Introduction

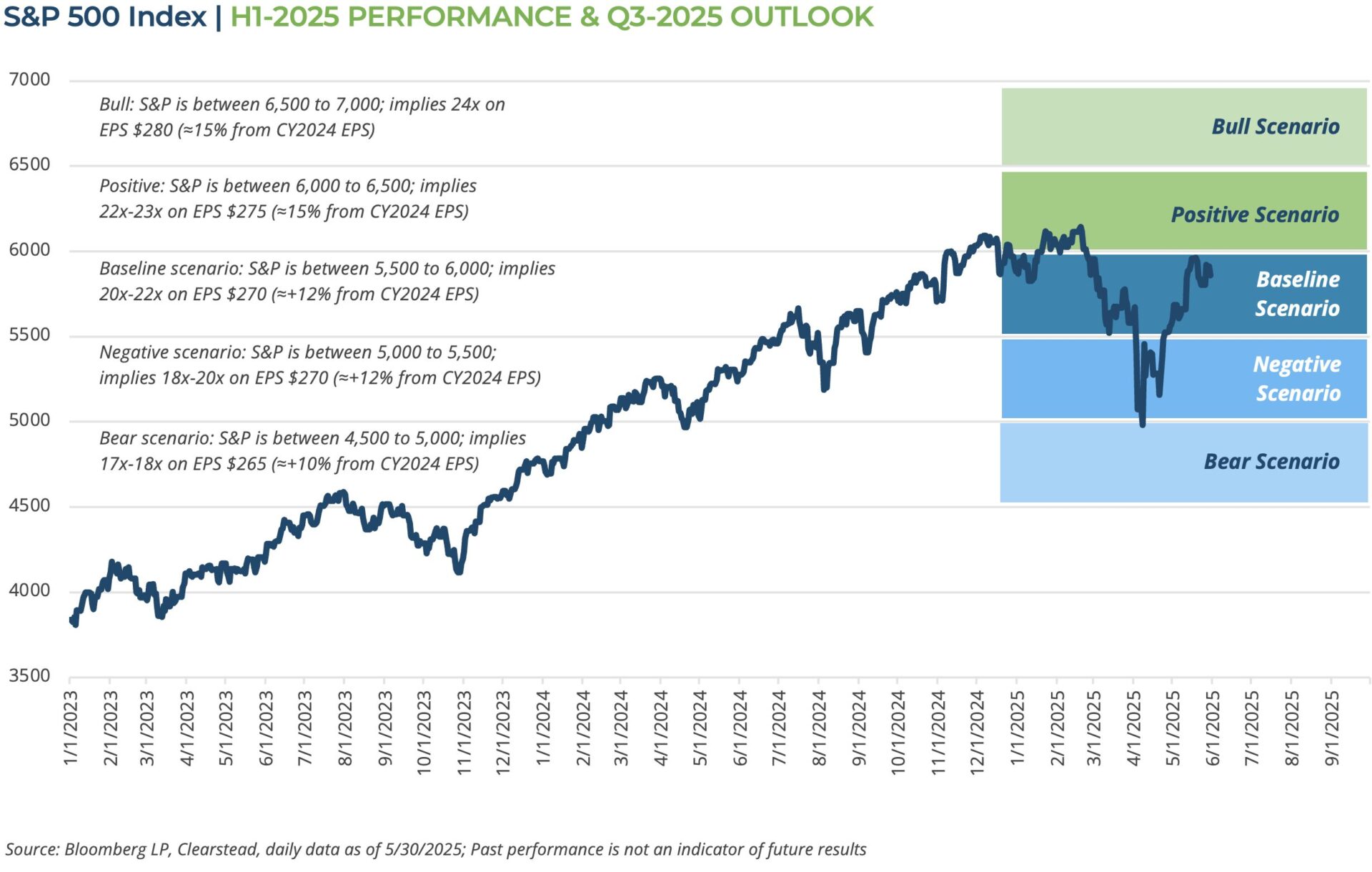

The first five months of the year have been eventful. After charting a new historic high in mid-February, the S&P 500 sold off, then corrected (down by more than -10%), and got within a hair’s breadth of a bear market (down by -20%) just after the Trump administration announced higher tariff rates on nearly every US trading partner than in any time in the past 100 years. There were signs of panic selling in the market. But just as markets looked the worst, the Trump administration announced a 90-day pause to most of these tariffs and the equity market began to improve.

Just after the Trump administration announced the reciprocal tariff (Liberation Day) regime, numerous market indicators began to suggest that a recession would be increasingly likely by the end of the year. This recessionary risk stemmed from the anticipation of slowing global trade, slowing global growth, and some rise in the price level for goods and some services in the US as higher priced (tariffed) imported goods worked their way into the US economy. However, the Trump administration’s successful negotiation of a trade deal with the UK as well as some progress to deescalate the trade war with China (see RC 12-May), eased market concerns. Given these developments, many market indicators of recession risks have declined in recent weeks.

There has been a vibe shift to a more positive sentiment in the markets over the past few weeks and the eventual tax bill winding its way through Congress could further boost investor sentiment over the summer months. The S&P 500 now trades once again at above its 200-day moving average and the VIX—the so called “Fear Gauge”—has moved lower and is near its long-run average. While this shift in sentiment is welcome, it may not last. Trump is always a wildcard, and it is difficult to anticipate the full range of policy actions or pivots that may come over the remainder of the year. The Trump administration may enact policies to help boost equities or they may enact policies that weigh on equities—only time will tell. Clearstead would caution, however, that while the risks of a recession have lessened, they remain elevated and another “growth” scare could loom later this year if the positive momentum in these bilateral trade talks does not translate into actual trade deals by mid-summer. Furthermore, the S&P 500 is expensive on a price-to-earnings basis and the prospect that adverse economic or policy news would be a catalyst for the S&P 500 to retest April’s lows cannot be ruled out. Nonetheless, thus far earnings have remained strong, the economy resilient, and gauges of sentiment from households to business as well as market indicators of risk appetite have moved in a positive direction. Additionally, there are credible reasons to believe that the US economy is less-cyclical than in decades past and its more service-sector oriented economy may be more resilient to recessionary downturns than when the manufacturing sector was a larger share of the economy.

As we move into June, the S&P 500 is up slightly on the year (total return as of 5/30/2025 the S&P 500 is 1.1% YTD) and it has fully recovered its losses from Feb-April period. We are now being asked by clients—where do we go from here?

Well, the short answer is there are still a lot of unknowns to contend with and, unfortunately, we still have more lingering questions than definitive answers. The most likely near-term dynamic is a volatile and sideways market as the range of outcomes, both positive and negative, for the US economy and markets have widened out for the year. Nonetheless, we are advising clients to stay the course and rely on the security of their portfolio construction and not to lose sight of their long-run investment goals. Clearstead recommends diversified portfolios structured with the goal of withstanding volatility and outperforming the market over the long-term. We hope that today’s volatility does not distract clients from the benefits of a strategic asset allocation and the power of compounding returns over time.

Given the uncertainty and unknowns that loom this summer—Will tariffs go up or down from here? Will the tax bill pass Congress? Will the labor market remain strong? What actions will the Fed take?—on the margins we are favoring things we can control. For instance, dividend paying stocks have historically been less risky and speculative than companies relying on multiple expansion or lower interest rates to make further gains, and shorter duration fixed income with reasonable yields look attractive. We believe that risk assets are likely to remain volatile this summer, but as the first five-months of the year have shown, investors that do not panic and are focused on their long-run goals usually come out ahead.

Disclosures: information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.