OBSERVATIONS

- Equity markets traded higher last week with the S&P 500 gaining 1.6% and small caps surging 4.7%. The yield on the 10-year Treasury was nearly unchanged, falling 2 basis points to end the week at 4.17%.[1]

- The December Manufacturing PMI suggested continued weakness in the US industrial sector, falling to 47.9 —any number below 50 denotes contracting activity—below November’s 48.2 figure.[1]

- In contrast, the December Services PMI increased to 54.4 from November’s 52.6 reading, registering the highest reading of 2025, driven by increases in both the hiring and new orders components.[1]

- The Job Openings and Labor Turnover Survey (JOLTS) showed that open job postings declined in November (latest available) to 7.146 million, lower than October’s 7.67 million job openings. However, quits, a proxy for collective worker confidence in finding a new job, increased in November to 3.161 million as compared to October’s 2.973 million quits.[1]

- Initial unemployment claims registered 211k last week, which is low and on-par with the first week of 2025.

- The sluggish trends in overall hiring continued in December as the economy created only 50k new jobs, and the job creation figures for both October (-173k) and November (+56k) were both revised lower. The unemployment rate, however, moved down to 4.4% in December from November’s 4.6% rate largely due to lower workforce participation—some workers stopped looking for work.[1]

- The Univ. of Michigan Consumer Sentiment Index improved to 54—above expectations and the highest level in three months—from December’s 52.9 figure, largely due to better perception of current conditions.[1]

EXPECTATIONS

- As we head into Q4 earnings season later this week, the Street is expecting 8.3% YoY earnings growth for the S&P 500. CY2025 earnings growth is tracking towards 13.0% YoY, which (should it be realized) would be the 3rd consecutive year of double-digit earnings growth for the S&P 500.[2]

- Estimates suggest that US corporate productivity accelerated to 4.9% (annualized rate) in Q3-2025, the highest rate in two years, as companies were able to produce more output without corresponding net increases in labor expenses. Estimates for Q2-2025 productivity were revised higher to 4.1% (annualized rate), suggesting that companies’ capital spending on automation, AI, and other labor-saving technologies is paying off.[1]

