Private credit has been a form of debt financing for hundreds of years. Private credit simply refers to the many types of privately negotiated loans between a borrower and a non-bank lender. The addressable market for private credit is upwards of $40 trillion1 and encompasses a broad universe of lending from direct corporate lending, asset-based finance, infrastructure debt, agriculture lending, and many other forms of borrowing in our global economy. The purpose of this article is to focus on the private credit direct lending market.

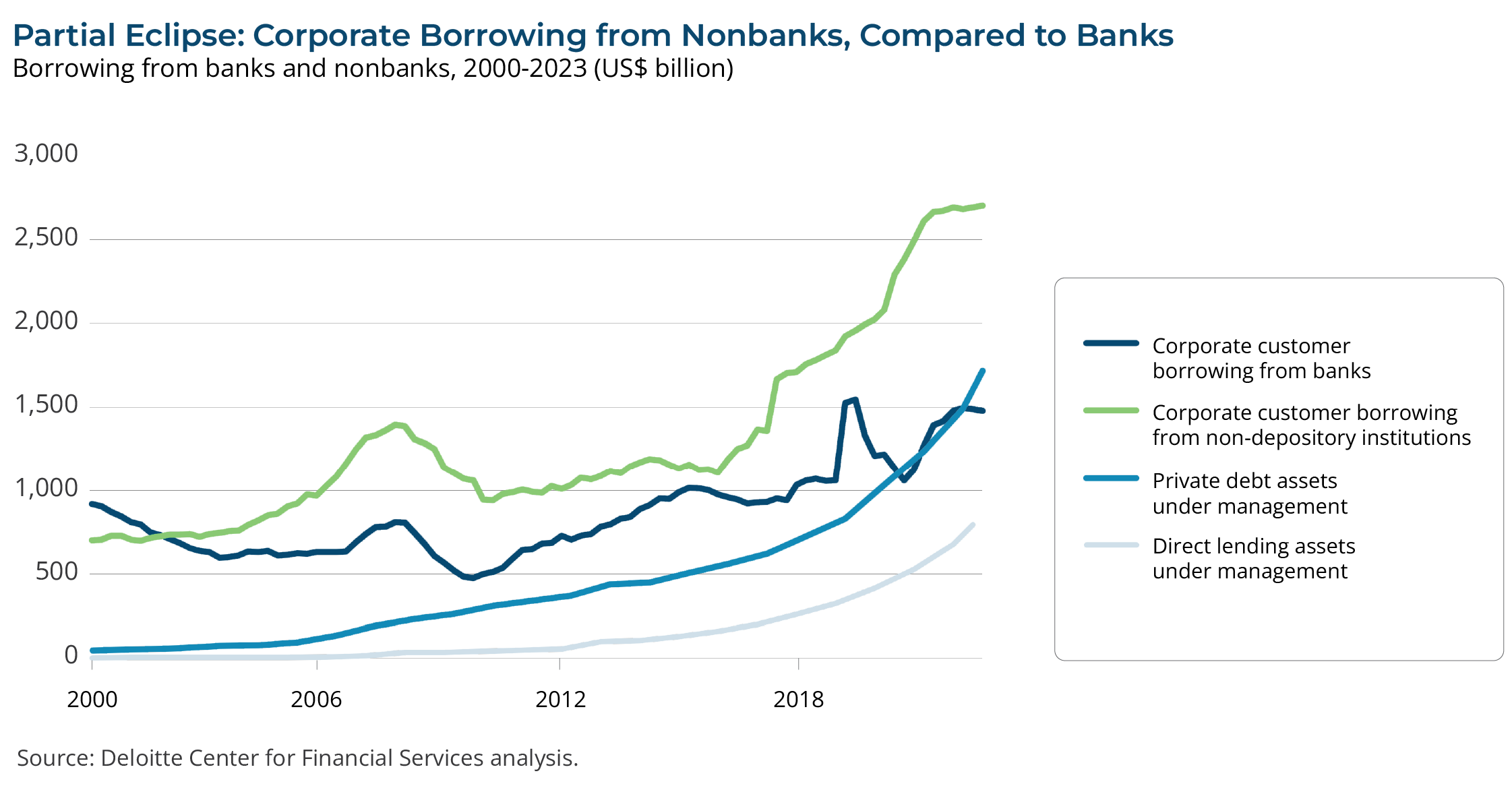

Traditionally banks have been the primary source of funding for corporate loans. While banks tightened the lending standards of loan portfolios, small and medium-sized businesses still needed funding for their operations. While the demand from Corporate America for debt financing remains robust and banks as a source of capital has declined, private market lenders have stepped in to fill the void as a source of capital.

