EQUITY MARKET VOLATILITY DOMINATES Q1 AS POLICY UNCERTIANTY EMERGES

“I have approximate answers and possible beliefs in different degrees of certainty about different things, but I’m not absolutely sure of anything.”

Richard Feynman

Summary

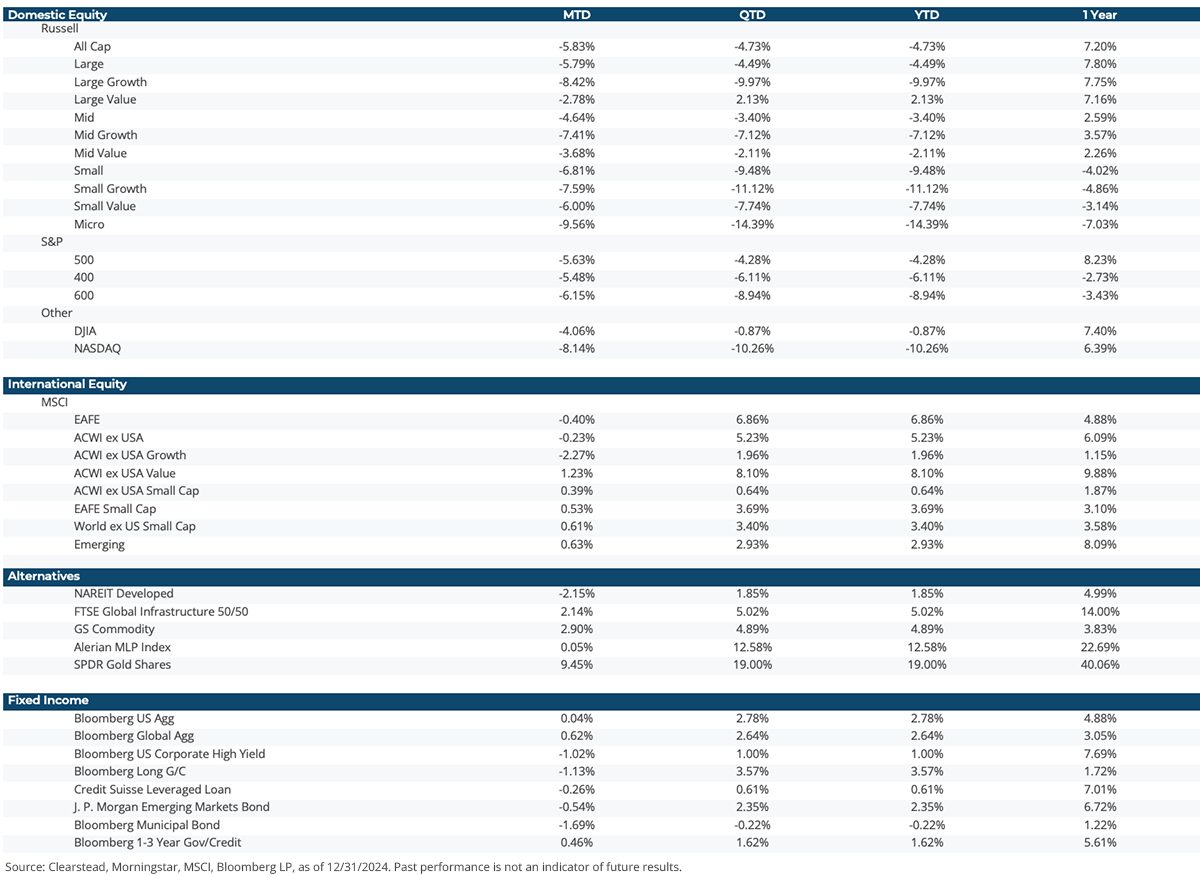

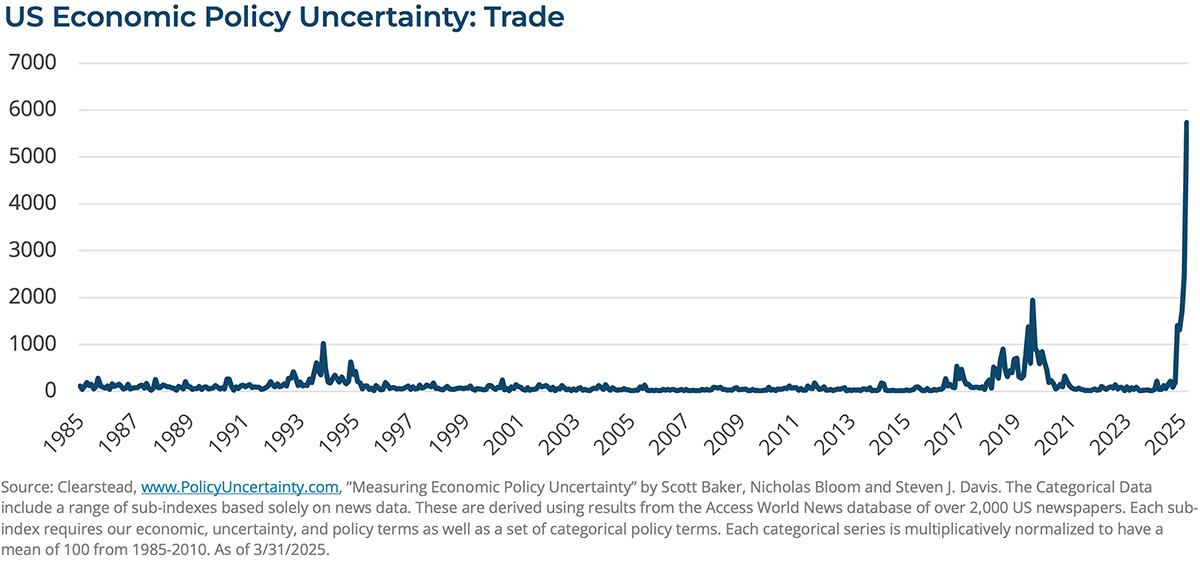

- US economic growth slowed in Q1 amid policy uncertainty driven by tariffs.

- The status of most US corporates and consumers remains healthy and labor markets continued to be resilient during the quarter.

- Earnings expectations for 2025 have softened, and the S&P 500 experienced its first negative quarter since the third quarter of 2023.

- Bond markets performed well as interest rates generally fell across the yield curve.

- Despite widening spreads, corporate credit markets generated positive returns while default rates remain low.

Economy

US Economic Growth Slows Amid Tariff Uncertianty

The US economy slowed to start off the year as policy uncertainty weighed on GDP growth during the first quarter. While not yet final, real GDP growth for the quarter is likely to show very little to no expansion, which follows a robust fourth quarter which saw GDP growth of 2.4% (Quarter over Quarter Seasonally Adjusted Annual Rate).[1]

Overall economic activity during the quarter appears to have been more driven by shifting sentiment related to policy uncertainty which weighed on business activity as well as personal consumption. A dramatic rise in imports (likely in advance of tariffs) also limited GDP growth.

Job growth remained resilient, tacking on an average of 150k new jobs during the quarter, while jobless claims remain quite low.[2] Relatedly, our current view is that job losses related to DOGE are limited given the ratio of federal employment (3.0 million) to total employment (160 million) and impacts to the Washington D.C., Maryland, and Virginia regions are most likely where the economic impact is felt.[3] However, there is a body of work which suggests that once government contractors are considered, the impact of government job losses may extend beyond baseline assumptions, in that 1-2 contractors may be at risk of job loss for every displaced government worker. This means that, if eventually 250k federal workforce employees were eliminated, the total employment impact may be between 500k and 750k persons.[4] Time will tell, but as of today we do not expect significant broad-based labor market disruptions from DOGE. Recent inflation readings point to a stickier than expected inflation backdrop, with the Federal Reserve’s preferred barometer of inflation (core Personal Consumption Expenditure Core Price Index) recently registering 2.8% on a year-over-year (YoY) basis. Both market-based and survey-based measures for expected future inflation remain high, raising the likelihood that inflation (core-PCE) remains above 2.5% for most, if not all, of 2025.

