OBSERVATIONS

- Markets were mixed last week with the S&P 500 losing 0.5%, while small caps (Russell 2000) gained 0.1% and the yield on the 10-year Treasury rose 7 basis-points (bps) to 4.38%.[1]

- The services sector continues to indicate economic expansion, albeit at a more tepid pace. The ISM Services PMI registered 51.6—any figure above 50 denotes expanding economic activity—marking the 56th month (out of the last 59 months) of economic growth for the services side of the economy. Not surprisingly, the Prices Paid sub-index rose to the highest level since January 2023 amidst tariff uncertainty.[1]

- Non-farm labor productivity shrank by -0.8% (annualized rate) in the first quarter, down from 2.0% growth in productivity in Q4-2024, but this statistic was directly impacted by the estimate that the US economy shrank in Q1—largely due to a surge in imports—while the number of hours worked in the quarter edged up.[1]

- Meanwhile, unit labor costs—a broad measure of the cost of labor in the US—showed an increase of 5.7% (annualized rate) in Q1, suggesting US businesses may see margin pressure from higher labor costs.[1]

- Initial unemployment claims eased last week by 13k and fell to 228k new claims; the labor market continues to exhibit resilience in the face of trade uncertainty and some signs of a slowing global economy.[1]

- A survey by the NY Federal Reserve showed little increase in 1-Yr inflation expectations registering 3.6% year-over-year (YoY) in April, which was on par with expectations last month, but higher than expectations at the start of the year, which were for a 3.0% YoY increase in prices over the course of the year.[1]

EXPECTATIONS

- The Federal Reserve left its main policy rate unchanged (4.25 – 4.50%) last week, which was widely expected and Fed Chairman Powell stressed that the Fed judged that the impact of the US’s evolving tariff policy was uncertain and that the Fed was willing to be patient to see if the tariffs would cause inflation to move higher as well as its impact on economic growth and employment.[1]

- Meanwhile the Bank of England cut its main policy rate by 25 bps to 4.25% in response to expectations of slower growth and left the door open for additional cuts if the US tariffs caused a more substantial decline in the UK economy than anticipated.[1]

- Similarly, China’s central bank announced a broad array of policy easing measures last week as it moved to buttress their economy from the global trade war, including a 10 bps cut to a key repo policy rate, a 50 bps cut to banks’ reserve requirements, and the introduction of a new $70 billion lending facility to support services consumption and elderly care.[1]

ONE MORE THOUGHT: US-UK Trade Deal Provides Glimmers of Hope[2]

