OBSERVATIONS

- Markets were mixed last week with the S&P 500 losing 0.4% while small caps (Russell 2000) gained 2.1%, and the yield on the 10-year Treasury rose 5 basis points to end the week at 4.22%.[1]

- Small business optimism rose in December to 99.5, a slight increase from November’s 99.0 reading and above its 52-year average of 98, largely due to increasing expectations for better business conditions.[1]

- Headline inflation came in better than expected in December with both CPI (2.7% year-over-year – YoY) and core-CPI (2.6% YoY)—removing volatile food and energy categories—showing no change from the pace of inflation in November.[1]

- In contrast, prices at the wholesale level accelerated in November (latest available) to 3.0% YoY from October’s 2.8% YoY pace, while core-PPI, which removes the food and energy categories, also registered a 3.0% YoY reading, ahead of the October 2.9% core-PPI figure.[1]

- Unemployment claims remain low, registering only 198k last week, a decline of 10k from the week prior and 20k lower than the same week last year.[1]

- Retail sales increased in November by 0.6% month-over-month (MoM) from October. Excluding the volatile auto and gas categories, retail sales increased by 0.4% MoM. Overall, these figures confirm the stability of the economy and the US consumer’s inclination to spend.[1]

- Industrial production came in stronger than expected in December, increasing by 0.4% MoM and capacity utilization also increased to 76.3% up from November’s 76.1% level.[1]

EXPECTATIONS

- Q4 earnings season kicked off last week with the major US banks reporting mixed Q4 results. Goldman Sachs, BlackRock, and Morgan Stanley beat expectations, while JPMorgan and Wells Fargo missed. Many financial sector stocks were negatively impacted by the Trump administration’s suggestion that credit card companies should cap interest rates on card balances at 10%.[1]