Equity Markets

S&P Enters Correction while Growth & Value See Big Rotation

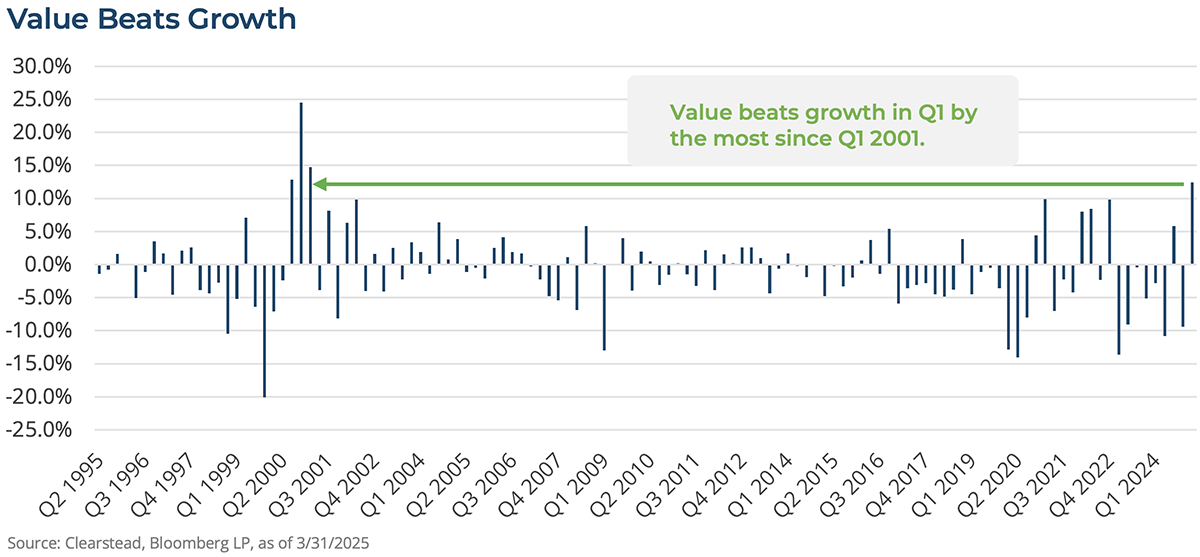

Global equity markets remained volatile throughout the first quarter with pronounced volatility from mid-February through the end of quarter which saw the S&P 500 decline 10.0% from its all-time high to its lows reached in mid-March.[2] Declines were driven by the so called Magnificent 7 (NVIDIA, Meta, Apple, Alphabet, Microsoft, Amazon, Tesla) which fell 16.5% during that time.[2] Technology sector weakness would help value stocks beat growth stocks by the most since Q1 2001. The S&P 500 closed the quarter down 4.3% — though after excluding the Magnificent 7 the S&P 500 actually gained 0.6% for the quarter.[2]

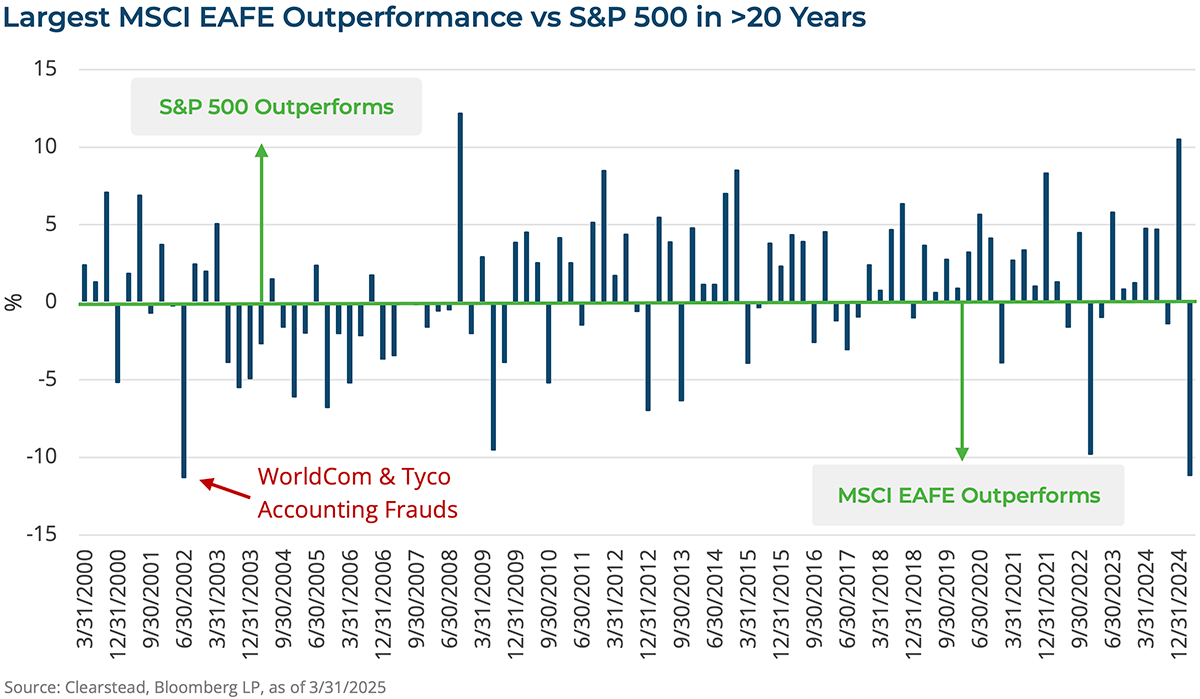

Meanwhile, small cap stocks (Russell 2000) fell 9.5% — the Russell 2000 index is now 15.7% below its all-time high set in November of 2021, seemingly weighed mostly by growth concerns.[2] In terms of outperformers, developed international markets were the relative winners in the quarter with the MSCI EAFE index gaining 7.0%, besting the S&P 500 by 11.3%, the most in a quarter since the second quarter of 2002.[2]

