Markets Grind Higher and Leadership Broadens

“Discernment is not knowing the difference between right and wrong. It is knowing the difference between right and almost right.” – Charles Spurgeon

Summary

- US economy looks likely to have slowed down in Q4 (economic growth <2%); but official economic data has been delayed due to the government shutdown making it difficult to determine the true picture of the US economy.

- Most US corporates have healthy sales and earnings, and the US consumer remains stable despite the labor market looking more fragile during the quarter.

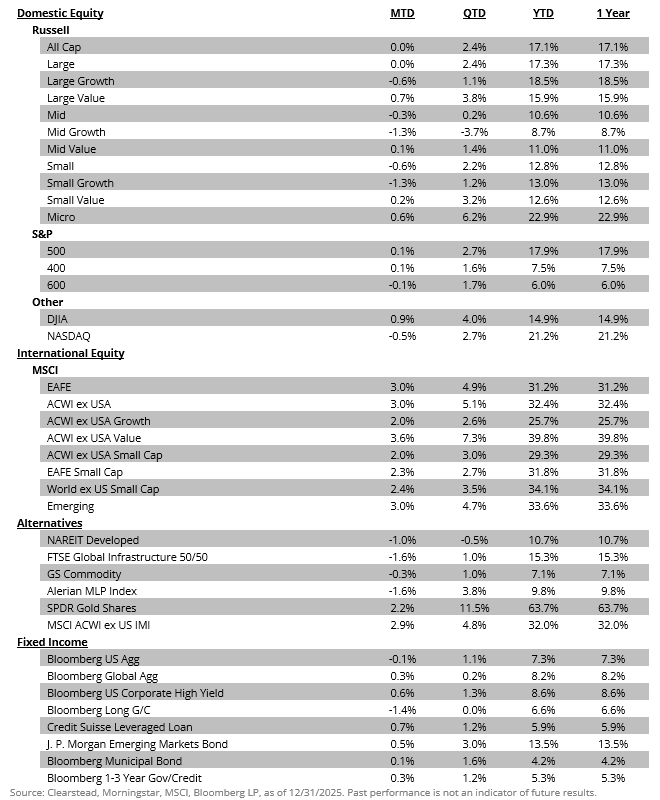

- The quarter featured a rotation away from some AI and semiconductor names, and a broader range of US equities made the strongest gains.

- US equities were further buoyed by two Fed rate cuts in Q4, and markets continue to expect some additional monetary easing in 2026.

- Bond markets were also volatile, but most fixed income categories made gains in Q4 and the yield on the 10-year Treasury ended the quarter nearly unchanged from the end of Q3.

- Reflecting the broad health in corporate fundamentals, corporate credit spreads remain low, and credit markets generated positive returns.

