Observations

- Markets declined sharply last week—see One More Thought—with the S&P 500 losing -2.2% and small caps (Russell 2000) falling -1.5%, while the yield on the 10-year Treasury rose +1 basis point last week to 4.31%.[1]

- Small business optimism retreated in February to 100.7—which was -2.1 points lower than in January—but it is the fourth consecutive month in which the index is above its 51-year average of 98.[1]

- Headline inflation came in better than expected in February, with the CPI falling to 2.8% year-over-year (YoY) down from January’s 3.0% YoY figure. Core-CPI, which removes volatile food and energy prices, fell to 3.1% YoY—the lowest core-CPI has been since April-2021—down from January’s 3.3% YoY core-CPI figure.[1]

- Similarly, producer prices also beat expectations and showed no increase (+0.0% month-over-month) from January’s producer price level. Headline PPI fell to 3.2% YoY down from January’s 3.7% figure and core-PPI—which excludes food and energy—fell to 3.4% YoY down from January’s 3.8% figure.[1]

- Job openings climbed in January to 7.74 million up from December’s 7.508 million openings, while the quit rate—a measure suggesting confidence in finding a new job—increased to 2.1% in January from December’s 1.9% figure and is closer to pre-Covid quit rates which averaged about 2.3% in 2018 and 2019.[1]

- Initial unemployment claims registered 220k last week, nearly unchanged from the week prior and on-par with initial unemployment claims last year during the same week of the year.[1]

- The University of Michigan Consumer Sentiment Index fell in March to 57.9—which was below expectations and -10.5% lower than in February (64.7)—as consumers grew increasingly worried about tariffs and inflation—future inflation expectations jumped compared to last month.[1]

Expectations

- As we prepare for the Fed’s interest rate decision later this week, markets do not expect the Fed to cut rates on Wednesday—only an 8% chance according to the Fed Fund Futures—but markets currently do expect the Fed to cut rates by -25 basis points in June and currently they expect a second -25 basis point cut in September. However, the Fed may use its upcoming projections and press conference to reset expectations.[1]

- Congress avoided a government shutdown last week by passing a continuing spending resolution which extended government funding at 2024-levels through the end of government’s fiscal year (Sep-2025).[1]

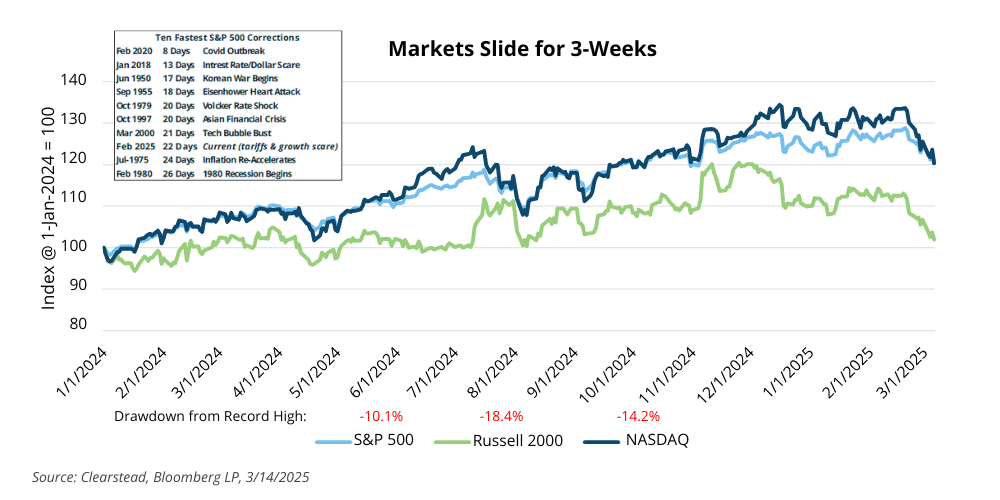

One More Thought: The S&P 500 Enters Formal Correction Territory [1]

Last week the S&P 500 declined more than 10% since its record high on February 19, 2025. This sell-off has been driven by two primary developments. The first was that some of the largest constituents in the S&P 500, the so-called Mag-7 (Apple, Microsoft, NVIDIA, Amazon, Meta, Alphabet, and Tesla) had surged due to the large advances in AI over the past few years. However, in late February, some of the wind came out of the sails on this investment theme. A Chinese AI model (DeepSeek) showed earlier in the year that US AI models were not as far ahead in the tech-race as many people had assumed. Secondly, NVIDIA—a company who had seen explosive growth over the past few years, and whose chips have powered most AI models in the US—signaled that future growth was still set to be strong, but traders largely assessed the days of incredible growth for the AI-trade may be in the past. As a result, the Mag-7 stocks collectively have declined by nearly -17.0% since mid-February. The second factor relates to a growth-scare. The US economy came into 2025 with a fair amount of momentum—low unemployment, strong wage growth, and good productivity numbers. Corporate America generally boasted strong balance sheets, stable or growing profit margins and select portions of the economy were seeing investments in expanding production. The service sector seemed to be humming along, and the manufacturing sector was at least hanging in there as we began the year. However, as Q1-2025 unfolded, some data pointed to a more skittish US consumer and then the Trump administration began to announce a series of tariffs designed to bolster US tax revenue as well as re-orient global supply chains toward reshoring productions towards America. The details of the tariffs came fast and furious—including frequent shifts in the tariff levels, which countries were targeted, and what goods were covered. Markets whipsawed as investors priced in more supply-chain uncertainty, CEOs paused capital spending, and consumers braced for potentially higher prices. The near-term result seems to be a bit slower growth. Equity market drawdowns are a normal part of market cycles. Typically, these occur about once per year, but the speed of this correction was relatively fast—only seven corrections have occurred in fewer trading days—see Chart of the Week. Investors should brace for more volatility as markets learn more about the emerging global trade war.

Chart of the Week

[1] Bloomberg LP, 3/14/2025