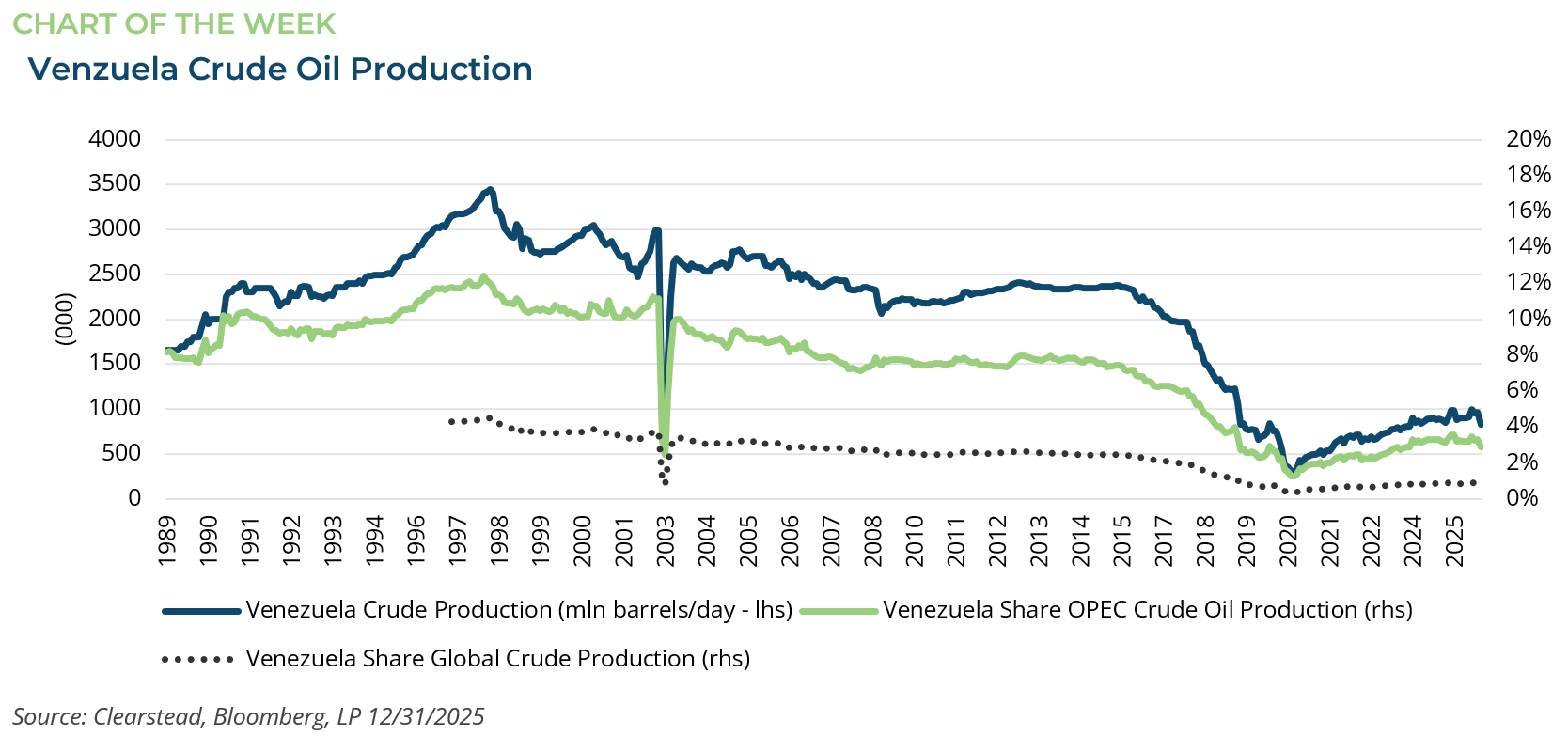

ONE MORE THOUGHT: The US intervention in Venezuela and its implications

The US military action in Venezuela has generated headlines but relatively little reaction in global equity markets. Venezuela is a very small part of the global economy and energy markets. Venezuelan oil production has been in decline for 25 years—see Chart of the Week—and now represents only 1% of daily crude production globally. Venezuela is in neither the Frontier nor emerging markets equity indexes. Similarly, Venezuelan bonds were only about 1% of the emerging market bond universe. These bonds defaulted in 2017 and were trading at less than 10 cents on the dollar before the US action sparked a recovery to about 40 cents on the dollar. In short, the impact of the US ouster of Maduro has largely been ignored by the broader financial markets. Venezuela does have the capacity to produce more crude oil, and the US policy on Venezuela may now shift to cooperation with the remnants of the Maduro regime and/or the government that eventually follows. This could lead to increased investment by US energy companies, as well as the lifting of sanctions that may allow for the importation of the chemicals and technology to make Venezuela’s existing oil assets more productive. This could potentially double the amount of production from Venezuela from less than 1 million barrels a day to closer to 2 million barrels a day within a year. While not insignificant, this is likely to put only a small amount of downward pressure on global oil prices over the next 12 to 18 months, assuming the investments and the sanctions relief materialize. Any further material increase in crude production from Venezuela would require significant infrastructure investment, exploration, and field development. Stepping back, the developments in Venezuela are likely to be seen as an example of a broader shift in geopolitics. The Trump administration’s move to arrest a corrupt head of state is consistent with the notion that the era of rules-based globalization is behind us, and that regional spheres related to trade, geopolitics, and cooperation are the new direction of global affairs—a concept known as a multi-polar world. In this evolving worldview, the US may increasingly look to Latin America to rebuild supply chains, secure critical natural resources, and eventually create or elevate new geopolitical institutions. Undoubtedly, this has implications for our allies in Europe as well as Asia, as global powers such as China and Russia look to define their own regional spheres of influence and partnerships.

[1] Bloomberg LP, 1/9/2026

[2] FactSet Earnings Insight 1/9/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.