Economy

US Soft Patch but Then a Pickup

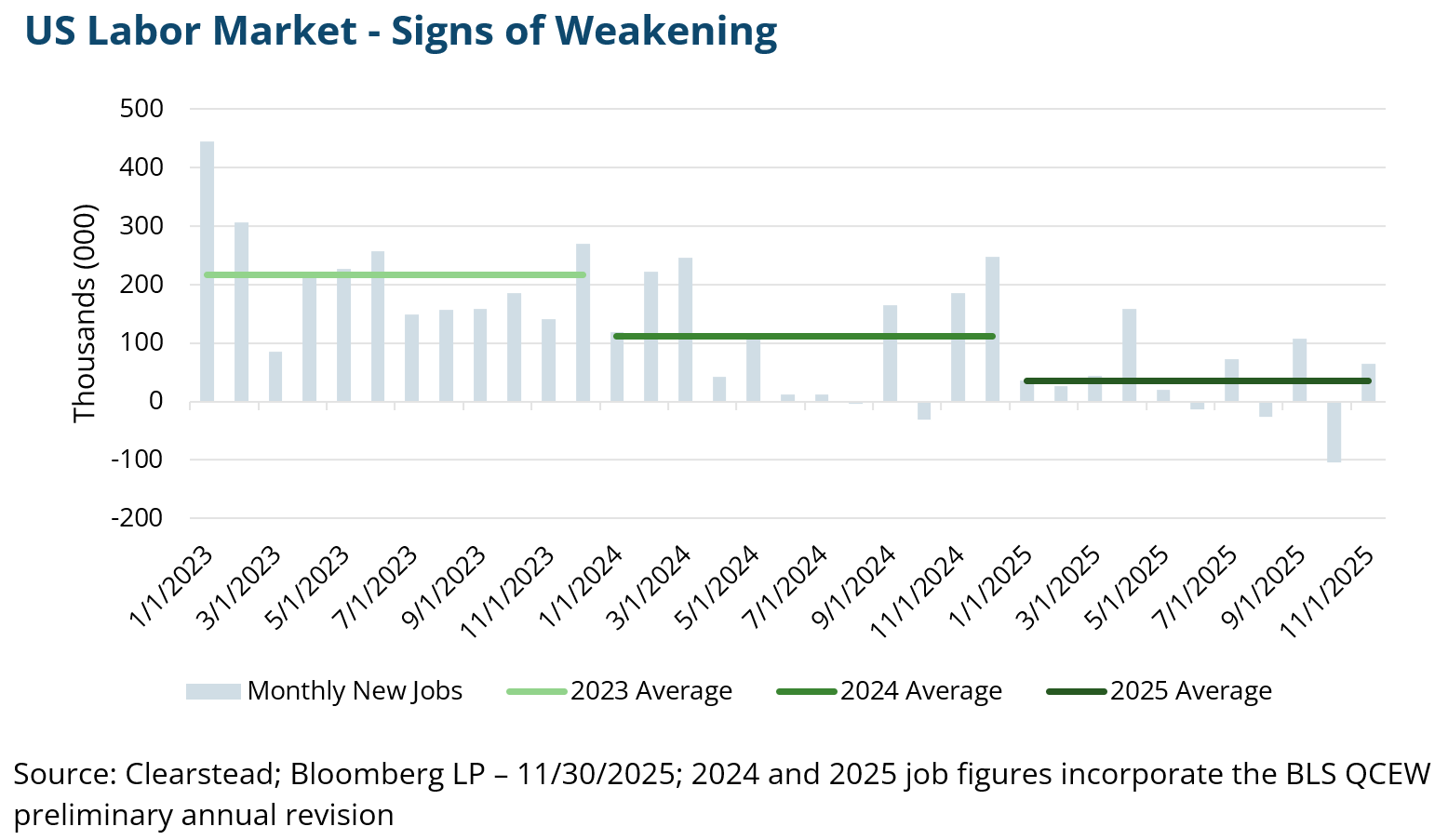

It appears the US economy decelerated in Q4, but how much slower the economy grew has been complicated by the longest government shutdown on record. The US government shuttered from 1-October to 13-November, and due to the shutdown almost all government data releases from October and November have been delayed, and some may never be published at all. The initial official estimate of real Q3 GDP growth was +4.3%, which was faster than Q2’s +3.8% figure.1 However, some trade, consumer spending, and industrial production data from recent months suggest that growth in Q4 is likely to be 1.8% (Bloomberg Consensus). The slowdown in the economy has also been manifest in the US labor market. Recent employment reports suggest that hiring has slowed markedly since last summer began. Over the past six months through November, the US economy only created about 100k total new jobs—about 16k monthly new jobs on average. While layoffs remain low, the headline unemployment rate has risen to 4.6% and other measures of the labor market—temporary employment, those unemployed for more than six-weeks, or those working part-time—suggest the labor market is fragile.2 Similarly, several measures of consumer sentiment suggest most households are increasingly squeezed between a weak labor market and higher prices for many goods and services.

