OBSERVATIONS

- Markets were choppy last week, with software names seeing the steepest declines. The S&P 500 lost 0.1%, while small caps (Russell 2000) rose by 2.2%. The yield on the 10-year Treasury fell 3 basis points to 4.21%.[1]

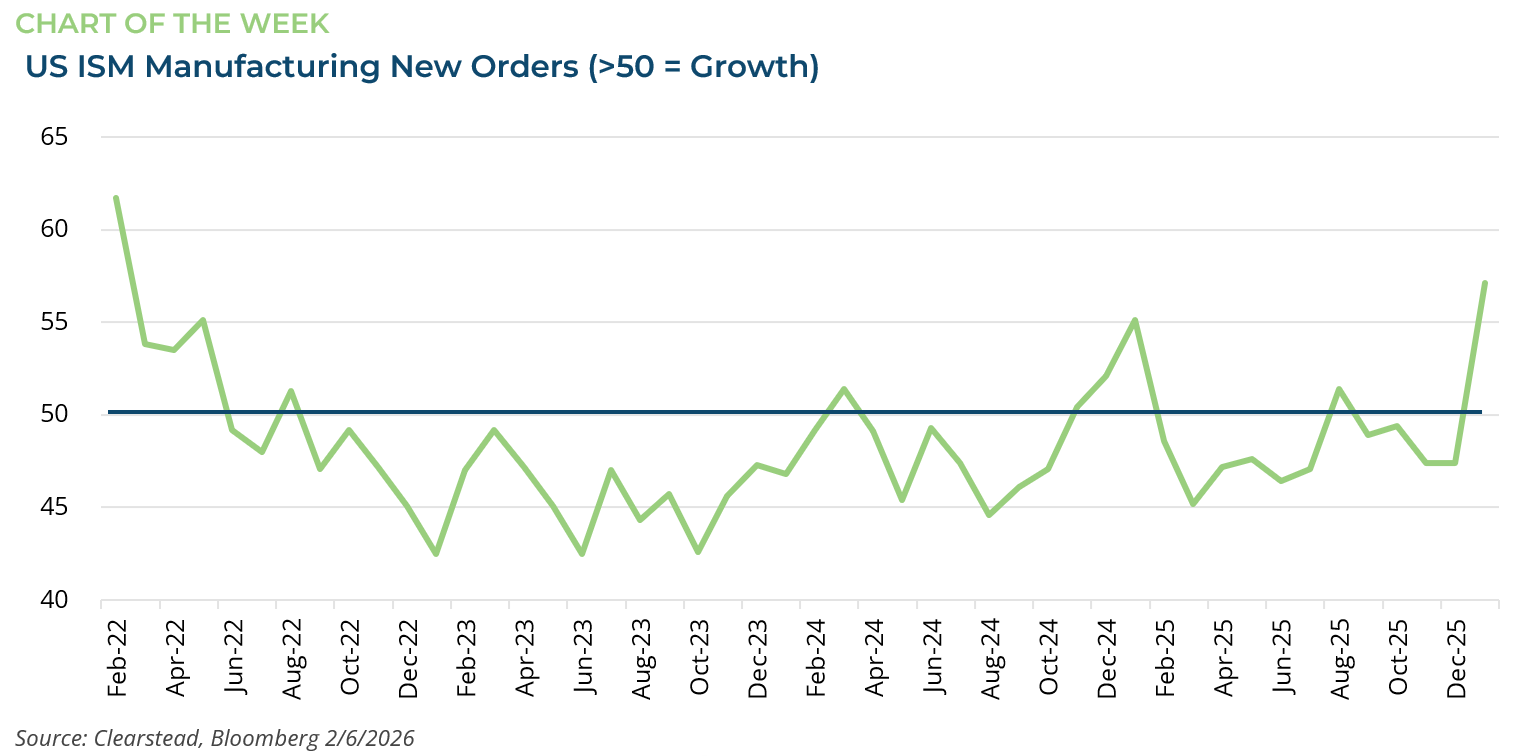

- The manufacturing sector PMI beat expectations in January and surged to 52.6—any reading above 50 denotes expanding economic activity—up nearly 5 points from December’s 47.9 reading.[1]