With banks stepping back from leveraged lending, private direct lending has grown rapidly – global AUM hit $2.1 trillion in 2023, quadrupling over the previous 10 years,2 and is forecast to climb further to $2.8 trillion by 20283 (almost equal in size to the high yield bond market and the broadly syndicated loan market).

As a result of the rapid growth, the private credit market faces increased scrutiny regarding transparency and potential risks, such as higher leverage and the use of “payment-in-kind” (PIK) interest structures, which have been accompanied by a plethora of press reports (and opinions) that attempt to paint private credit in a negative light.

The demise of TriColor, a subprime auto dealer and lender, and First Brands, a producer of aftermarket auto parts, have been painted as the “canary in the coal mine” of the private credit market. The problem with such an analysis is that neither one of these examples had anything to do with private credit. In both cases, fraudulent behavior appears to be at the heart of the issue. One could say that markets that grow rapidly and get ahead of themselves are prone to lax standards and poor underwriting, but these were not private credit market productions – the banks involved should be looking for the cockroaches within their own four walls.

The reality is that with any type of investment, there are likely to be some failures; even at the “AAA” levels, there is a probability of default, albeit small. The Cliffwater Direct Lending Index (CDLI), the most comprehensive source of information on direct lending, reports that, as of 6/30/2025, 98.8% of borrowers in direct lending are current on principal and interest. Journalists seem to only write about one-off scenarios where one borrower or one lender in a $485 billion index gets into trouble yet neglect to mention the $479 billion (98.8% × $485b) that’s working just fine.4