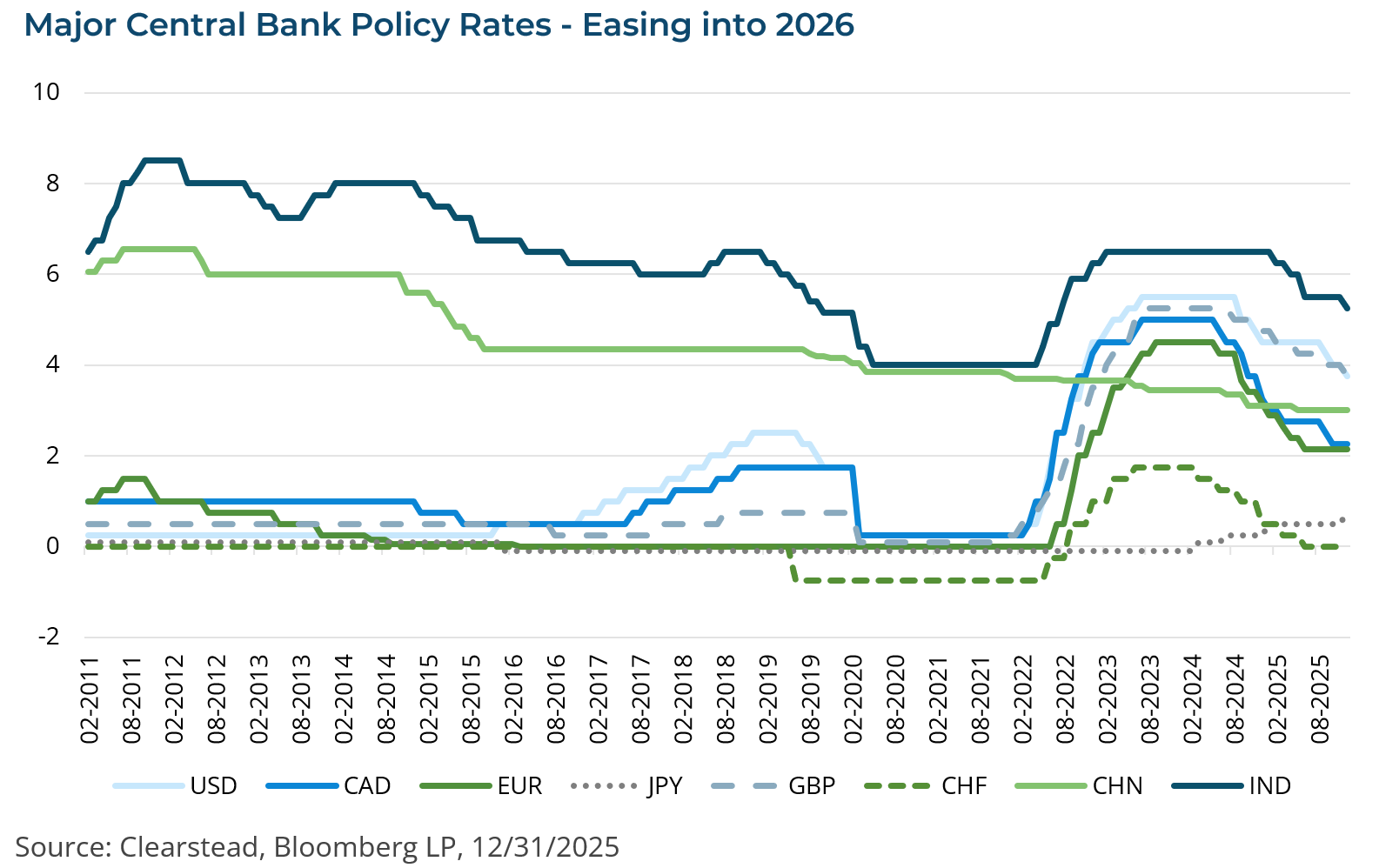

All this suggests that the US economy is likely to be amid a soft patch that may continue through much of Q1-2026. However, there is reason to think that the US economy may improve by the time the snows of winter begin to melt this year. First, the One-Big-Beautiful Bill—the 10-year fiscal framework passed by Congress last summer—contained some stimulus measures for both households (no tax on tips, overtime, or social security) and for businesses (incentives for fixed capital investments) that should spur some additional activity in 2026. Second, while the labor market looks fragile, the unemployment rate is still low by historic standards and there is little evidence of widespread layoffs looming. Thus, while current job seekers may find landing a job difficult, those with jobs should be able to hold on to them during the course of 2026. Lastly, the Federal Reserve cut rates by 75 basis points in 2025 and, while they remain cautious, they are likely biased towards additional rate cuts in 2026 if economic growth looks like it will falter and the labor market weakens further.

Equity Markets

A Broadening Out of Leadership; Will it Persist?

