OVERVIEW

The federal government shut down at midnight on October 1st due to the fact that Congress could not pass any of the 12 appropriations bills needed to fund the government into its new 2026 fiscal year. The result is that about 750,000 to 900,000 federal government workers are now on unpaid leave. As such, in the absence of reliable government data, uncertainty has increased about the state of the US economy. For example, the recently released Fed beige book suggests little or no change in economic activity in September as three of the twelve Fed Districts reported slight to modest growth in activity, five reported no change in economic activity, and four noted a slight softening.[1]

However, despite the seemingly tranquil economic backdrop, there have been several credit events in recent weeks relating to the bankruptcies of First Brands and Tricolor Holdings along with a $50 million dollar write-off by Zions Bancorp after a loan went bad due to alleged fraud by a borrower—Western Alliance Bank also noted exposure to the alleged fraud. So far, these events seem idiosyncratic and not systemic, but credit markets will be increasingly on edge if more large defaults occur in Q4.[1]

Nonetheless, markets largely shrugged off all this confusing and unpleasant news, just like in September, when the S&P 500 hit eight separate record highs, October followed suit with eight more new record highs.

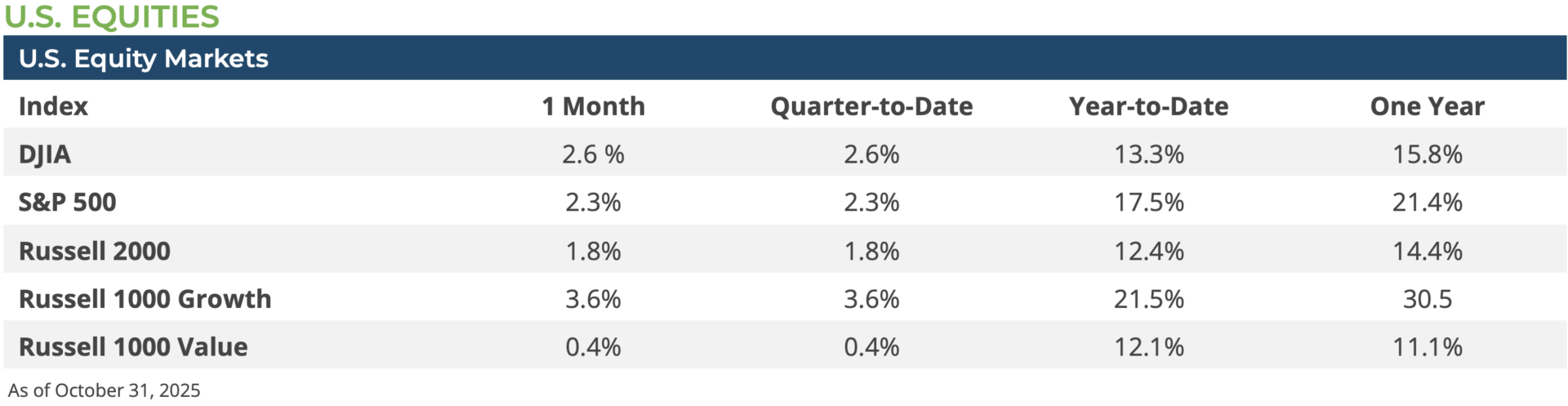

October saw equity markets broadly make gains, but returns were not distributed evenly during the month with a relatively narrow group of AI-oriented growth stocks leading the way while lower beta, more defensive stocks lagged during the month. The month started out with a bout of volatility that was touched off by a flare up in the trade war between the US and China. As a result, the S&P 500 lost more than 3% intraday and the VIX—so called fear gauge—rose to as high as 25 in the days that followed.[1] However, it soon became clear that the Trump administration was making progress towards de-escalating the trade conflict with China and the month ended with a tentative trade framework that cheered markets. In the meantime, the Q3 earnings season kicked off to a strong start and the sentiment around AI names, semiconductors, and data centers continued to gain ground. Overall large cap growth stocks (Russell 1000 Growth Index) gained over 3.6% while their value peers (Russell 1000 Value Index) gained only 0.4% in October. Small caps (Russell 2000 Index +1.8%) lagged their large cap peers (Russell 1000 Index +2.2%), but mid cap stocks (Russell Midcap Index -0.8%) lagged the most as this index contains more Industrial names and fewer tech stocks than either its small cap or large cap peer indices.