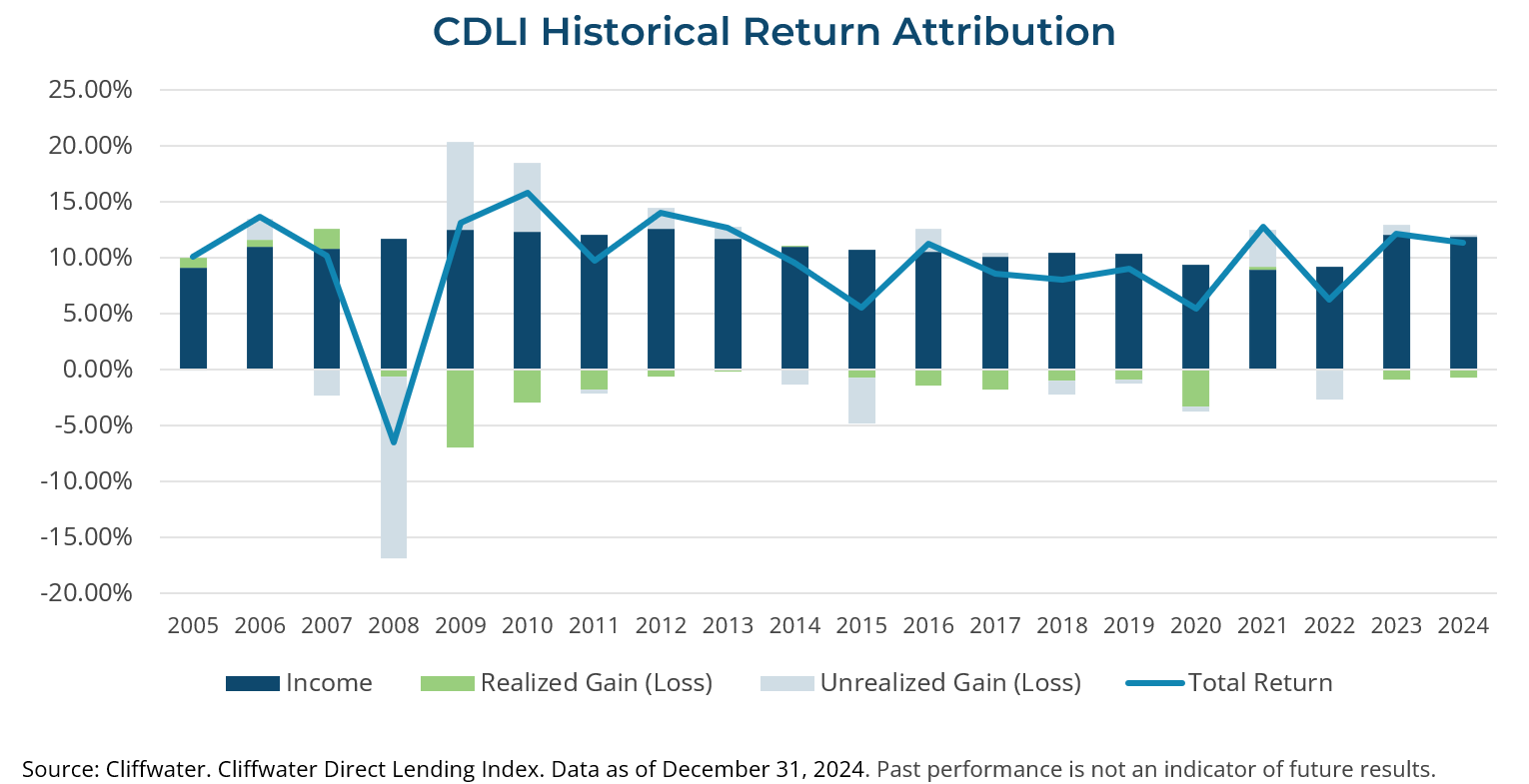

Direct lending has been tested across five unique credit cycles: The Global Financial Crisis (GFC), the European banking crisis, energy sector distress, COVID, and the 2022 recession head fake. Since 2005 the total return by calendar year of the CDLI has averaged 9.65%, with 2008 standing as the lone year of negative performance.

In 2008, the CDLI’s negative performance was primarily driven by lenders marking asset values lower, generating unrealized losses exceeding 16%. However, the credit losses that would ultimately be realized throughout the GFC period would fall well short of lenders’ early markdowns, thus providing the boost to 2009 and 2010 returns as the defaults were less severe than anticipated.

While private direct lending isn’t new, the market has been attracting new borrowers beyond their historical lower middle market customers. Larger companies are increasingly turning to private direct lending markets to meet their long-term capital needs. These larger borrowers have also been successful in pitting their traditional bank loan syndicate lenders against private credit lenders to achieve more favorable lending terms. While spreads have tightened and covenants can be less onerous, the borrowers are generally large, established corporations, with experienced leadership, and a history of responsible stewardship of their companies. Often the borrowers have investment grade credit ratings and choose to borrow in the private credit markets to access capital on more flexible and customizable terms, with potentially greater speed of execution. Again, private credit is filling a void that banks once satisfied.

One key to successful participation in the private credit market is partnering with experienced, well-established private credit asset managers. As the growth of private credit direct lending has risen, so has the number of lenders (asset managers) grown. In fact, a new manager entered the direct lending market approximately every five days in 2023.5 As the private credit space has become more crowded, manager selection has become more difficult. Golub Capital writes, “The long-term performance history of the direct lending market shows a striking dispersion between investor returns delivered by top-quartile and bottom-quartile managers—a performance gap that has persisted over time. In our view, this is because successful managers have built resilient franchise businesses with enduring competitive advantages that have historically enabled them to maintain consistently low credit losses.”6

Steve Nesbitt, the CEO of Cliffwater, LLC, stated that, “The private debt market brings together sophisticated lenders (asset managers) and borrowers (private equity sponsors) that exhibit a strong alignment of interests to the benefit of investors that are willing to forfeit some liquidity in exchange for a higher yield and possibly better underwriting (lower defaults) by accessing high-quality lenders.”7 As early investors in private direct lending, Clearstead clients have successfully participated in this growing investment market. We are not naive to the fact that there will be challenges in the private credit markets when an economic downturn happens, but partnering with experienced market leaders, we believe, will be beneficial when the tide rolls out and we see who is swimming naked

[1] Apollo, State Street Investment Management, SIFMA, as of July 24, 2025

[2] Reserve Bank of Australia. (2024, October 17). Growth in Global Private Credit.

[3] Preqin. (2024, April 8). Private Debt’s Rapid Growth Merits Closer Scrutiny, IMF Says

[4] Cliffwater, 2025 Q2 Report on U.S. Direct Lending

[5] Golub Capital internal analysis and Preqin. Utilizes Preqin’s database of first-time direct lending funds launched by an asset manager globally. The dataset includes 535 first-time direct lending funds launched from 1995-2023. As of February 1, 2025.

[6] Golub Capital, Timely Insights, https://education.golubcapital.com/resource/dispersion-persistence-of-manager-performance-in-direct-lending/

[7] Stephen Nesbitt, CEO, Cliffwater LLC, 11/07/2025

Disclosures: information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.