US Dollar Debasement – Gold, China, and Speculation

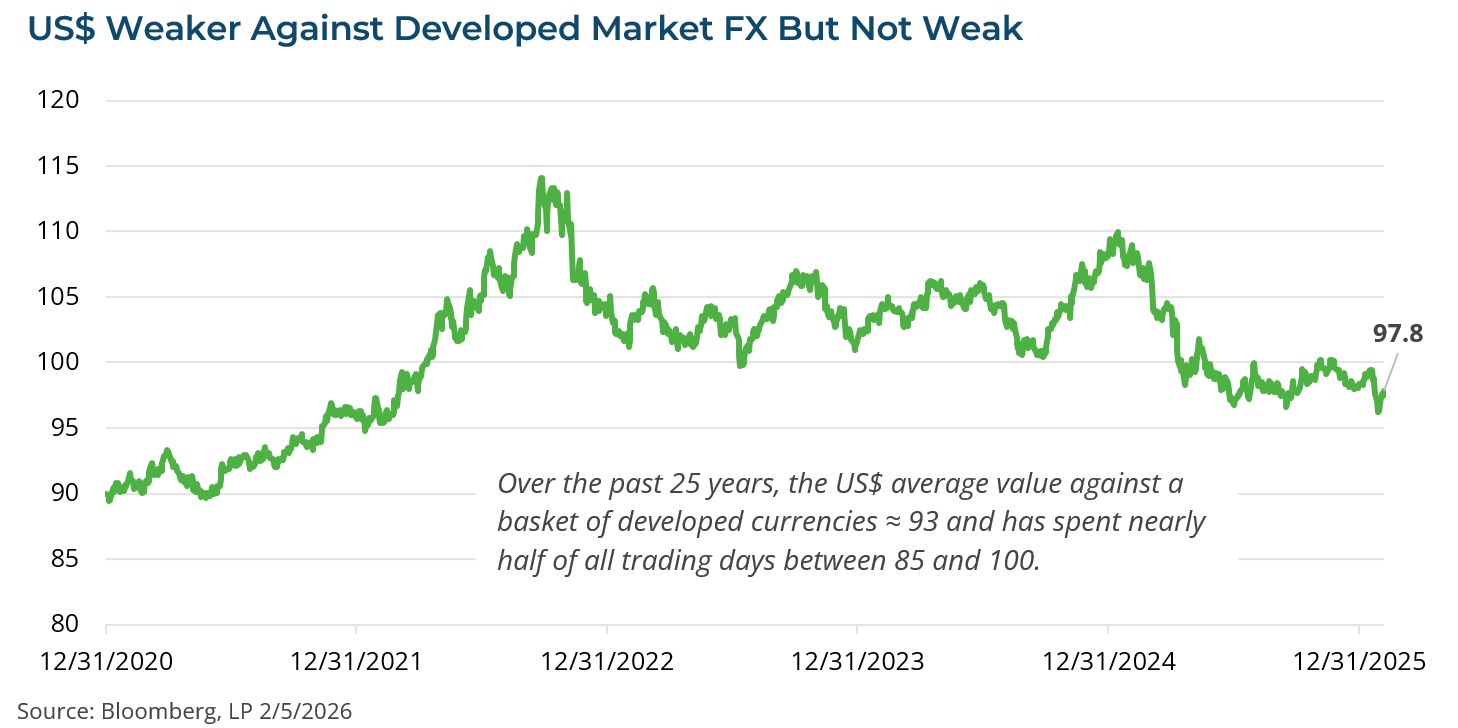

There has been much discussion of late regarding the idea of US dollar debasement. It seems much of the financial press is abuzz with talk of the “debasement trade,” a catchall term for bets against the US dollar and broader US financial assets. The signs of US dollar debasement seem to be everywhere, and it has slumped about 12.5% against a basket of developed market foreign currencies.[1] Gold and other precious metal prices have surged, in part, as a strategy to hedge against the fall of the US dollar. Lastly, there are reports of foreign buyers shunning US Treasuries and other US financial assets. In the media, this sometimes results in headlines that US exceptionalism is under threat, the US dollar will plummet against other currencies, and the US could experience a debt crisis. None of these are likely in the near-term.