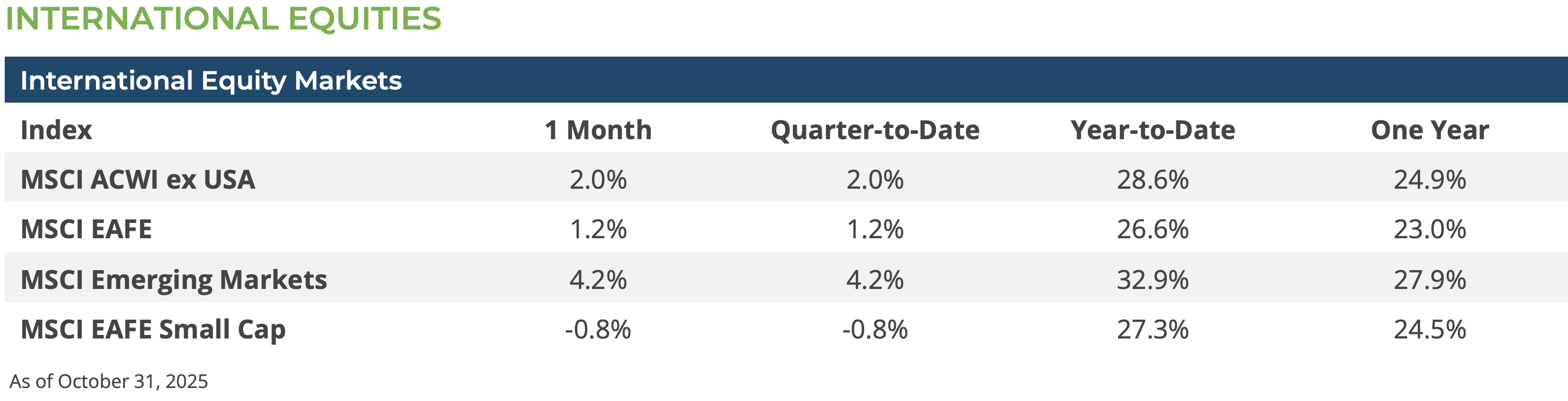

International stocks made gains in October largely on par with US equities (MSCI ACWI ex US +2.0%). International developed stock (MSCI EAFE Index +1.2%) lagged the gains made by emerging market equities (MSCI EM Index +4.2%). Emerging market equities made the strongest gains in October despite the fact that Chinese equites were slightly negative on the month (MSCI China Index -3.8%). In contrast, equities in South Korea and Taiwan—both part of the EM Index—surged in October on the back of their world-leading tech companies like TSMC and Samsung. Non-US equities returns were also blunted somewhat in October as the US dollar made gains against a broad basket of foreign currencies during the month. Unlike in the US, where growth stocks strongly outperformed, there was little difference in international equities between growth and value stocks (MSCI ACWI ex US Growth Index +2.4% vs MSCI ACWI ex US Value Index +2.2%). Similar, however, to US equities, small cap stocks underperformed their large cap peers outside of the US as well (MSCI ACWI ex US Small Index +0.2% vs MSCI ACWI ex US +2.0%).