Despite a weaker progression for real GDP growth in Q1, S&P 500 earnings are still expected to grow by 7.3% in Q1 on a YoY basis with revenue growth of 4.2% YoY — as we enter reporting season, guidance will be closely watched to gauge corporate sentiment.[5] It is important to note that expectations for earnings growth for the first quarter of 2025 have been lowered by 4.1% from the beginning of the year. While lowered estimates may be cause for concern, the earnings downgrades are generally in line with the average changes over the prior 60 quarters, which have seen earnings estimates fall by an average of 4.2% during a quarter.[4] For the calendar year, earnings are still projected to grow by 11.5% YoY on revenue growth of 5.4% YoY.[4] These figures have similarly come down and we note that further downgrades may be likely as economic uncertainty weighs on business activity.

Fixed Income Markets

US Treasury Yields Fall, Bolstering Fixed Income Performance

Tariff uncertainty and slowing growth outweighed inflation concerns, helping to push bond yields lower as treasury markets rallied during the quarter. The 10-Year US Treasury yield fell 36bps in Q1 from 4.57% to 4.21%, while the 2-Year US Treasury yield fell from 4.24% to 3.89% to end the quarter.[6] The bond market rally pushed the aggregate bond market (Bloomberg US Aggregate Bond Market index) higher by 2.8%. Meanwhile, higher beginning yields and falling interest rates helped to offset spread widening that resulted from the negative tone in markets for both investment grade and high yield bond markets. High yield (Bloomberg Corporate High Yield index) gained 1.0% in the quarter while investment grade bonds (Bloomberg US Corporate Index) rallied 2.3%.[7]

The uncertainty around tariffs, combined with backwards inflation data as well as future inflation expectations, kept the Fed in pause mode. With the Fed Funds rate at 4.50%, market expectations have shifted to an assumption of three, 25 basis point rate cuts by year-end. The Fed appears to be in a bit of a conundrum given the uncertainty over tariffs and their potential economic implications, for not only growth but for inflation as well. As a result, the central bank has noted that it would not adjust interest rates lower without greater clarity around tariffs and their economic impact. Still, the Fed has left open the possibility of at least two quarter point rate cuts, assuming inflation cools.

Summary & Outlook

Markets entered this year riding a wave of American exceptionalism. Most market observers (including Clearstead) noted that the US economy looked poised to grow faster than most of the rest of the developed world in 2025. Similarly, the earnings outlook for the US’s largest firms looked poised to deliver a second straight year of double-digit earnings growth and the new Trump administration was thought to be embarking on a pro-growth agenda to cut taxes and deregulate the economy. Three months into the year, an equal number of market analysts are ready to declare the American exceptionalism trade over. Indeed, the MSCI EAFE outperformed the S&P 500 for the quarter by the widest margin in nearly 25 years. While the Trump administration’s aggressive, and front-loaded policy agenda of tariffs and government job cuts has soured sentiment both within the US and abroad, the US remains a myriad of structural advantages that suggest better days are ahead for US-based risk assets. The S&P 500 came into the year expensive on a price-to-earnings basis—driven primarily by the run-up in the prices for the Mag 7 stocks—and it did not take much in the way of bad news to have the most expensive portions of the S&P 500 give back some of last year’s robust gains. Similarly, a great deal of money flowed into US equities in the last few years, and Trump’s America First policy agenda may have precipitated many non-US investors to rebalance back into their home markets after a few stellar years of US equity returns. Nonetheless, the US still boasts higher productivity gains than most of the rest of the world, has corporate board structures that are minority shareholder friendly, and is still leading the world in innovation. These factors are structural and should be long-term drivers of corporate earnings growth. Given that share prices generally follow earnings growth, despite the rough quarter and recent news, the exceptionalism of US risk assets is likely to prevail over the coming quarters and years.

