OBSERVATIONS

- Markets traded higher last week with the S&P 500 gaining 0.4% and small caps (Russell 2000) rising 0.9%, while the yield on the 10-year Treasury rose 12 basis points to end the week at 4.14%.[1]

- The manufacturing sector continued to weaken as the manufacturing PMI fell to 48.2 in November, down from October’s 48.7 reading, and it has now been below 50—any figure below 50 denotes contracting activity—for 34 of the past 36 months.[1]

- In contrast, the services sector PMI increased to 52.6 in November from 52.4 in October. The services sector PMI has been above 50 in 32 of the past 36 months and has never fallen below 49 during this period.[1]

- Industrial production increased by 0.1% month-over-month (MoM) in September from August. Industrial production in September was 1.6% higher year-over-year (YoY) with balanced gains across each of its subcomponents—manufacturing (+1.5% YoY), mining (+2.8% YoY), and utilities (+1.4% YoY).[1]

- Initial unemployment claims remain low and registered 191k claims last week, which was a decrease of 27k from the previous week and about 14k less than the same week last year.[1]

- The Fed’s preferred measure of inflation (Core PCE) rose 0.2% MoM and 2.8% YoY, both in line with expectations, cementing the likelihood of a 25bps rate cut (see Expectations).[1]

- Consumer sentiment (University of Michigan Sentiment Index) rose for the first time in five months to 53.3. The increase was driven by improved expectations in personal finances across all demographics.[1]

EXPECTATIONS

- Despite fears that the US consumer may be running out of steam, data capturing Black Friday sales—the Friday after Thanksgiving—showed that overall retail sales increased by 4.1% YoY—while the subset of on-line, ecommerce sales increased by 9.1% YoY. The data also suggested a bifurcation of spending between high income households and lower- and middle-income households that increasingly eschewed bigger-ticket purchases.[1]

- The Federal Reserve will meet later this week, and markets have now priced in a 95% chance that the Fed will lower interest rates by 25 basis points.[2]

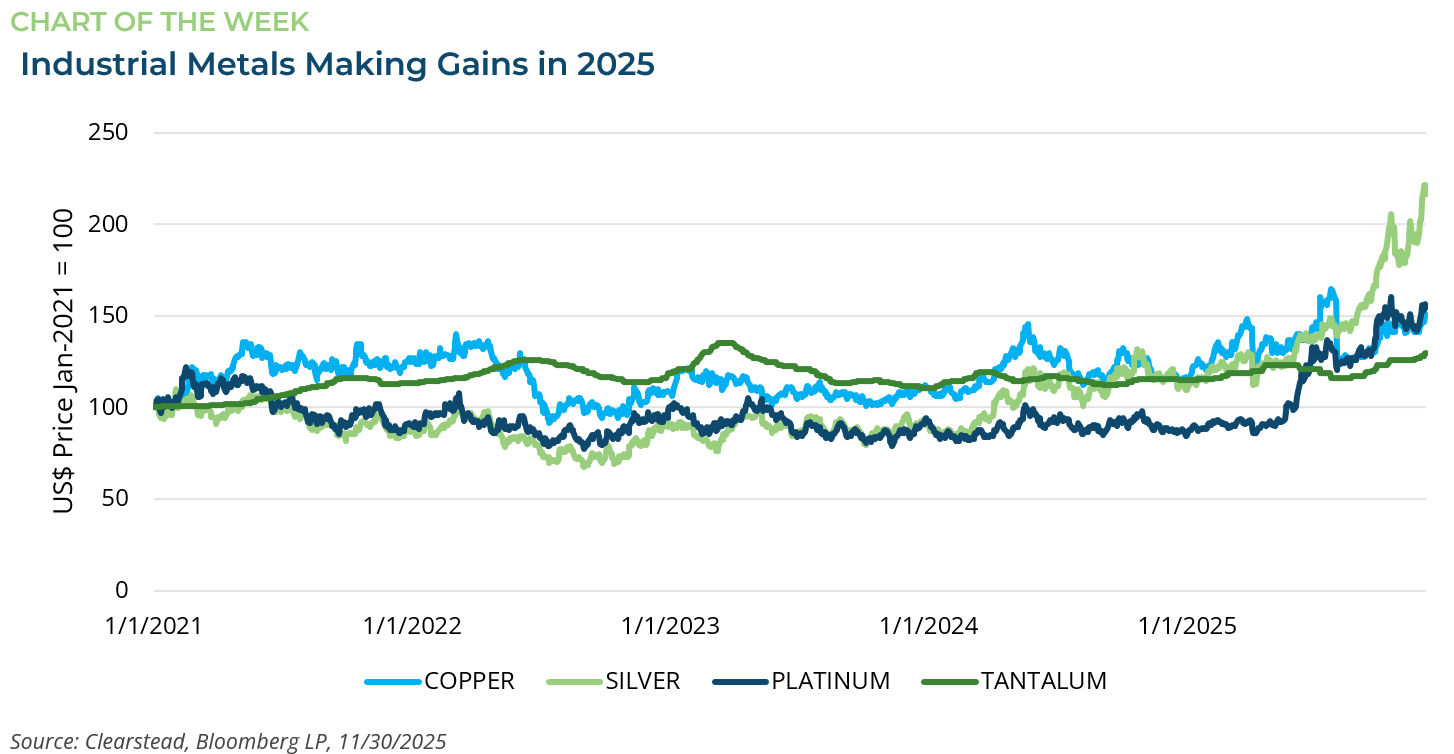

ONE MORE THOUGHT: Select Metals Face Large Structural Shift in Demand[2]

A variety of industrial metals have rallied this year, and copper, in particular, is trading near an all-time high. Some of the reasons for their surge are related to cyclical factors such as a weaker US dollar, Federal Reserve easing interest rates, and some improvement over the course of the year for better global growth. However, there are also structural forces at play, that likely have much further to run. The data center buildout at the core of the AI race, the increasing electrification of cars, the modernization of global electrical grids, and the trend towards more battery-based tools, appliances, and sub-components all support greater use of copper as well as select other metals—many of them rare earth minerals. By some measures, existing copper capacity and mining supply should allow the amount of production to meet or even modestly exceed demand for the next 2-3 years, but by 2029 the supply of this critical metal may fall short of demand. The US has made it a priority to expand its access to rare earth metals—most of which are currently sourced in China. While rare earth metals are actually found in many parts of the world including the US and Canada, refining capacity for the rare earth metals is predominantly located in China. In response to this, the US government has made direct investments in Lithium Americas Corporation—lithium is a key component of battery technology—as well as a stake in MP Materials to develop a rare earths processing facility. Forecasting commodity demand is notoriously difficult. The trend towards electrification and away from gas-power of all types will undoubtedly lift demand for copper and other select metals. However, as technologies advance, they tend to become more efficient—today’s electric cars for instance use close to 10% less copper than earlier versions—and product designers, if faced with high metal input costs, would be incentivized to reduce usage. Furthermore, a soft patch in global growth at any point in the coming years could have a meaningful negative impact on spot prices. Nonetheless, the long-run structural demand for copper and other select metals looks robust. The International Energy Agency predicts that electricity demand will grow close to 4% over the next three years compared to the IMF’s outlook that real global growth will be about 3% over the same period. Given this, exposure to copper and select metals may be a way to diversify portfolios from equities while at the same time benefiting from electricity’s growing market share in the energy space.

[1] Bloomberg LP, 12/5/2025

[2] GS Base Metal Analyst 20-Nov-2025; Metal Views 3-Dec-2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.