates as needed. Clearstead plans to have additional discussion of the emerging global trade war in the coming weeks in our regular Research Corner publication as well as our Q1 Quarterly Letter due out next week. In the meantime, here are a few thoughts from us about trajectory of risk assets and markets in general over the coming weeks.

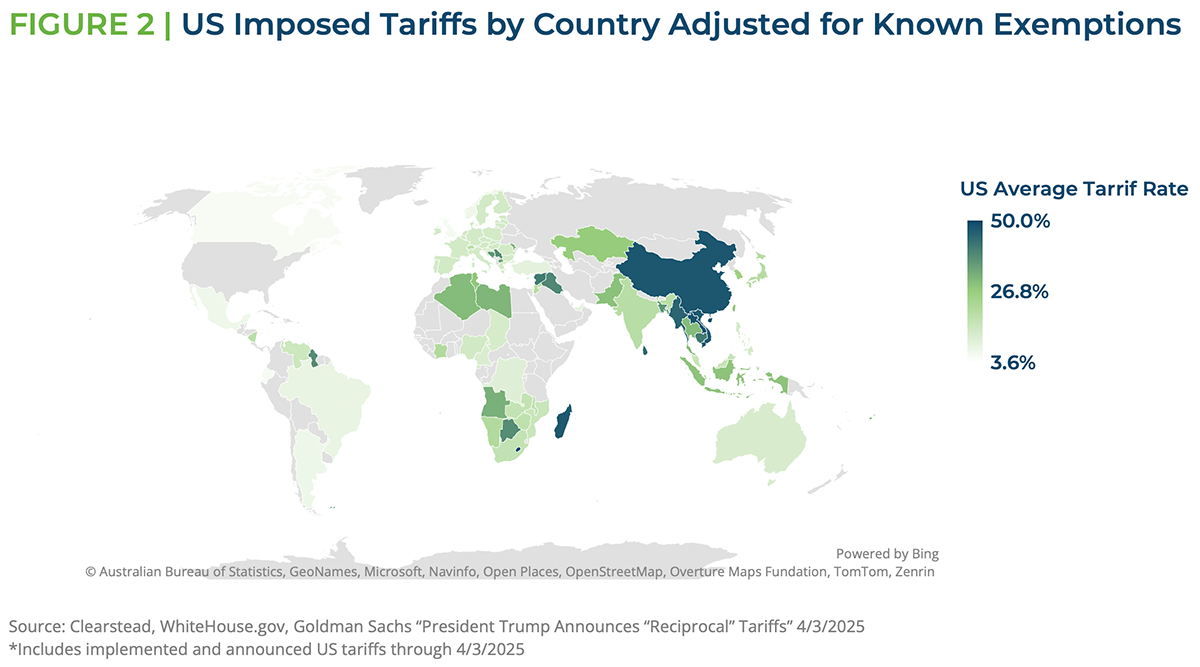

- The initial market reaction suggests that investors had not anticipated the full extent of Trump’s reciprocal tariff regime (see Figure 2).

- Tariffs range from 10% on the low end for some countries to about 50% (total) for China and even higher for select south-Asian economies.

- Further bilateral negotiations are possible between the Trump Administration and select countries, and news of such talks—entailing lower reciprocal rates, less non-tariff trade barriers, and potential product exemptions—would be greeted positively by the markets.

- However, if the conservative-oriented Project 2025 document is any guide—thus far it has been a reasonable barometer of Trump’s economic agenda—bilateral talks will not reduce the US reciprocal tariff rate back to pre-Trump levels.

- Currently markets are pricing in the likelihood of slower growth both in the US and globally as well as reduced global trade; thus far we do not think markets are pricing in an eventual recession.

- While the risks of recession are heightened in the aftermath of these tariff announcements, it is worth noting that the US economy comes into this trade war in good shape—low unemployment, strong corporate balance sheets, and an economy more levered to domestic consumption than global trade.

- One model of GDP growth (Atlanta Fed GDPNowcast) is suggesting growth for Q1 is likely to be close zero and the US Federal Reserve recently noted that US tariff policy could slow growth for the remainder of 2025.

