OBSERVATIONS

- Markets traded slightly lower for the week, with the S&P 500 returning -0.3% and small caps (Russell 2000) returning -0.6%, while the yield on the 10-year Treasury moved up 6 basis points to end the week at 4.41%.[1]

- Small business optimism edged down (-0.2) in June to 98.6 from May’s 98.8 reading but remains close to the survey’s 51-year average of 98. Fewer small businesses cited uncertainty as a top concern in June, but many remain concerned about the labor availability and high labor costs.[1]

- Initial unemployment claims remain low with only 227k new claims filed last week, which was 5k less claims than were filed the week prior and about 2k less claims filed than the same week last year.[1]

- Data from CoStar—a commercial real estate data provider—showed that hotel occupancy has been slightly lower for the past six weeks, but on-par with 20-year median occupancy levels for this time of year.[2]

EXPECTATIONS

- The minutes from the most recent Fed meeting indicate that they viewed the economy as stable, but that uncertainty remained over the impact of the US evolving tariff policy. Nonetheless, the minutes noted that “most participants assessed that some reduction in the target range for the federal funds rate this year would likely be appropriate,” suggesting the Fed could ease rates in H2-2025 barring a reversal of the recent trends towards lower inflation.[1]

- Q2 earnings season kicks off this week with the largest banks reporting mid-week. As the reporting season begins, analysts are expecting S&P 500 Q2 earnings growth to be about 5.0% year-over-year, which is about 4.2 percentage-points (pp) lower than analysts expected at the beginning of the quarter. While it is common for analysts to reduce their earnings growth estimates during a quarter, the negative revisions for Q2 were larger than average revisions over the past 5 years (-3.0pp) and 10-years (-3.1pp).[3]

ONE MORE THOUGHT: New Tariff Deadlines, New Tariff Letters[1]

