OBSERVATIONS

- Equity markets were volatile last week but ultimately ended the week only modestly lower with both the S&P 500 and small caps (Russell 2000) losing 0.3%, while the yield on the 10-year Treasury gained 1 basis points to end the week at 4.23%.[1]

- Construction spending in October— long delayed due to the government shutdown— showed that activity increased by 0.5% month-over-month (MoM) to 2.175 billion (annualized rate), primarily due to greater activity in private residential construction.[1]

- Real GDP growth for Q3-2025 was revised higher to 4.4% (annualized), up from the initial estimate of 4.3%, due to upward revisions to both exports and changes in inventories. The first estimate for Q4 GDP growth will be released in late Feb-2026.[1]

- The Fed’s preferred measure of inflation, the PCE price index, showed that prices increased by 0.2% MoM or 2.8% year-over-year (YoY). Core-PCE, which removes the volatile food and energy categories, also increased by 0.2% MoM and 2.8% YoY in November. This is a touch higher than the PCE figure for October (2.7% YoY) but equal to September’s PCE reading (2.8% YoY).[1]

- Initial unemployment claims were 200k last week, nearly unchanged from the week prior and over 20k fewer than the same week last year.[1]

EXPECTATIONS

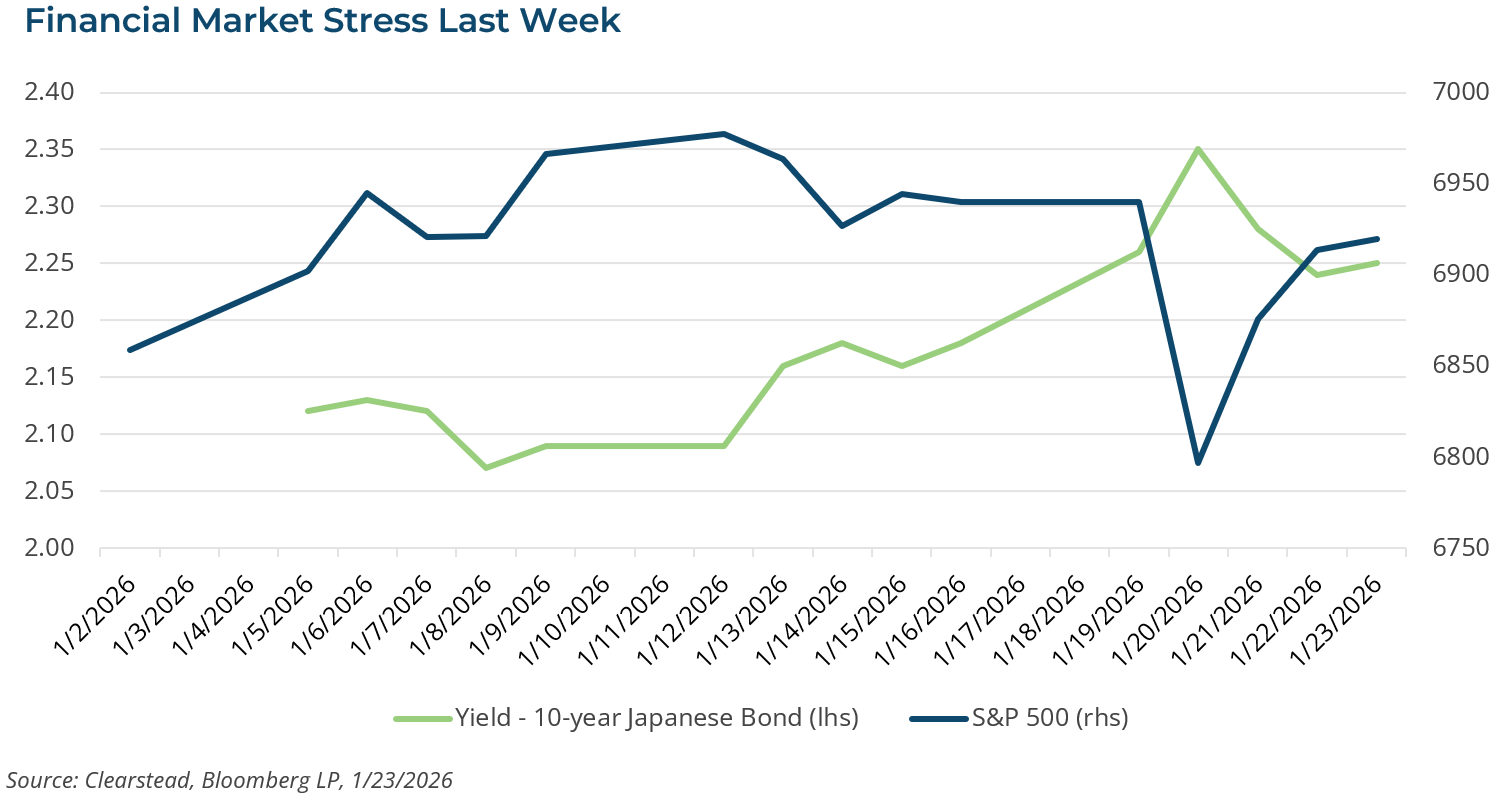

- Japan’s Prime Minister (PM) Sanae Takaichi dissolved parliament last week, paving the way for elections on February 8th. Her LDP party will likely secure a large majority in the Japanese lower house of parliament. PM Takaichi is an advocate for fiscal spending to drive economic growth. As a result, longer-dated Japanese bonds have sold off in recent days as concerns over Japanese fiscal spending increased.[1]

- The Bank of Japan kept interest rates steady last week at 0.75% but signaled that a rate hike could happen in April. The BOJ effectively laid the groundwork for increasing its bond-buying activity as yields on longer-dated Japanese bonds moved sharply higher and volatility surged in both the bond and currency markets.[1]

- Q4 earnings season is off to a good start, with about 13% of the S&P 500 having reported. About 75% of the companies reporting so far have had a positive earnings surprise, which is below the 5-year (78%) average for beats and on-par with the 10-year (75%) average. Overall, Q4 earnings are tracking towards an increase of 8.2% YoY.[2]