- Meanwhile, the service sector PMI also beat expectations in January, registering 53.8. This is unchanged from December’s reading and marks the 19th consecutive month the services PMI has been above 50[1]

- Initial unemployment claims increased by nearly 20k last week to 231k new claims. This was higher than expected and about 15k more claims than the same week last year.[1]

- The December (latest) Job Openings and Labor Turnover Survey (JOLTS) showed that job openings declined to 6.5 million, the lowest level since Dec-2020 and below expectations, from November’s 6.9 million. However, the quit rate, often a proxy for worker confidence in finding a new job, was unchanged in December at 3.2 million.[1]

- Due to the two-day partial government shutdown last week, the January jobs report will be released this Wednesday instead of last Friday—expectations are for about 70k new jobs created in January.[1]

- The University of Michigan Consumer Sentiment Index improved in February to 57.3 from January’s 56.4 level, driven by an improvement in respondents’ perception of current economic conditions.[1]

EXPECTATIONS

- The European Central Bank (ECB) held its benchmark interest rate at 2.0% for the fifth consecutive meeting as economic growth improved marginally, and core-inflation (excluding food and energy prices) fell to 2.2% year over year (YoY). The ECB suggested that inflation would stabilize at their 2% target later this year.[1]

- Similarly, the Bank of England, in a close vote, held its benchmark interest rate steady last week at 3.75%, but left the door open for a rate cut in the Spring. Core inflation remains at 3.2% YoY, but the labor market continues to soften with unemployment rising to 5.1%, close to the Covid-era high of 5.3%.[1]

- In the US, Fed Fund Futures have increasingly priced in a rate cut in June—coinciding with the expected first Fed meeting chaired by Fed Chairman in waiting Kevin Warsh. A second cut is expected in the Fall.[1]

- While markets have been volatile, the Q4-2025 earnings season has been positive. 59% of S&P 500 constituents have reported, and approximately 76% have had a positive surprise. This is below the 5-year (78%) average for beats but on-par with the 10-year (76%) average. Overall, Q4 earnings are tracking towards an impressive increase of 13.0% YoY.[2]

ONE MORE THOUGHT: Signs of an Economic Pickup [1]

After years of hovering below 50, the January ISM Manufacturing reading broke out to 52.6, potentially signaling a meaningful shift in the economy (readings above 50 indicate expansion). This was the strongest reading since 2022, suggesting the post-COVID inventory destocking cycle is likely over. After two years of companies aggressively trimming inventories to lean out after the pandemic, the US corporate sector now appears to be entering a proactive restocking cycle. This would mark a fundamental shift in business behavior that would likely have positive implications for forward-looking indicators, corporate earnings, and overall financial markets. The New Orders component of the manufacturing PMI surged from 47.7 to 57.1, and, for the first time in months, delivery times lengthened, pointing to emerging supply chain tightness. Some of this surge may be explained by seasonal restocking, but the overall strength of this indicator has been confirmed by the regional Fed surveys, which have broadly pivoted higher. This economic momentum is likely to continue if long-term interest rates and oil prices remain near current levels as well as no negative surprises related to tariffs. For the last 20-25 years, some economists and hedge funds have built their entire macroeconomic framework around the rate of change in the US ISM Manufacturing PMI. Over the last five years, however, this indicator has been less of an oscillator and more range-bound, confounding traditional economic models. The shift likely reflects the evolving composition of the US economy, which is now more services-oriented and asset-light, with accommodative monetary policy also altering the landscape. That said, the ISM Manufacturing New Orders indicator remains highly relevant for the cyclical side of the economy and warrants close attention. A genuine inflection in “on-the-ground” economic growth suggests that the rotation seen in January has room to run, favoring allocations to cyclical sectors and mid-and-small-cap stocks. Should this growth persist, it will also create a high hurdle for further monetary easing as economic activity intensifies and hiring eventually picks up.

[1] Bloomberg LP, 1/30/2026

[2] FactSet Earnings Insight 1/30/2026

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.