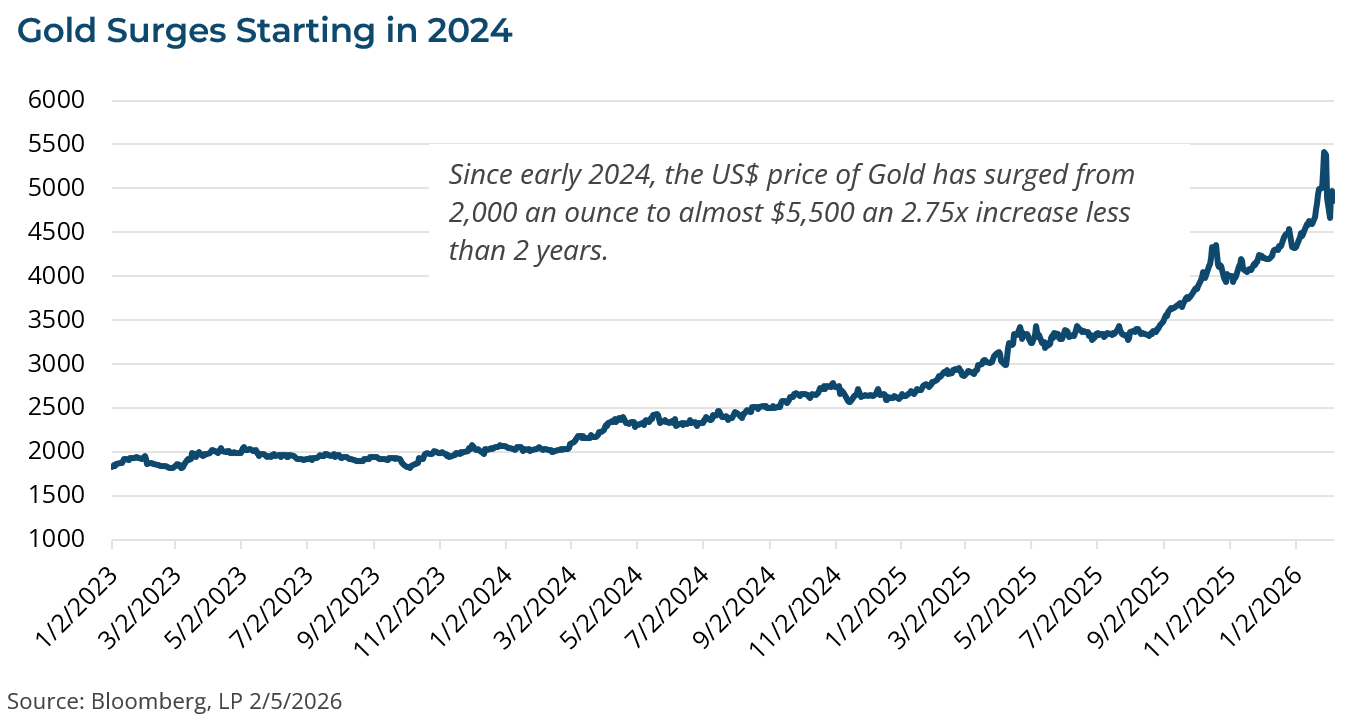

Indeed, there is some substance behind each of these “signs” of the US dollar debasement trade. However, there are also aspects of the debasement trade that seem overdone and so are some of the implications for US markets as a result. First, the price of gold (and silver) has moved sharply higher in the past 24 months. Some of the movement in gold prices has been due to the increase in structural demand by global central banks to diversify their foreign holdings away from dollars to gold and other precious metals.[2] China, in particular, has been actively increasing its holdings of gold, particularly since the US sanctioned Russia in 2022.[2] But the increase in global central bank buying—which is typically pretty stable quarter to quarter—is unlikely to be the proximal cause for the surge of the price of gold. A more reasonable explanation is simply speculation and FOMO trades. Flows into ETF gold strategies surged last year with the AUM of gold ETFs doubling last year to nearly $560 billion.[3]