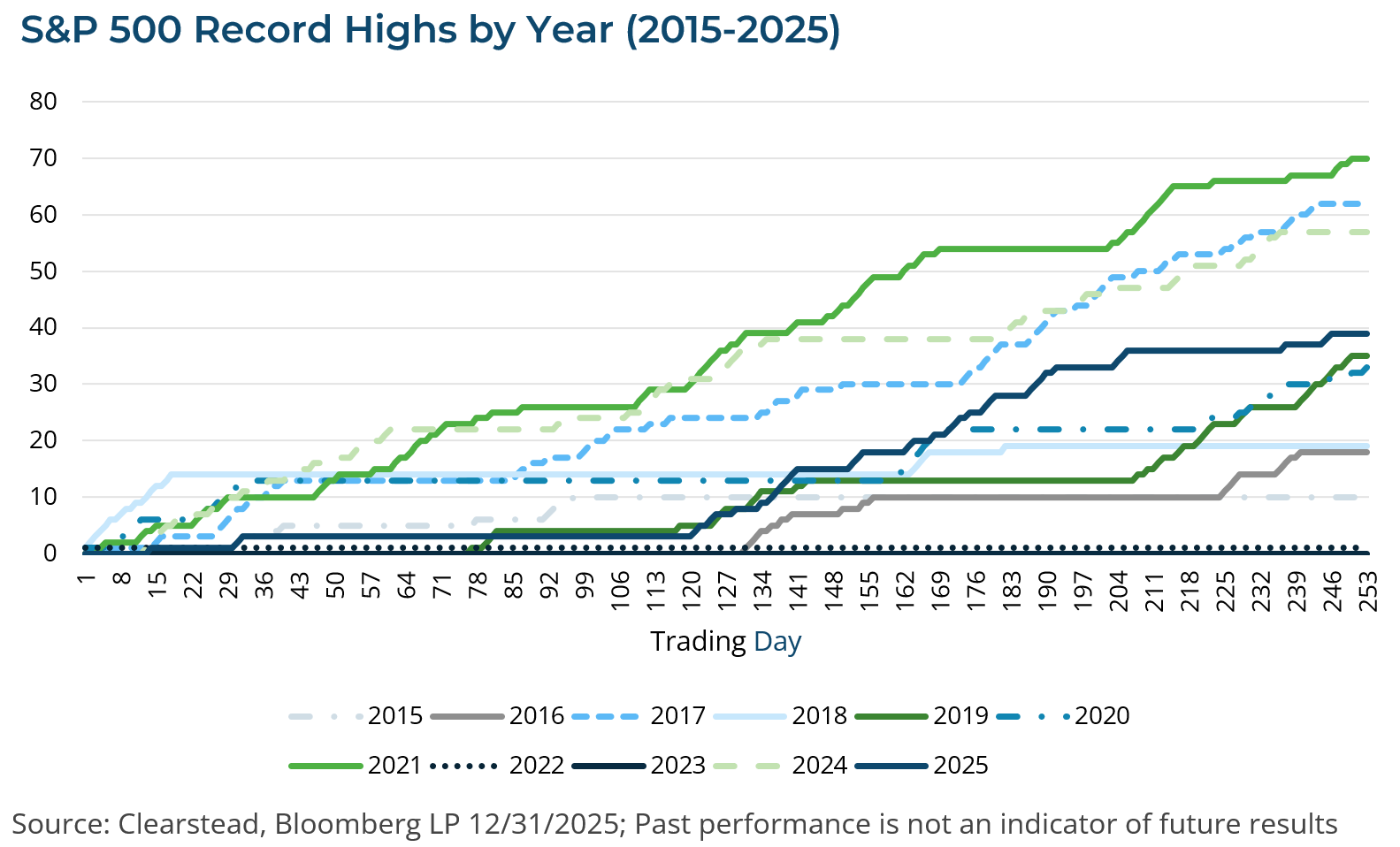

Compared to the returns from Spring and Fall (+10.9% Q2 and +8.1% Q3), the S&P 500’s return of 2.7% in Q4 seems modest, but it capped off a third strong year of returns for the Index—the S&P 500 returned 17.9% for 2025. Perhaps more importantly, Q4 marked a change of equity leadership as value-oriented stocks outperformed their more growth-oriented peers (Russell 1000 Value Index +3.8% vs. Russell 1000 Growth +1.1%). While Magnificent 7—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla—collectively outperformed the S&P 500 there were stark differences among the seven mega-cap names. Apple gained 6.9% during the quarter while Microsoft fell -6.5%.1 For the first time this year, markets began to distinguish between the big AI/semiconductor tech names, with several previous high-flying AI stocks suffering setbacks, while other AI names continued to trade near record highs. It seems that markets are trying to figure out which AI firms are most likely to be long-term winners and which firms may be penalized for over-borrowing as the AI race for more datacenters and better AI models continues with little end in sight. During the year (2025), the S&P 500 hit 39 record highs and ended the year just 1.3% below its most recent record high set in late-December.1 Supporting these market gains were equally strong gains in S&P 500 earnings which are tracking towards 14% year-over-year growth for the year.3 Price-to-earnings (P/E) multiples—the price an investor is willing to pay for $1 of future earnings—also expanded during the year leaving many to conclude that the valuations of US large caps are stretched. The current P/E multiple for the S&P 500 is 22.0, which is in the top tenth percentile for expensiveness of the index over the past 30-year period.1

