OBSERVATIONS

- Markets traded lower amid a short week and light trading volume with the S&P 500 losing 1.0% and small caps (Russell 2000) also losing 1.0%, while the yield on the 10-year Treasury was little changed—gaining 6 basis point—to end the week at 4.19%.[1]

- For CY2025, the S&P 500 finished off its third strong year in a row by returning 17.9%—including dividends—and cumulatively over 100% from end of Sep-2022, which was near the low of the 2022 bear market.[1]

- The S&P CoreLogic National Housing Price Index showed that the rate of home price appreciation was largely unchanged in October (latest available), with home price increases edging up to 1.4% year-over-year (YoY) compared to the 1.3% YoY increase in September.[1]

- Initial unemployment claims remain low at 199k for the final week of 2025. Overall, initial unemployment claims were 1.6% higher than in 2024, but unemployment claims were lower by 53k in aggregate for Q4-2025 as compared to Q4-2024. This suggests that the labor market is heading into 2026 in slightly better shape than the one year ago.[1]

EXPECTATIONS

- In late December, the Bureau of Economic Analysis released its first estimate of Q3 GDP growth—long delayed due to the recent government shutdown—showing that the economy grew by 4.3% (annualized rate) as both consumer spending (3.5%) and a boost from net trade exceeded expectations.[1]

- The preliminary estimate for Q4-2025 will likely be released in February. Meanwhile, the Atlanta Fed’s GDPNow model predicts 3.0% real growth in Q4, while consensus estimates from Bloomberg put Q4 real growth at only 1.8%.[1]

- The minutes from the Fed’s December meeting showed that most Fed officials supported the decision to lower rates, considering the downside risks to the labor market. Most Fed officials anticipated the need for further rate cuts in 2026, but a few were inclined to hold rates steady for a period of time this year to gain confidence that inflationary pressures are subsiding.[2]

ONE MORE THOUGHT: Wrapping up Q4-2025 as well as the full year[1]

