Observations

- Markets slid last week as fears of a slowing economy and the impact of tariffs on Mexico and Canada imports increased. The S&P 500 lost -3.1% and small caps (Russell 2000) fell -4.10% and the yield on the 10-year Treasury rose 9 basis points to 4.30%.1

- The manufacturing PMI fell in February to 50.3 down from 50.9 in January—any number above 50 denotes expanding economic activity—and was dragged down by weaker figures for new orders.1

- In contrast, the services PMI increased to 53.5 in February, up from January’s 52.8. However, the prices paid subcomponent—a proxy for inflationary pressures in the economy—surged to 62.6 from January’s 60.4 level, which is only the fourth time this component has been above 62 in the past two years.1

- Imports continued to surge again in January—rising to $401.2 billion, which was a +$36.6 billion increase over December’s imports and a +23.1% increase year-over-year—at least in part, due to firms trying to build inventories ahead of the implementation of Trump’s tariff agenda.1

- Initial unemployment claims subsided last week, falling -21k claims to only 221k new claims last week—so far, despite the layoffs in the Washington DC area, initial claims remain low by historic standards.1

- The US economy created 151k new jobs in February, which was slightly below expectations but above January’s revised job figure of 125k new jobs. The unemployment rate ticked slightly higher to 4.1% from January’s 4.0% level and the participation rate fell to 62.4% from January’s 62.6% level.1

Expectations

- The Fed’s Beige Book—a qualitative assessment of the economy by Fed districts—noted that overall US economy was stable in January, with six districts noting no material change from December, while four districts report modest or moderate growth while two districts noted slight contractions in activity.2

- The Trump administration pressed ahead with a broad set of 25% tariffs on Canadian and Mexican imports last week. Select energy products, primarily coming from Canada, are being tariffed a lower 10% rate and the Trump team delayed the imposition of 25% tariffs on autos, auto parts and components until 2-April.1

- The European Central Bank (ECB) reduced its main policy rate by -25 basis points to 2.5% but signaled that it may be more cautious regarding any future cuts noting at present its policy is “meaningfully less restrictive” and like the US Federal Reserve the ECB would be more data dependent going forward.1

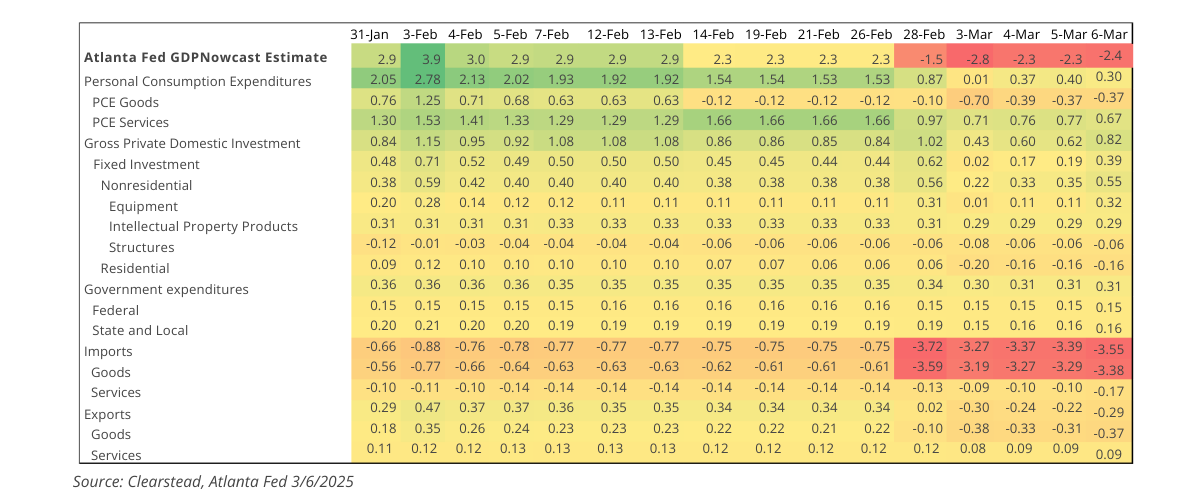

One More Thought: Atlanta Fed’s GDPNowcast Forecast Spooking Markets1

A slew of negative headlines began to swirl over the past several weeks as a variety of economic indicators began to suggest increased caution by the US consumer and weakening sentiment in US boardrooms. In addition, many companies have seemingly been taking President Trump at his word, and firms relying on foreign suppliers began to build inventories in recent months, most likely in the hopes of avoiding some of the potential tariffs that President Trump campaigned on in 2024 and began to implement in his first weeks in office. As a result, the value of US imports surged in December and January which has led to some economic models—such as the Atlanta Fed’s GDPNowcast model—to suggest real Q1 growth may be negative. This is because the way real GDP is calculated, net imports (total imports minus total exports) works to decrease our estimate of GDP growth. Thus, the surge in imports is detracting from many GDP models including the Atlanta Fed’s estimate—see Chart of the Week. In the last week the Atlanta Fed Nowcast forecast of Q1-2025 GDP growth swung from +2.3% (annualized rate) to -2.4% (annualized rate). Now there are several things to consider before one concludes the US is set to experience negative growth that would be highly correlated with a recession. First, this model may be overly weighting the trade portion of the economy. Second, some of the other components of this model such as personal consumption of goods may have been weaker in January and February due to the cold weather in parts of the country and the wildfires in California. Thirdly, gold imports are part of the increase in the US imports overall in the first few months of the year, but these imports are considered a financial asset and are excluded from the import figure when the Bureau of Economic Analysis produces its official estimate of quarterly GDP. Lastly, we know from history that more than a month out from the actual end of quarter, the Atlanta Fed GDPNowcast model is likely to change and its estimate at the end of the quarter is typically much more accurate than its estimates several weeks from the quarter’s end. For all these reasons, it is rational to conclude that growth has weakened in Q1-2025 compared to Q4-2024’s +2.3% growth rate, but it seems premature, at present, to conclude the US economy is headed for a recession.

[1] Bloomberg LP, 3/7/2025

[2] https://www.federalreserve.gov/monetarypolicy/beigebook202502-summary.htm