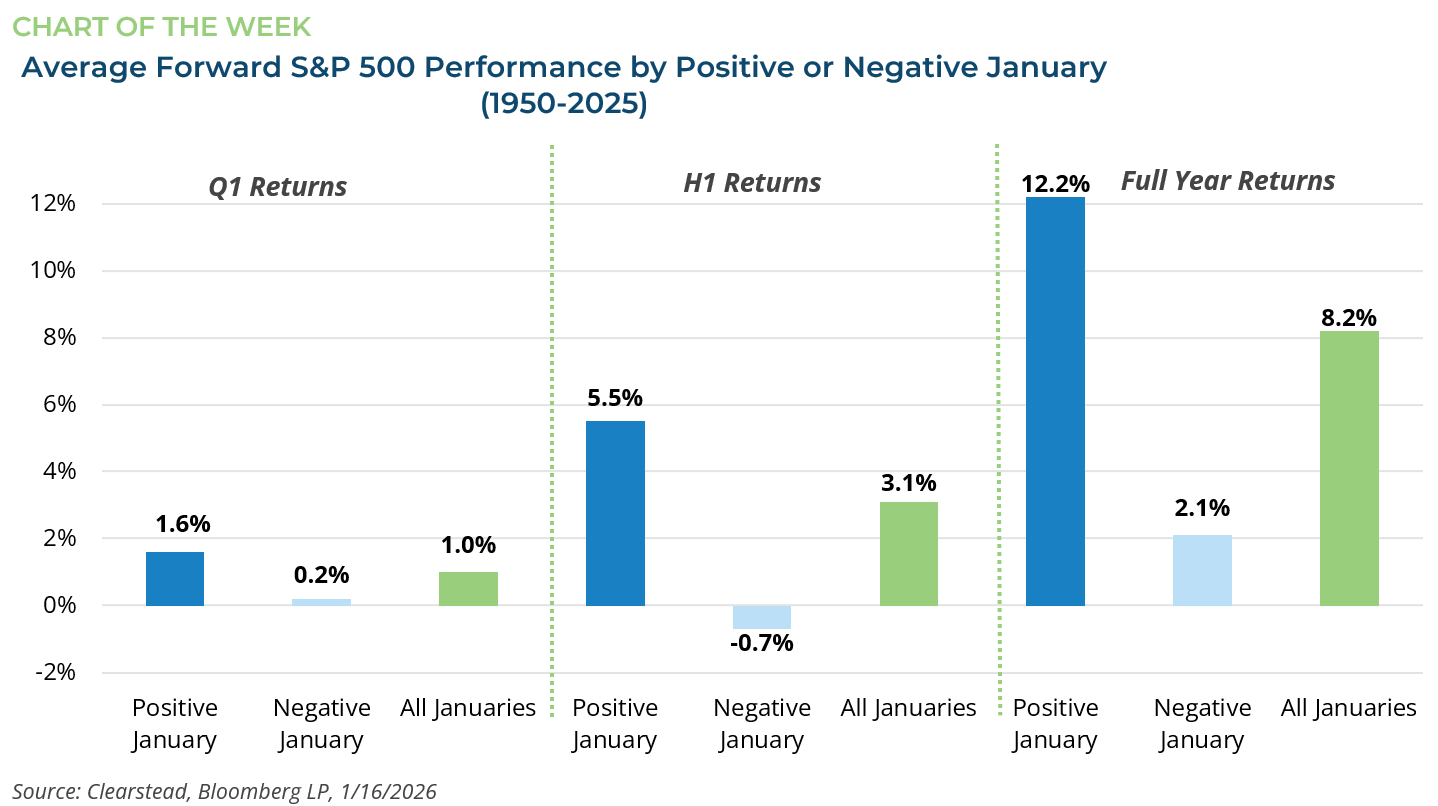

ONE MORE THOUGHT: What Could January Be Telling Us About Markets in 2026[1,2]

January seasonality has a history of offering clues about the market’s tone, but the message for 2026 is less about a simple market call and more about the potential for a meaningful change in leadership. The “January effect” is best known as a tendency for small-cap stocks and prior-year laggards to bounce in the new year as tax-loss selling abates and fresh capital is deployed through new contributions and strategic reallocations. This dynamic often supports risk assets broadly, but its strength has varied over time and should be treated as a tendency, not a hard-and-fast rule. Beyond the anomaly in small-caps and prior year losers, January has often set the tone for the rest of the year in terms of return profile and leadership. Historically, years that begin with a positive month of January for the S&P 500 have, on average, produced materially stronger full-year gains than years that begin in the red. Early price action generally aligns with persisting trends for the year ahead. In years when the S&P 500 performance is negative during January, the index is up 2.3%, on average, for the full year. In years where the S&P 500 performance is positive, the market rises 13.8% for the full year. Additionally, sector and thematic performance add another dimension to the January barometer. Research by Fidelity found that, since the early 1990s, equally weighting the four best-performing S&P 500 sectors after the month of January and holding them through year-end has delivered a modest edge over simply owning the index. The turn of the year generally coincides with major portfolio resets, as investors deploy new capital and reevaluate their market views. So far in 2026, the message is rotation! Cyclical and value-oriented exposures are leading after years of mega-cap growth dominance. The Materials and Energy sectors sit atop the leaderboard—through the first two weeks of the month—with Energy surging even as crude prices decline – an unusual occurrence. The Metals & Mining complex (using ETF ticker XME as a proxy) has already posted double-digit gains in 2026, while small-cap stocks are outpacing both the S&P 500 and the Nasdaq. International equities are outperforming US large caps in a relatively stable dollar environment. Taken together, early 2026 is pointing toward a changing market regime in which cyclicals, the value factor, smaller companies, real-asset equities, and non-U.S. markets may drive returns. The swan song of market rotation is sung loudly and often by professional investors, so proceed carefully. Treat early-year leadership as a useful clue, not a guaranteed script for the rest of 2026.

[1] Bloomberg LP, 1/16/2025

[2] https://www.fidelity.com/viewpoints/active-investor/january-barometer

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.