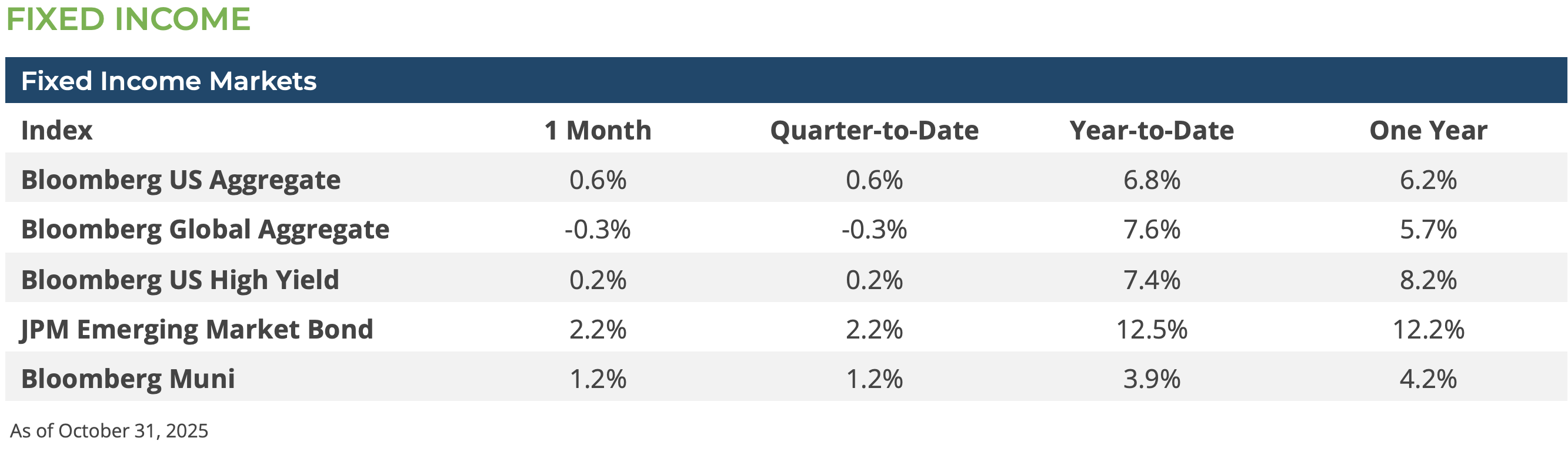

Interest rates continued their march lower in October. Since hitting the 2025 high of 4.79% on January 14th, the US Treasury 10-year bond yield closed on October 31st at 4.08%. For the month, the Bloomberg Aggregate index returned 0.62% and year-to-date the return was 6.80%, almost equally split between interest income earnings of 3.21% and price appreciation of 3.29% (the balance being 0.30% related to mortgage accretion).[1]

In the municipal market, October’s return for the Bloomberg Municipal Bond index (1.24%) followed September’s strong performance of 2.32%.[1] This momentum sets the stage for November, historically a technically stronger month. The main driver remains the widening gap between the front and long end performance. Since month-end July, the Bloomberg Municipal Long Bond Index has outperformed the Bloomberg Muni Short Index by over 600 basis points (6.88% vs. 0.67%).[1]

CONCLUSION & OUTLOOK

Even though the economic picture is unclear, at the Fed’s October FOMC meeting, as they did in September, it cut its main policy rate by 25 basis points to 3.75% – 4.00%. These rate cuts follow the 100 basis points of cuts starting in September of last year. The Fed believes its monetary policy is restrictive and its desire is to find that neutral spot that neither stimulates nor restricts economic growth. But, without reliable economic data, what is the Fed to do? In Fed Chair Powell’s words, “What do you do if you’re driving in the fog? You slow down.”

While prognosticators dither waiting for data, risk assets continue to climb the wall of worry to reach new highs. Equity markets in general gained in October, but not all stocks rose with the same vigor as AI-oriented equities. The Mag-7 stocks—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla—gained 4.9% in the month, while the S&P 500 ex Mag-7 stocks gained only 0.8%.[1] The staggering gains of mega-cap tech stocks have given rise to concerns that we are in an AI equity bubble. At present, we have taken solace in the fact that most of the AI capex spending has come from the largest US tech firms—such as Microsoft, Google, Amazon and Meta—and it has been funded primarily via these large tech firms’ free cash flow.

Should the market continue to grind higher in the coming quarters, Clearstead may further trim some of the gains associated with US growth and tech positions in favor of lower-beta, more-value oriented positions. While the economic and profit dynamic that underpin today’s market gains looks reasonable, Clearstead remains clear-eyed about the risks of the AI boom potentially transitioning to an AI bubble in the periods ahead.

Subscribe to our weekly Research Corner and other market commentary so you don’t miss our updates.

[1] Bloomberg LP

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.