ONE MORE THOUGHT: Greenland, Volatility, Tariffs, and National Security[3]

Markets suffered their first bout of volatility in 2026 last week, with the S&P 500 falling more than 2.0% on Tuesday, 20 January. The VIX—the so-called fear gauge—moved above its long-run average and closed over 20, and the yield on the 10-year Treasury moved up by over 15 basis points from the prior week to 4.29%. The trigger was the concern that the Trump administration might impose an additional 10% tariff on several European nations opposing US efforts to gain sovereignty over Greenland. President Trump initially said all options were on the table, but in his speech at the World Economic Forum in Davos, he ruled out using the US military to seize the island territory from Denmark. Following a flurry of diplomacy at Davos, he then announced that no additional tariffs would be needed and that the US and Europe had negotiated a “framework for a deal” intended to deliver US objectives in Greenland. While the specifics of any future Greenland agreement remain unclear, markets quickly discounted the risk of a negative tail event, with equities gaining most of their losses back by the end of the week. Greenland’s significance is rooted in national security: to achieve the administration’s “golden dome” missile defense ambitions, additional US military assets would likely need to be stationed there. How much land is required for these assets—and how much territory and legal sovereignty Denmark and Greenlanders are prepared to cede—remains uncertain. It appears the US, Denmark, and other European NATO allies may expand a 75-year agreement that already gives the US military broad latitude to operate in Greenland. Nonetheless, despite the lack of details, markets breathed a sigh of relief and volatility in the Japanese debt markets also eased late last week, which have allowed markets to refocus their attention on earnings, interest rates, and economic growth. Market stress often erupts from unexpected sources, reinforcing both the discipline to look past short-term noise and the importance of maintaining a well-diversified portfolio.

[1] Bloomberg LP, 1/23/2026

[2] FactSet Earnings Insight 1/23/2026

[3] https://www.wsj.com/world/alarm-over-trumps-greenland-threat-gives-way-to-uncertainty-around-future-deal-9044633b?mod=hp_lead_pos2

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.