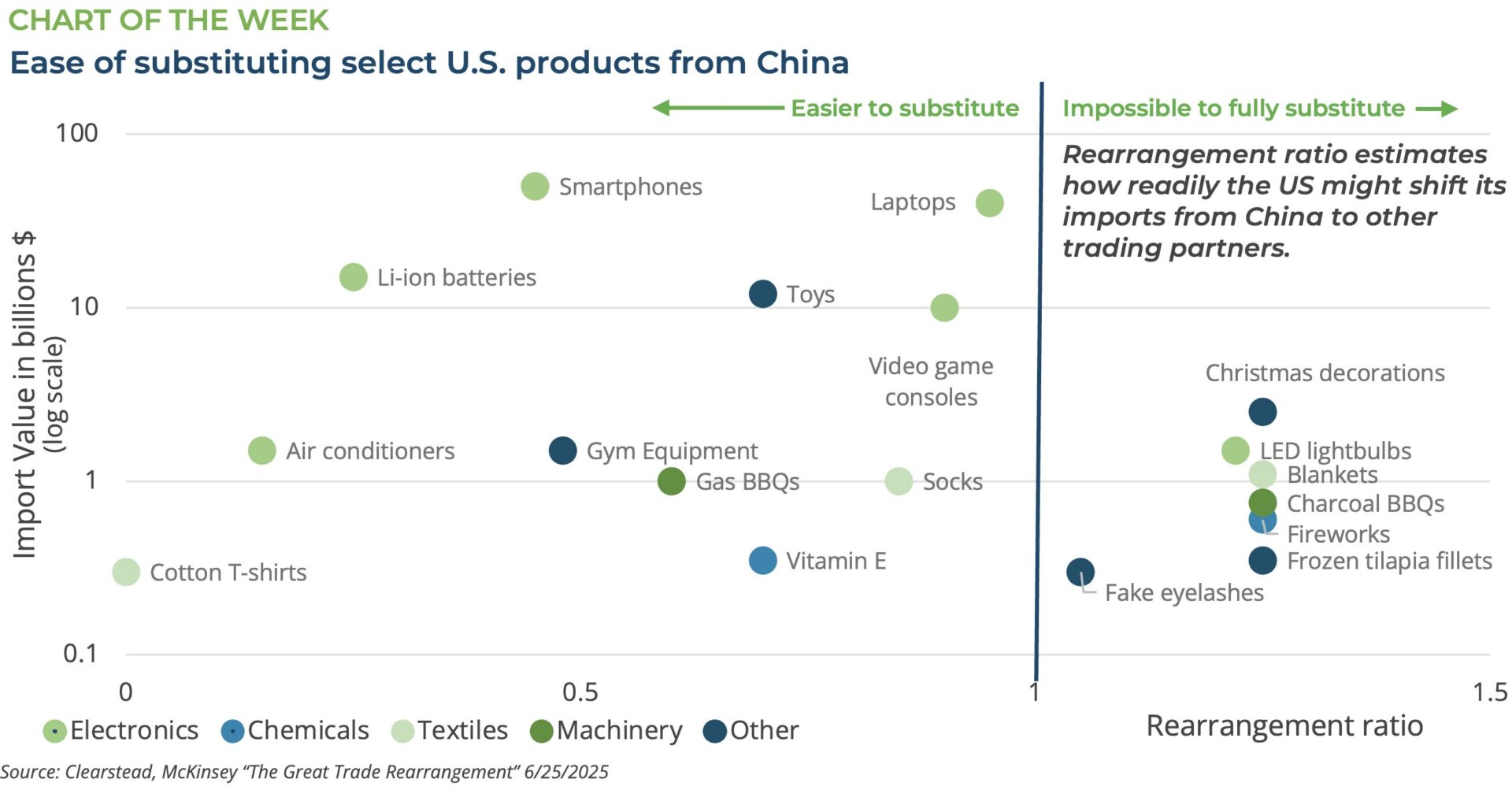

Once again tariffs are in the headlines. On April 9th, the Trump administration paused most of the reciprocal tariffs announced earlier in April for 90 days pending bilateral talks with numerous countries. Early last week as the deadline approached, he delayed implementation of these tariffs until 1-August. So far, the Trump administration has negotiated framework deals with the UK and Vietnam and has a preliminary agreement with China, but several other key trading deals have yet to come to fruition. This includes deals with Canada, Mexico, the EU, South Korea and India. Many market observers had hoped that the Trump administration would largely lock-in the status quo—a 10% blanket tariff on most imports alongside higher tariffs on select goods such as autos, steel, and aluminum—but this does not seem to be the case. Last week the administration suggested higher tariffs are likely on copper, pharmaceuticals, and semiconductors in the coming months and sent letters to more than a dozen countries informing them of their new tariff rate as of August. He also threatened to increase the tariffs on imports from Canada from 25% to 35%—excluding goods covered under the USMCA trade deal—and 50% tariffs on Brazil unless these countries negotiated bilateral trade deals before the 1-August deadline. President Trump previously threatened to raise the tariff on EU imports to 50% as well. So far, markets seem to have interpreted these tariff threats more as negotiating tactics rather than firm plans. For instance, talks with the EU seem to be progressing but are likely to leave the 10% base tariff in place, with higher tariffs for select EU goods such as autos and steel. Canada, for its part, has indicated it is working towards a trade deal with the US by the August deadline. It is worth noting that while, thus far, there has been little evidence of the tariffs—as much as they have been imposed and implemented thus far—making their way into the final price for consumer goods, it is highly likely that consumers will notice price increases by the end of the year in some fashion. Recent surveys by the New York Federal Reserve suggest that at least half of companies are prepared to pass along the preponderance of the tariff increases to their customers. Additionally, analysis by McKinsey (see Chart of the Week) suggests that for several products, there is little chance for US businesses to find suppliers outside of China that have enough scale to meaningfully shift supply. For instance, the US imports 1.25x more holiday decorations (Christmas/Halloween) from China than all other producers of these goods globally. The implication is that these goods will almost certainly cost more by the end of the year, once pre-tariff inventories are exhausted. In other categories, such as air conditioners, US importers may be able to re-orient supply chains to find a lower-tariffed country alternate supplier. It will take time for supply chains to re-orient and this process cannot truly begin until the US finalizes our global tariff policy.

[1] Bloomberg LP, 7/11/2025

[2] https://str.com/press-release/us-hotel-results-week-ending-5-july

[3] FactSet Earnings Insight 7/11/2025

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.