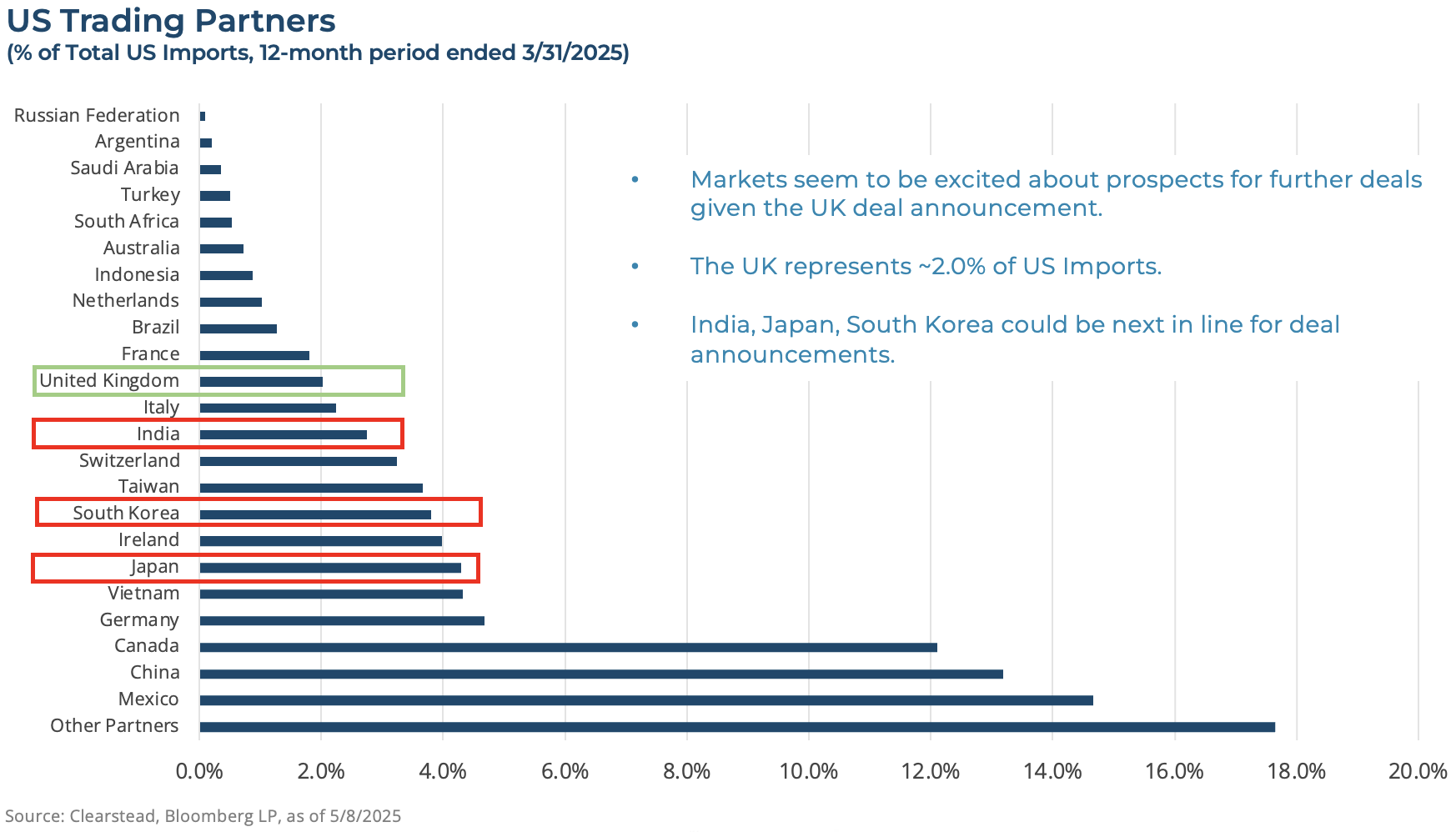

The Trump administration announced its first bilateral trade deal negotiated during the 90-day reciprocal tariff pause (announced on 9-Apr) with the United Kingdom. The administration is touting this deal as a framework for other bilateral talks which are ongoing with several larger trading partners including Japan, India, and South Korea. A trade deal with the UK was viewed by many trade analysts as an easier discussion, in part, because the US has had a small trade surplus—exporting more goods and services than it imported—with the UK in recent years. The UK deal leaves in place a 10% baseline tariff but reduces the tariff on UK autos—subject to a 100k quota—to 10% from 25%, removes any tariffs on the small amounts of specialty steel and aluminum imports from the UK, and exempts most UK exports of aerospace components to the US. In return, the US secured zero tariffs for US beef and ethanol exports, a commitment to boost Boeing plane purchases as well as remove some non-tariff barriers for other US agricultural products. The UK deal may provide some guidance for other bilateral trade deals with smaller countries, but it is unlikely to inform talks with the European Union and China, which are likely to prove much more complex and contentious. Secretary Bessent met with Chinese officials over the weekend, and two parties agreed to substantially reduce tariffs—30% for Chinese imports to the US and 10% of US imports to China—for 90-days to all for more detailed trade talks. The UK deal is a positive sign that the US may be able to bypass a worst-case scenario regarding a global trade war, but much work remains and markets will be on pins-and-needles as trade talks with China, Canada, Mexico, and Europe evolve.

[1] Bloomberg LP 5/9/2025

[2] https://www.wsj.com/economy/trade/trump-us-uk-trade-deal-de54d812?mod=hp_lead_pos3

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.