OVERVIEW

The record long 43-day government shutdown finally came to an end with close votes in both the House and the Senate to pass a continuing spending resolution that funds the Agriculture Department (including SNAP benefits), Veteran Affairs and Defense, and the Legislative Branch (staffers) through the end of the government’s fiscal year (September-2026). It also provides funding for the rest of the government until the end of January. While the government re-opening is welcome news, Congress will still have to pass nine other appropriations bills before the end of January or a partial shutdown could once again loom.

Although the shutdown came to an end, data starved financial markets remain in partial darkness as some data will never be known. For example, the U.S. Bureau of Labor Statistics said it would not be publishing the closely watched employment report for October, but will combine nonfarm payrolls for that month with November’s report after the recently ended government shutdown prevented the collection of data for the household survey.[1] Other data will be released but significantly delayed; the initial “advance” GDP estimate for the third quarter of 2025 was originally scheduled for release on October 30th, but will be published on December 23rd. Economic clarity remains an elusive commodity.

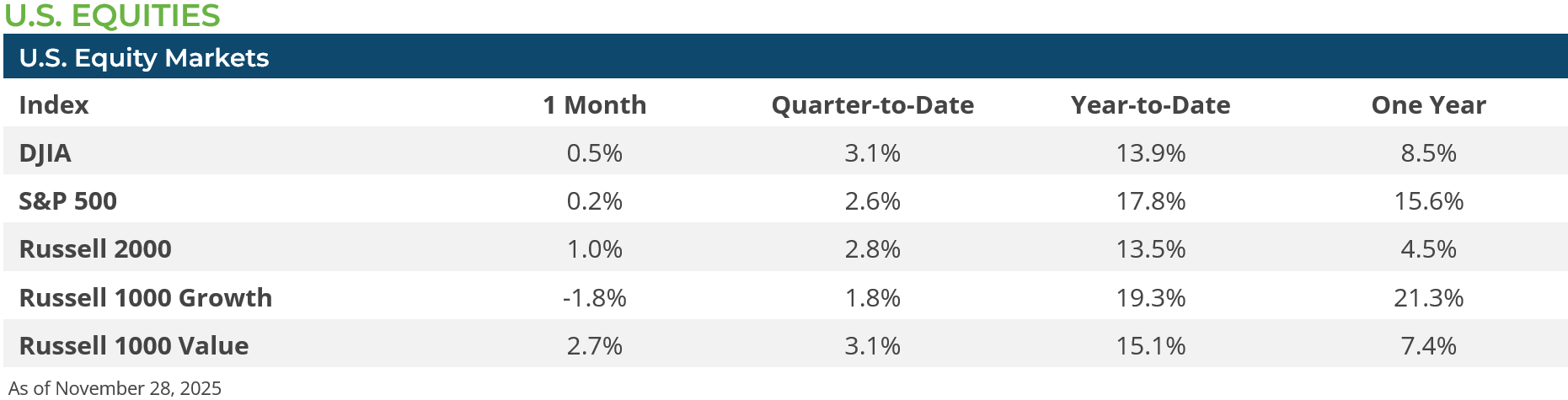

The markets experienced some rather volatile trading, but the S&P 500 ended November nearly flat (+0.2%) and less than -1.0% off its all-time high from late October, while interest rates were marginally lower.

Equity markets opened up November with a bout of volatility. After 36 separate record highs in 2025, including eight that occurred in October alone, the S&P 500 largely sold-off for the first three weeks in November.[2] However, a strong finish to Q3 earnings season and a bevy of Fed speakers late in the month indicating that a mid-December rate cut was likely powered the S&P 500 to recoup most of its losses for the month. In the end, the S&P 500 traded close to flat, while mid-caps (Russell MidCap Index +1.3%) and small caps (Russell 2000 Index +1.0%) both made gains for the month. The gains were broad-based in November, with tech stock losing 4.3% along with Consumer Discretionary down -2.4% and Industrials down 0.9%, but all other sectors made gains, led by Healthcare which was up 9.3% for the month. Growth stocks (Russell 1000 Growth Index -1.8%) lagged their value peers (Russell 1000 Value Index +2.7%) because they were dragged down by the Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) which collectively was down 1.1% during the month.