International markets also fared well in Q4, with international developed markets (MSCI EAFE +4.9%) outgaining the S&P 500. Emerging market equities (MSCI EM Index +4.7%) largely kept pace with international developed stock markets despite the drag caused by Chinese equities which declined (MSCI China Index -7.4%) substantially during the quarter. China remains negatively impacted by weakness in its property markets and several measures of consumer activity underwhelmed during the quarter which spurred profit-taking in Chinese equities—despite the Q4 decline, the MSCI China Index gained over 31% for the year.

Fixed Income Markets

Resilient economy, healthy corporate fundamentals, and a stable interest rate environment delivered solid results

Despite some headwinds, the U.S. economy still appears to be stable. Although inflation is higher than the Federal Reserve desires, the trend has been for lower levels of inflation and while the “no fire, no hire” labor market is worrisome, the 4.6% unemployment rate is still at the low end of jobless figures over the past 50 years.2 In this environment corporate spreads (a reflection of the additional risk an investor takes on by lending to a corporation instead of the government) have remained stable at historically low levels. As of December 31, the Bloomberg U.S. Corporate High Yield Average Option Adjusted Spread was 266 basis points (bps) versus its long-term average of 480 bps.1 With that as a backdrop, bond markets experienced positive returns in 2025, with the Bloomberg US Aggregate Bond Market index gaining 7.3%, while high-yield bonds gained 8.6%, and municipal bonds (Bloomberg Municipal Bond Market Index) gained 4.3%.

As was noted earlier, there are signs of softness in the labor markets which gave the Fed the ammo it needed to continue to cut its main policy rate in October and December. Interestingly, in 2025 the impact of the Fed’s easing monetary policy had a pronounced impact on the short-end of the yield curve with little change at the long-end. Since the end of 2024 to December 31, 2025, 2-year U.S. Treasury yields have declined by 77 bps (4.24% to 3.47%) while 30-year U.S. Treasury yields have increased by 6 bps (4.78% to 4.84%).1 While the Fed appears focused on the labor market, fixed income markets are staring at stubbornly high inflation and trillion-dollar budget deficits that could drive interest rates higher.

Despite potential challenges, the outlook for 2026 remains constructive with mid-single digit type return prospects for aggregate bond markets, though volatility may emerge given what we note on budget deficits and inflation. A Fed that is biased to ease monetary policy, resilient corporate fundamentals, and relatively attractive yields driving investor demand could create a favorable and rewarding environment for fixed income investors. While the tailwinds of easing monetary policy have diminished, the headwinds of restrictive monetary policies do not appear to be in the 2026 central bank playbook. Similarly, most other major global central banks do not appear likely to restrict monetary policy significantly this year as well, which suggests that global liquidity should be stable-to-expansionary over the coming quarters.

Summary & Outlook

As we head into 2026, some analysts are painting a bearish picture—an economy that looks increasingly weak, stretched equity valuations, talk of an AI-stock bubble, and three-straight years of robust S&P 500 Index returns (2023 +26%, 2024 +25%, 2025 +17.9%) which is a setup for a reversal. Additionally, some observers have noted that next year’s returns could be challenged because next year will feature a midterm election—typically the mid-term years are the weakest year for the S&P 500 within a 4-year presidential cycle.