In terms of other financial assets, such as equities and fixed income, there is little evidence of any real pullback from foreign investors. We should recall that the S&P 500 returned over 17% last year, which does not suggest global investors are shunning US equities. In fact, last year, non-US investors had positive net purchases of US stocks and bonds.[4] There is some nuance here. Typically, the US has been running large trade deficits—handing foreign companies US dollars in exchange for foreign produced goods and services. This means that many foreign firms were taking in a lot of dollars and then often re-investing these proceeds into US financial assets until they either repatriated the profits or used the proceeds to eventually buy dollar-priced equipment, inputs, or services to make more product for sale. The Trump administration’s tariffs seem to be reducing our trade deficit and, as a result, foreign firms have less US dollars to recycle into the purchases of US financial assets. Similarly, because there has been a great deal of policy changes from the Trump administration related to tariffs, international security relationships with many foreign firms are re-examining their supplier base and often viewing the US as a less predictable market—hence they are hedging their exposure to the dollar as well as requiring a higher rate of return from US financial assets. A recent analysis by the Bank for International Settlements, a think-tank for global central banks, found that increased dollar hedging activity is occurring and it is putting downward pressure on the dollar.[5]

What does this mean for US investors? Well added risk-premia that foreign investors are placing on US financial assets may mean that US fixed income yields may see some marginal upward pressure as the marginal foreign buyer requires a higher yield before investing. Equally, US equity valuations, which are stretched, may be marginally less attractive to global investors. However, none of these factors suggest that there is a strong move away from the US dollar in terms of its global usage.