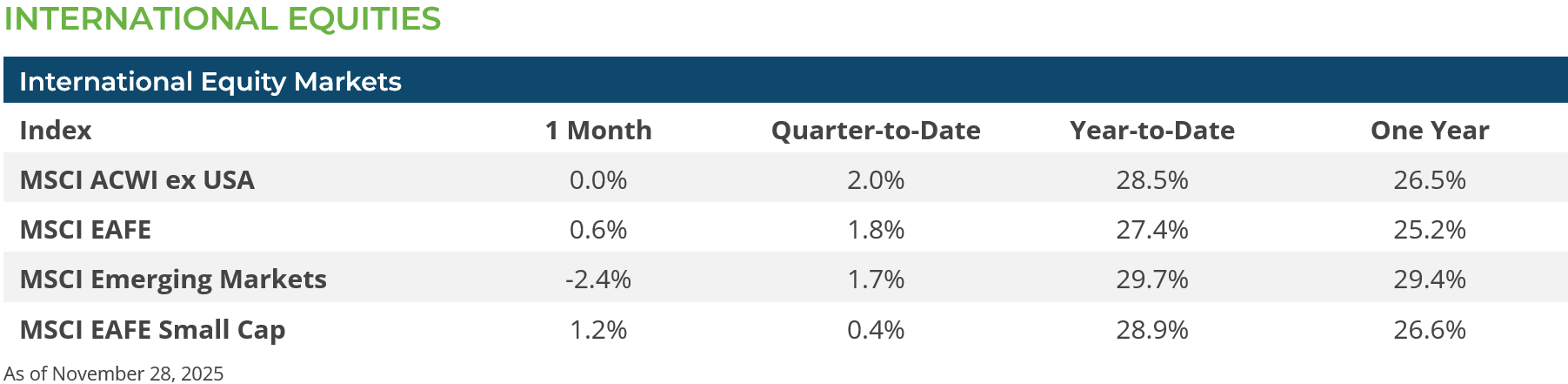

International equities also saw mixed results for November. International developed market equities (MSCI EAFE Index +0.6%) made modest gains during the month, but emerging market equities (MSCI EM Index -2.4%) lost ground. Emerging market equities were, in part, dragged down by Chinese equities (MSCI China Index -2.5%) which were under pressure as several economic indicators surprised to the downside and some companies reported negative earnings pressure. Similar to the US, international small caps (MSCI ACWI ex US Index +0.8%) outpaced their large cap peers in November (MSCI ACWI ex US Index -0.0%). The US dollar traded in a fairly narrow range in November and did not have a material impact on non-US equity returns.