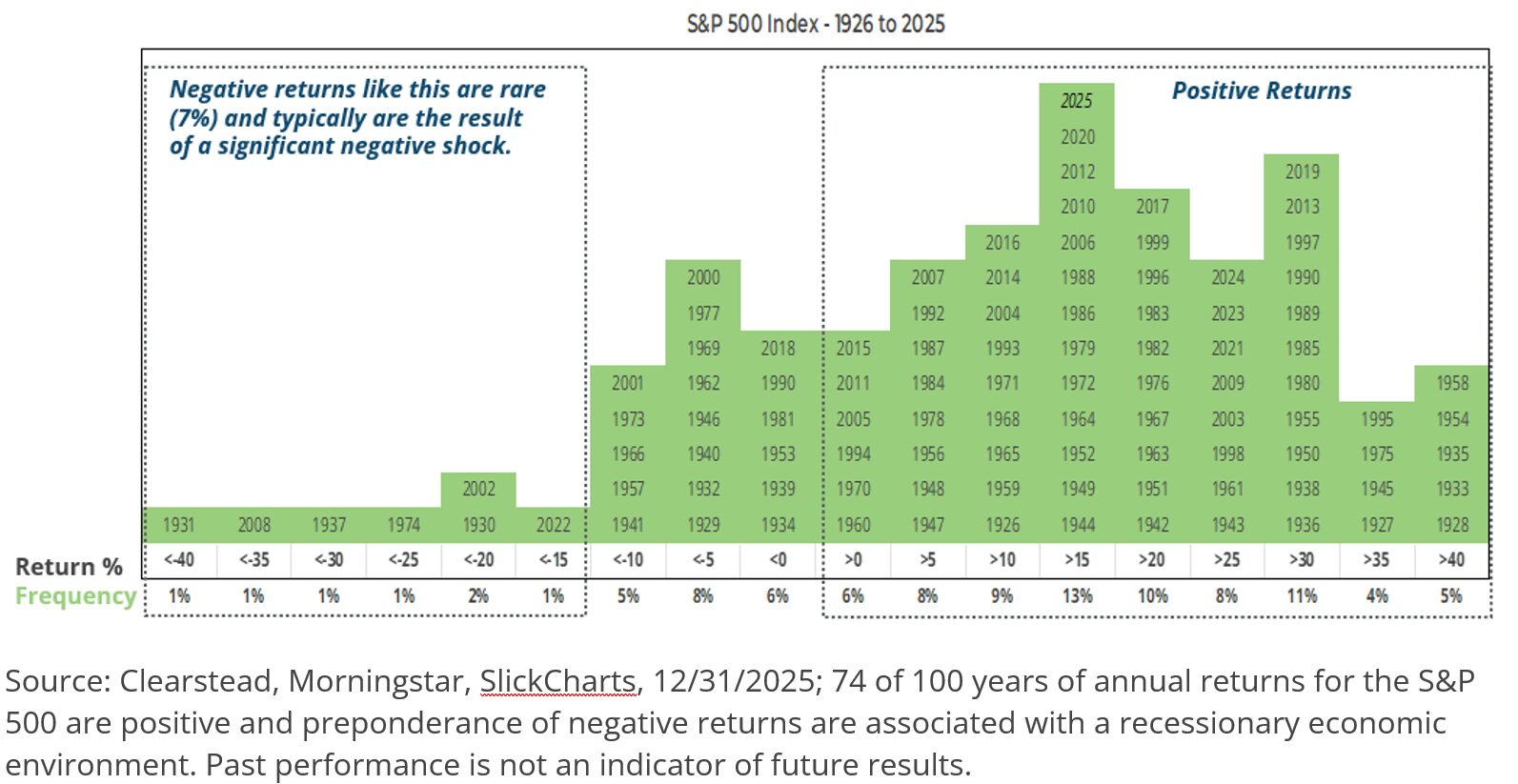

However, as we look out over the investment landscape, Clearstead is reminded that the consensus estimates for next year’s corporate profits look solid—in the 11% to 13% range—and that a broader set of companies look likely to prosper. We judge that global liquidity is not under stress, and the US labor market, while fragile, still remains stable. Valuations are a cause for concern, but multiples have historically not contracted significantly when margins are stable-to-expanding, which we expect is the backdrop for corporate earnings next year. Given this backdrop, our baseline outlook is that, absent a significant negative shock, equity markets are poised to grind higher, while we expect bond markets should earn their coupon. While 2026 may not feature as strong of returns as the past few years, it is set up to reward the patient investor. The biggest difference between 2026 and the past few years may not be the delta between next year’s return and the returns of past years but rather that stocks that deliver next year’s returns may come from the areas of the market that have lagged recently. Clearstead clients may be seeing a broader set of investment options in the coming quarters, reflecting the likelihood that increased diversification of portfolios may improve the odds of another good year.

1 Bloomberg LP, 12/31/2025

2 Bureau of Labor Statistics, 12/31/2025

3 FactSet – Earnings Insight, 12/19/2025

DISCLOSURES

Information provided is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.