- Estimates range from -0.5% to -1.0% in terms of these tariff policies’ impact on US growth.[3]

- Much of what we have seen by way of US economic policy has been counter cyclical, though it is important to note that these are important pieces to partially fund an eventual pro-cyclical tax policy.

- It is worth noting that should these tariff levels remain in place—Clearstead judges that subsequent bilateral negotiations are unlikely to fundamentally alter the current tariff rates—they could bring in as much as $700 billion per year, according to an initial estimate by Capital Economics—but this assumes that US consumption patterns are largely unchanged after the tariffs are implemented.[4]

- We think the net of today’s headlines combined with an eventual tax bill are still likely to be pro-growth. But markets will need to navigate a volatile path until full scope of the Trump administration’s economic policies are implemented.

- Volatility is likely to remain a fixture for equity markets as they adjust to policy headlines.

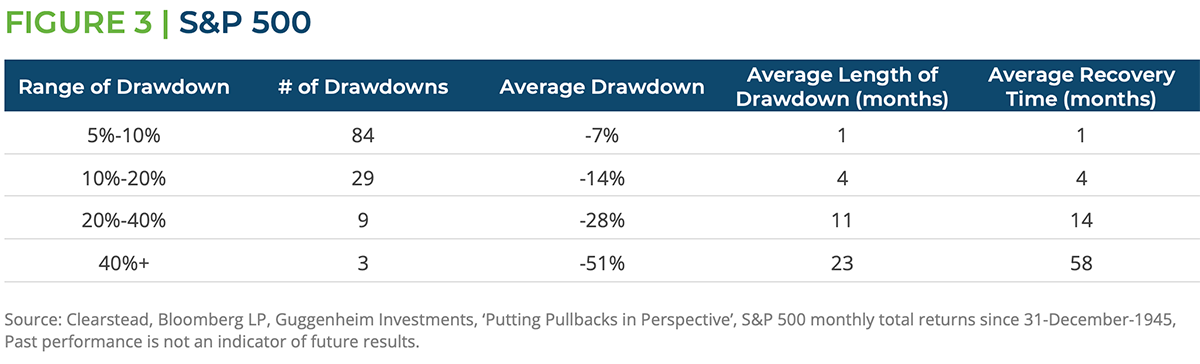

- We would like to reinforce that declines for public markets, and volatility in general, are features not bugs of markets (see Figure 3).

[1] Bloomberg LP as of 4/3/2025

[2] Goldman Sachs US Weekly Kickstart “Among the key policy shifts in April, tariffs will outweigh the slowing of QT for equities” 3/28/2025

[3] PIMCO “Washington Watch: Tariff Man Shows Up on “Liberation Day”; Yale Budget Lab 4/3/2025

[4] https://www.wsj.com/livecoverage/trump-tariffs-trade-war-stock-market-04-02-2025/card/economists-tariffs-to-raise-700-billion-for-u-s-and-boost-inflation-DDimAeALjEnHu30XFvw6

Disclosures: Any performance data shown represents past performance. Past performance does not guarantee future returns. Current performance data may be lower or higher than the performance data presented. The information provided is intended for investors are qualified to invest in alternative investments and are willing to accept the increased risks and illiquidity for alternative investments. The information in this report is from sources believed by Clearstead Advisors, LLC (“Clearstead’) to be reliable as of the date listed or presented and is subject to change without notice. The views expressed herein are those of Clearstead investment professionals at the time comments were made, may not be reflective of their current opinions and are subject to change without notice. This material is for informational purposes only and does not consider the investment objectives or financial situation of the person receiving this information. A person seeking information about an investment strategy represented in these materials should contact a financial professional to help evaluate as to whether it is consistent with a person’s investment objectives, risk tolerance, and financial situation. The information contained herein or any opinion expressed shall NOT be construed to constitute an advertisement, investment advice, an offer to sell or a solicitation to buy any securities mentioned herein or other financial instruments. This commentary does not purport to provide any legal, tax, or accounting advice. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this report. Performance of all citied indices is on a total return basis with dividends reinvested. Benchmarks may be included for informational purposes to measure the performance of investments compared to markets in general. Clearstead is making no claim that an included benchmark is the most appropriate for evaluating an investment strategy.