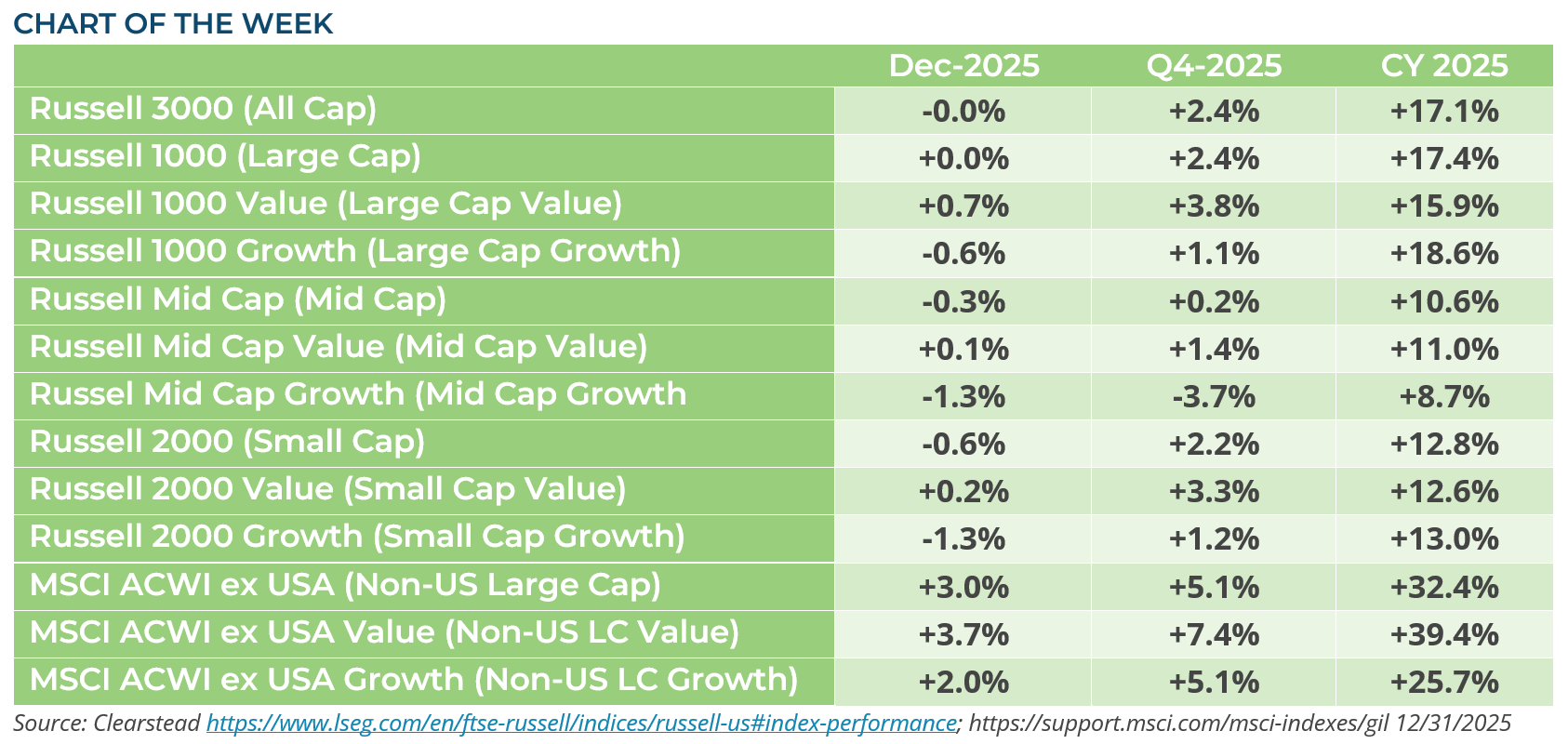

Well, 2025 is in the books. December continued many of the trends that defined much of Q4. US large caps (Russell 1000 +0.0%) were flat on the month, but outperformed US small caps (Russell 2000 -0.6%), which lost ground in December. The same was true for the full quarter (Q4 Russell 1000 +2.4% vs. Q4 Russell 2000 +2.2%). Overall, Q4 witnessed a broader set of winners than in previous quarters. For instance, the value factor beat the growth factor in December as well as for the entirety of Q4—see Chart of the Week. However, for the full year, large-cap growth-oriented stocks outperformed their value-oriented peers. We saw the inverse of this for mid-cap stocks for 2025, which saw value-oriented names steadily outperform growth-oriented stocks. For small caps, there was little difference between the performance of the growth and value factors by the end of the year. While December saw several sectors decline for the month, only Real Estate (-2.0%) and Utilities (-1.4%) lost ground during the quarter. For the full year, every sector registered gains with Communication Services gaining the most (+33.6%) and Real Estate gaining the least (+3.2%). Outside of the US, results in December and Q4 were consistent with what has transpired steadily throughout the year. Value-oriented stocks consistently outperformed their growth-stock peers, and, similar to the US, small cap names underperformed large-caps for the full year. As we head into 2026, some strategists are painting a bearish picture—a US economy that looks increasingly weak, stretched equity valuations, talk of an AI-stock bubble, and three-straight years of robust returns (S&P 500: 2023 +26%, 2024 +25%, 2025 +18%). In addition, mid-term election years are typically the weakest for the S&P 500 within a four-year presidential cycle. As we look out over the investment landscape, Clearstead is reminded that the consensus estimates for next year’s corporate profits look solid—in the 11%-13% YoY range—and that a broader set of companies seems likely to prosper. Could the rotation that began in Q4 have legs? Global liquidity is not under stress, and the US labor market, while fragile, remains stable. Valuations are a cause for concern, but multiples do not typically contract significantly when margins are stable-to-expanding, which is the likely backdrop for corporate earnings in 2026. Given this environment, our baseline outlook is that, absent a significant negative shock, markets are poised to grind higher. While 2026 may not feature the strong returns to which we have become accustomed, it is likely to reward the patient investor.

[1] Bloomberg LP, 1/2/2025

[2] https://www.federalreserve.gov/newsevents/pressreleases/monetary20251230a.htm

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.