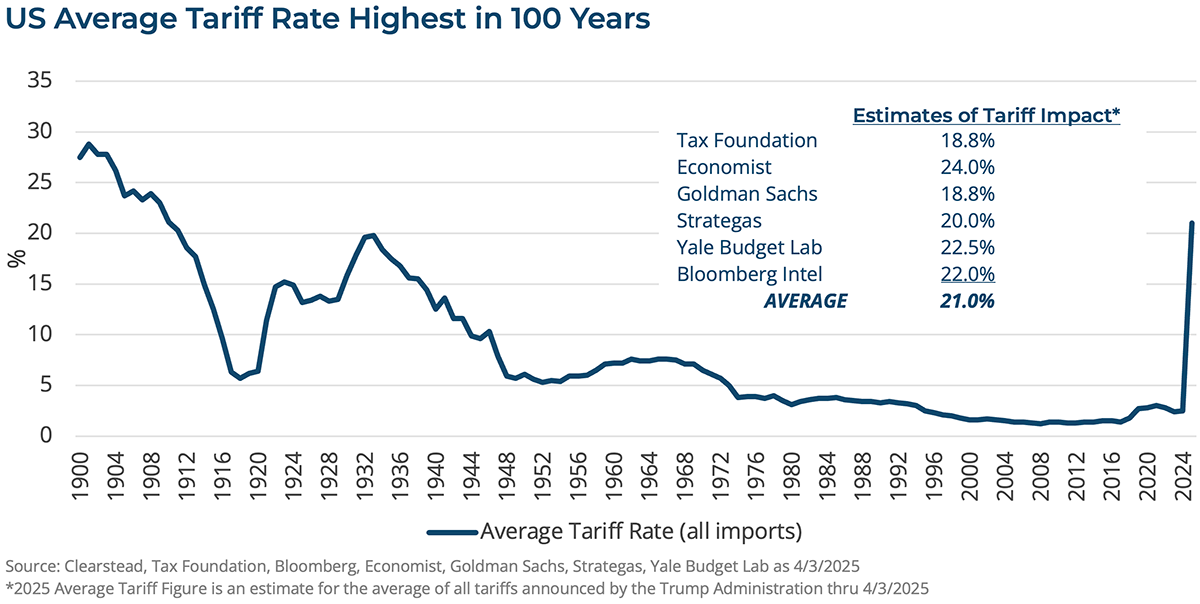

However, we began April with a tariff shock. While markets had been given ample forewarning of “Liberation Day” whereby Trump would announce reciprocal tariffs on most countries trading with the US, the magnitude of the tariffs announced went beyond what the markets had anticipated and thus last week’s sell-off. The sweeping tariffs take the average effective rate for all US imports to over 20%, which the US has not experienced since the early years of the 1900s. Most of the countries tariffed by the US have pledged to retaliate in some fashion and it is safe to conclude a global trade war with the US has begun. While the Trump Administration may be willing to negotiate on the margin, markets and global supply chains are likely going to adjust to a structurally higher average tariff rate. Equity markets reacted negatively to these announcements and markets sold off sharply in Asia and Europe and opened sharply lower in the US, Canada, and Latin America in the days after.

The imposition of these tariffs, along with those the Trump Administration has already announced (see Research Corner 17-Feb), is likely to slow US and global growth for the remainder of 2025. In many cases corporate profits will come under pressure as input prices rise, export markets become harder to sell into, and the US consumer pulls back in the face of potential—one time—upward move in the prices for many goods. Goldman Sachs estimates that for every 5 percentage-point increase in tariffs, corporate earnings for the S&P 500 are reduced by about 1-2 percentage-points.[8]

While the risks of recession are heightened in the aftermath of these tariff announcements, it is worth noting that the US economy comes into this trade war in good shape—low unemployment, strong corporate balance sheets, and an economy more levered to domestic consumption than global trade. We continue to believe that stable underlying fundamentals should protect the economy from falling into a recession in the very near future but would note that the odds are rising. With that said, we would expect to see hints of better news as the administration’s attention begins to pivot towards more of the pro-growth policy initiatives such as tax cuts and deregulation. In the meantime, for equity markets, it is reasonable to expect continued consolidation with sideways markets in the coming quarter with higher than usual volatility. In these stressful times with heightened uncertainty, investors benefit by removing emotion and remaining disciplined to one’s long-term strategy.

[1] Federal Reserve Bank of St. Louis, FRED as of 4/1/2025

[2] Bloomberg LP, as of 4/4/2025

[3] Federal Reserve Bank of St. Louis, FRED as of 4/1/2025

[4] Clearstead Investment Office

[5] Factset Earnings Insight, as of 3/28/2025

[6] Bloomberg LP, as of 4/1/2025

[7] Bloomberg LP, as of 4/1/2025

[8] Goldman Sachs US Weekly Kickstart “Among the key policy shifts in April, tariffs will outweigh the slowing of QT for equities” 3/28/2025

DISCLOSURES: Information provided is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.