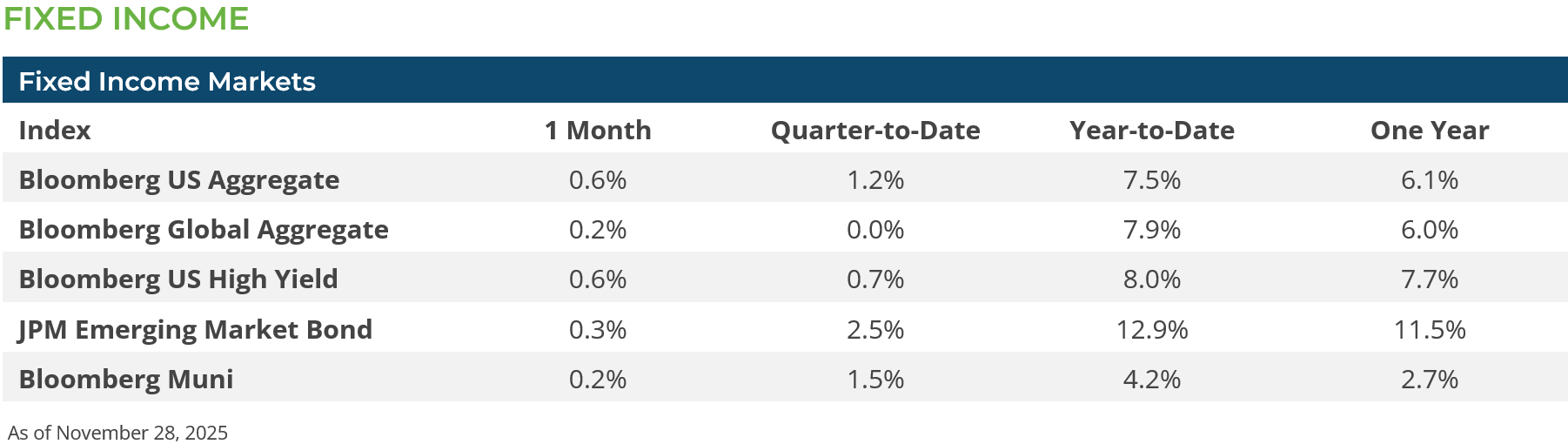

Although interest rates trended lower, they continue to trade in a range we have witnessed in recent months. The sweet spot to own were intermediate term (5 – 10 year) securities such as the Bloomberg U.S. Aggregate 5-7 Years Index that returned 0.83% while the Bloomberg Aggregate 10 Years or Higher Index posted a 0.45% return. Since mid-September corporate spreads have risen from historically low levels, but the Bloomberg U.S. (Investment Grade) Corporate Index continued to deliver positive results and was up 0.65% for the month.

The municipal bond market witnessed a plethora of new high-yield issues, strong investor demand, and generally stable credit fundamentals, although overall performance lagged behind the broader bond market. The Bloomberg Municipal Bond Index’s return for November was 0.23%.

CONCLUSION & OUTLOOK

Even in the fog of economic uncertainty, there have been sufficient data points that lead us to believe the U.S. economy continues to grow. At this point, 95% of the S&P 500 has been reported and 83% of companies have issued a positive earnings surprise, which is above the 5-year average (78%) and 10-year average (75%), and the earnings growth for Q3 is 13.4% YoY.[2] Inflation is under control, albeit a bit higher than the Fed desires. And although it might be difficult for recent college grads to land their first job, there has not been a serious rise in U.S. unemployment. From a macro perspective the outlook is one of stability.

At the micro level there are some burgeoning signs of pain. Does the worker skill set match the skills employers’ need? Ford Motor CEO Jim Farley recently told a podcast that he can’t find enough skilled mechanics to run his auto plants. Specifically, Ford can’t fill 5,000 mechanic jobs that pay $120,000 a year.[3] The Wall Street Journal further states, “The National Federation of Independent Business reported this month that one third of small business owners reported jobs they couldn’t fill, and 49% reported few or no qualified applicants for positions they were trying to fill.” The demand for labor exists, the supply chain is not meeting the demand.

News headlines abound about how artificial intelligence (AI) is disrupting the job market, but it is not all negative. On one hand, AI and automation have replaced certain roles, particularly those involving repetitive or routine tasks. On the other hand, AI is also a powerful driver of job creation. The Future of Jobs Global Report 2025[4] shows that employers expect 39% of key skills required in the job market will change by 2030, with technological skills leading the way in importance over the next five years.

We are living in a most interesting time period that could be as dramatic as when we went from a nation of farmers to a manufacturing juggernaut. During this transition, the financial markets of our parents’ generation may look vastly different than our children’s. The evolution may be chaotic, but the rewards could be significant.

Subscribe to our weekly Research Corner and other market commentary so you don’t miss our updates.

[1] Reuters, “ US canceling October’s employment report after shutdown prevented data collection,” November 20, 2025.

[2] Bloomberg LP

[3] Wall Street Journal, “Why Ford Can’t Find Mechanics,” November 17, 2025

[4] World Economic Forum, “Future of Jobs Report 2025: The jobs of the future – and the skills you need to get them,” January 8, 2025

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.