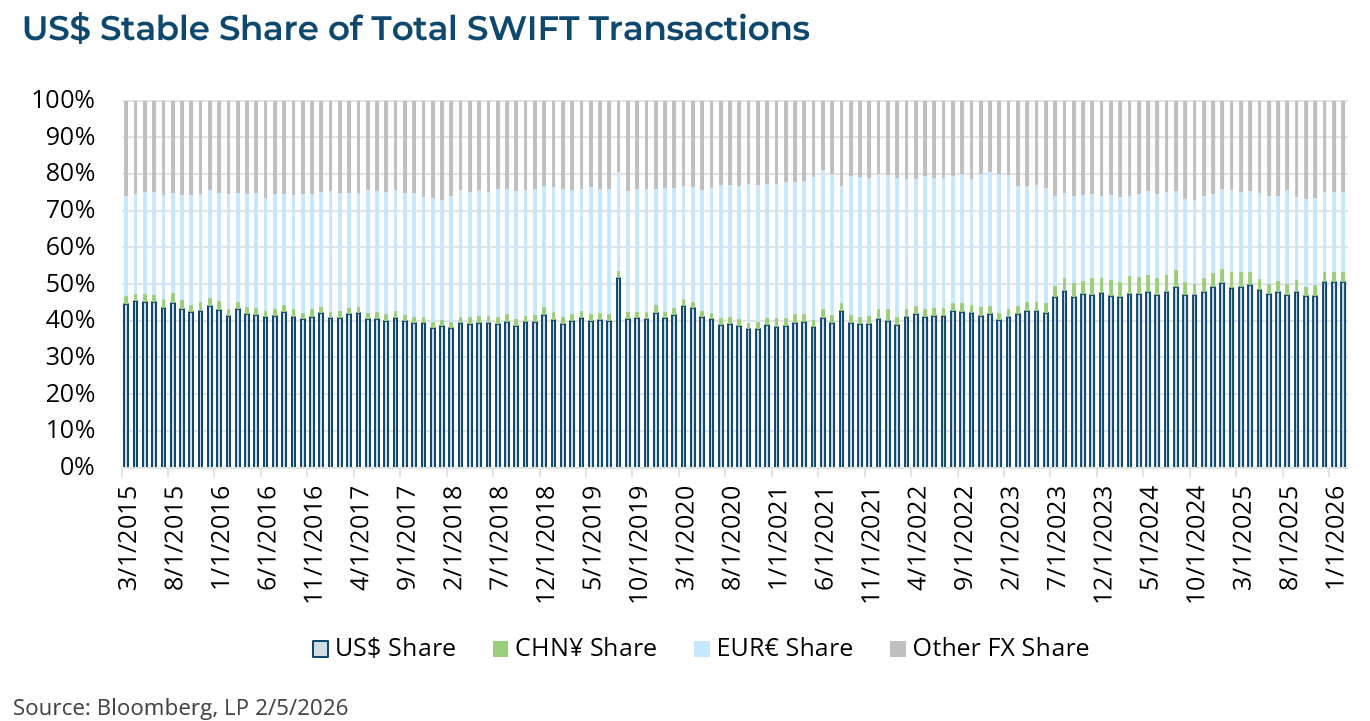

SWIFT data—a global multi-currency transaction network—shows approximately 50% of global transactions are in US dollars and this share has been stable over the past several years.[1] Conversely, China’s payment system—called CIPS and designed to compete with SWIFT—handles less than 3% of global value.[6] Furthermore, 88% of FX trades and 50% of global trade invoices are denominated in US dollars.[7] The dollar share of global reserves is 58%, down from 71% at the peak, but this has been stable for five years.[8] Similarly, the upward movement in gold, industrial metals, and other commodities in recent months directly reflects the fact that most of what is bought and sold in the world is denominated in US dollars—their prices have risen as the US dollar has weakened, keeping the net cost to foreign buyers largely unchanged.

Nonetheless, the policies of the Trump administration this year may lead to additional dollar weakness. The President has been vocal about his desire to see US interest rates cut further—which would, all else held constant act to weaken the dollar. Equally, the President has often times stated a desire for a weaker dollar to curb imports and improve export competitiveness. Similarly, if the economy reaccelerates in the coming months—see RC 9-Feb—then investors may again begin to fret over inflationary pressures. Rising inflation and a dovish Fed is a recipe for further dollar weakness. Lastly, the fiscal position of the US government could take a hit from a Supreme Court decision rolling back some the President’s tariffs which could ignite concerns over the long-run debt levels in the US. All of these things could transpire to push the US dollar marginally lower in the near-term against a basket of currencies.

Notwithstanding these issues, in the long-run, the US economy remains one of the most innovative, productive, transparent, and stably growing in the world. Despite more uncertainty in US economic and foreign policy, the bid-ask spread for the US dollar to most other currencies is tighter than most other foreign currency pairings, making the use of the dollar a cheaper option for most countries trading across the globe.[9] These factors are unlikely to change any time soon and provide a strong, long-run structural uplift for the dollar. While there may be a short-term trend towards “hedging America,” we are skeptical at present if this will indeed turn into a long-run “sell America” trade.

[1] Bloomberg, LP 2/5/2026

[2] https://www.gold.org/goldhub/gold-focus/2026/01/central-bank-gold-statistics-buying-momentum-continues-november

[3] https://www.gold.org/goldhub/research/gold-etfs-holdings-and-flows/2026/01

[4] https://www.apolloacademy.com/continued-strong-foreign-demand-for-us-assets/?utm_medium=email&utm_source=pardot&utm_id=1acbaea2e3ed4af8a10b9da51c43cee4&utm_campaign=EXT_Daily+Spark

[5] https://www.bis.org/publ/bisbull105.pdf

[6] https://www.fxcintel.com/research/analysis/cips-growth-may-2025

[7] https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr1087.pdf

[8] https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-u-s-dollar-2025-edition-20250718.html

[9] https://www.bis.org/publ/qtrpdf/r_qt2212x.htm#:~:text=The%20USD’s%20dominance%20in%20global,a%2010th%20of%20global%20trade.

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.