OBSERVATIONS

- Markets surged higher in the final week of November, with the S&P 500 gaining 3.7% and small caps (Russell 2000) gaining 5.5%, while the yield on the 10-year Treasury fell 5 basis points to end the week at 4.02%.[1]

- National home prices (S&P Cotality Case-Shiller) further eased in September to an increase of 1.3% year-over-year (YoY), which is just below August’s 1.5% YoY increase.[1]

- Retail sales increased by 0.2% month-over-month (MoM) in September from August and are 4.3% YoY. Excluding the volatile auto and gas categories, retail sales were up only 0.1% MoM but increased 4.2% YoY.[1]

- Headline produce prices (Producer Price Index-PPI) were unchanged in September at 2.7%—the same as in August—but core-PPI, which excludes volatile food and energy prices, fell to 2.6% YoY in September from August’s 2.9% YoY figure.[1]

- Unemployment claims came in below expectations last week and fell to 216k new claims a decrease of 6k claims from the week prior and further indicate only limited layoffs are taking place in the labor market.[1]

- Durable goods orders were solid in September, increasing by 0.5% MoM and August’s durable goods orders were revised higher. Additionally, non-defense capital goods orders excluding aircrafts—a proxy for broader fixed capital investment—rose by 0.9% MoM and August’s figures were also revised higher.[1]

EXPECTATIONS

- Given more dovish remarks by various Fed speakers last week, the market has now priced in an 83% chance that the Fed will cut its main policy rate by 25 basis points at its next meeting in mid-December.[1]

- The first estimate for Q3 GDP will not be released until Tuesday, December 23rd by the Bureau of Economic Analysis, but the Atlanta Fed GDPNow model predicts that Q3 GDP is tracking towards 3.9% (annualized rate), and the Goldman Sachs GDP Tracking Estimate has risen to 3.8% (annualized rate).[2]

- The Fed’s beige book—a qualitative assessment of the US economy in each of the twelve Fed districts—confirmed a largely stable economy in October with 9 of the 12 districts reporting little change to economic activity, while two districts reported a modest decline and one a modest pick-up in economic activity.[3]

ONE MORE THOUGHT: November Market Wrap Up[1]

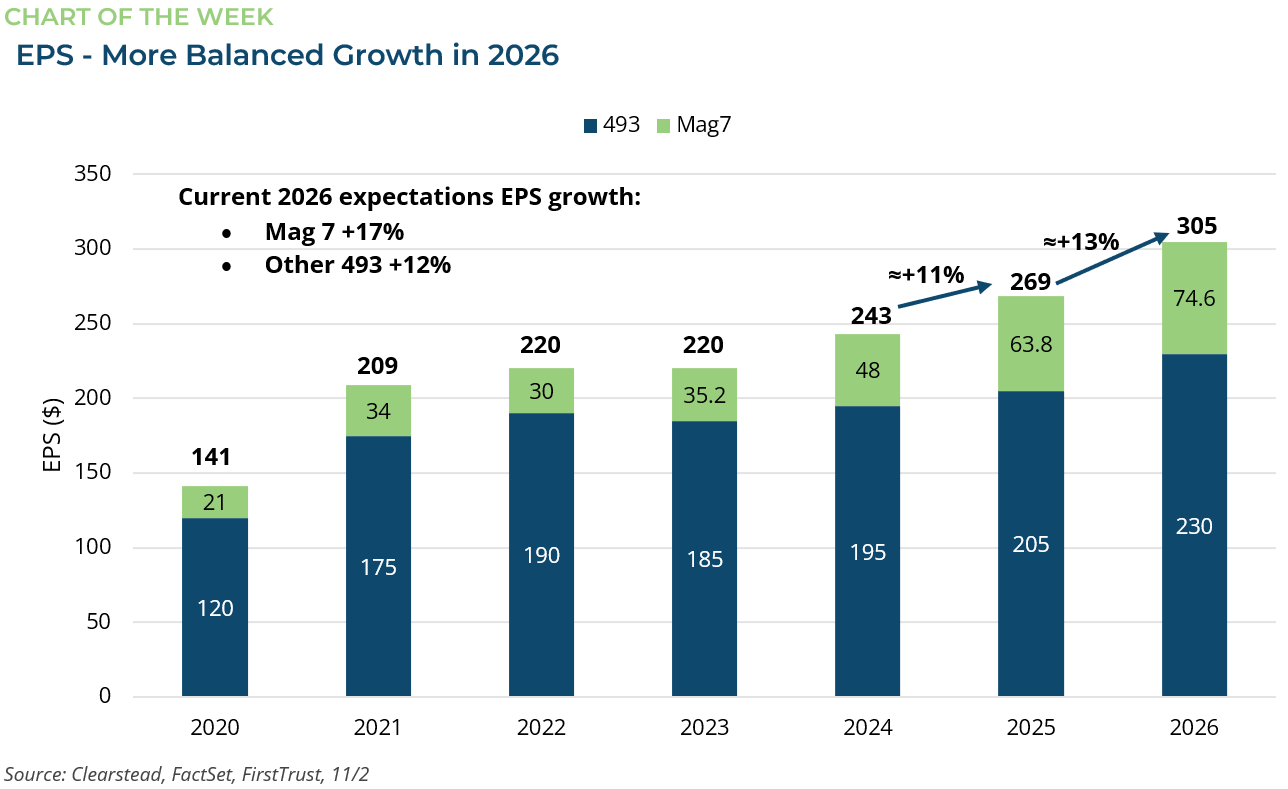

After five straight months of gains, November saw equity markets broadly decline over the first three weeks of the month before recovering in the last week. The S&P 500 traded lower in the first half of the month as several of the themes driving this year’s gains took a breather. For the first time since March, the Magnificent 7 (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) collectively underperformed the broader market on a monthly basis. Despite a strong Q3 earnings season (+13% YoY) and the number of positive earnings surprises (82%) being above longer-run averages, the S&P 500 gave up some ground as profit taking and rebalancing stalled further gains in equities for a bit. It should not be that surprising that after 5-months of gains and over 30 new record highs—eight of which were in October alone—that a lot of good news was already baked into equity prices. However, late in the month a bevy of Fed speakers seemed to suggest that the Fed would likely cut rates at its next meeting in mid-December and that was enough to help the market recover over the shortened Thanksgiving trading-week. As November came to a close, the S&P 500 recovered nearly all its losses from earlier in the month and finished the month up 0.2%, and despite the early month volatility will begin December trading less than 1.0% off from its all-time high reached in late October. Markets will increasingly be focused on the economic outlook and earnings expectations for 2026. At this point, there is positive news on both fronts. The economy is expected to modestly accelerate in 2026 on the back of the stimulus that is contained in the One Big Beautiful Bill—see RC 7-Jul. Additionally, the earnings outlook for the S&P 500—see Chart of the Week—looks solid with meaningful participation from a broader set of companies and not just the Magnificent 7. The S&P 500 has returned about 17.8% so far this year, and certainly some of the positive outlook for 2026 is already reflected in the gains registered in the past few months. Nonetheless, while one should not expect double-digit returns from the S&P 500 for a fourth year in a row, there is reason to think that 2026 could still be a good year for equities and further compound gains for patient investors.

[1] Bloomberg LP, 11/28/2025

[2] Goldman Sachs – USA GS Economic Indicators Update 24-Nov-2025

[3] https://www.federalreserve.gov/monetarypolicy/beigebook202511-summary.htm

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.