OBSERVATIONS

- Markets traded higher last week—the S&P 500 gained 1.5% and closed at a record high and small caps (Russell 2000) gained 1.0%, while the yield on the 10-year Treasury fell 3 basis points to 4.39%.[1]

- Existing home sales fell 2.7% month-over-month (MoM) to 3.93 million (annualized rate) in June. Year-to-date (YTD) existing home sales are 1.5% below existing home sales from the first six-months of last year.[1]

- New home sales increased 0.6% MoM in June to 627k (annualized rate), but this rate is 6.6% below the new homes sales in June-2024.[1]

- Initial unemployment claims remain very low with only 217k new claims filed last week, which was down 4k from the week prior.[1]

- Durable goods orders declined in June 9.3% MoM which was less of a decline than anticipated, and excluding transportation—primarily autos and planes—durable goods orders increased 0.2% MoM.[1]

EXPECTATIONS

- The European Central Bank (ECB) held interest rates steady at 2.0% last week and stressed patience as trade talks between the European Union (EU) and the US approach the 1-August deadline. The ECB indicated that the risks to growth are “tilted to the downside” but the outlook could improve if there is a quick resolution to the US-EU trade tensions.[1]

- About 34% of the S&P 500 have reported and, thus far, 80% of firms have reported a positive earnings surprise, which is above the 5-year average (77%) and 10-year average (75%). The blended earnings growth for Q2 is currently 6.4% YoY.[2]

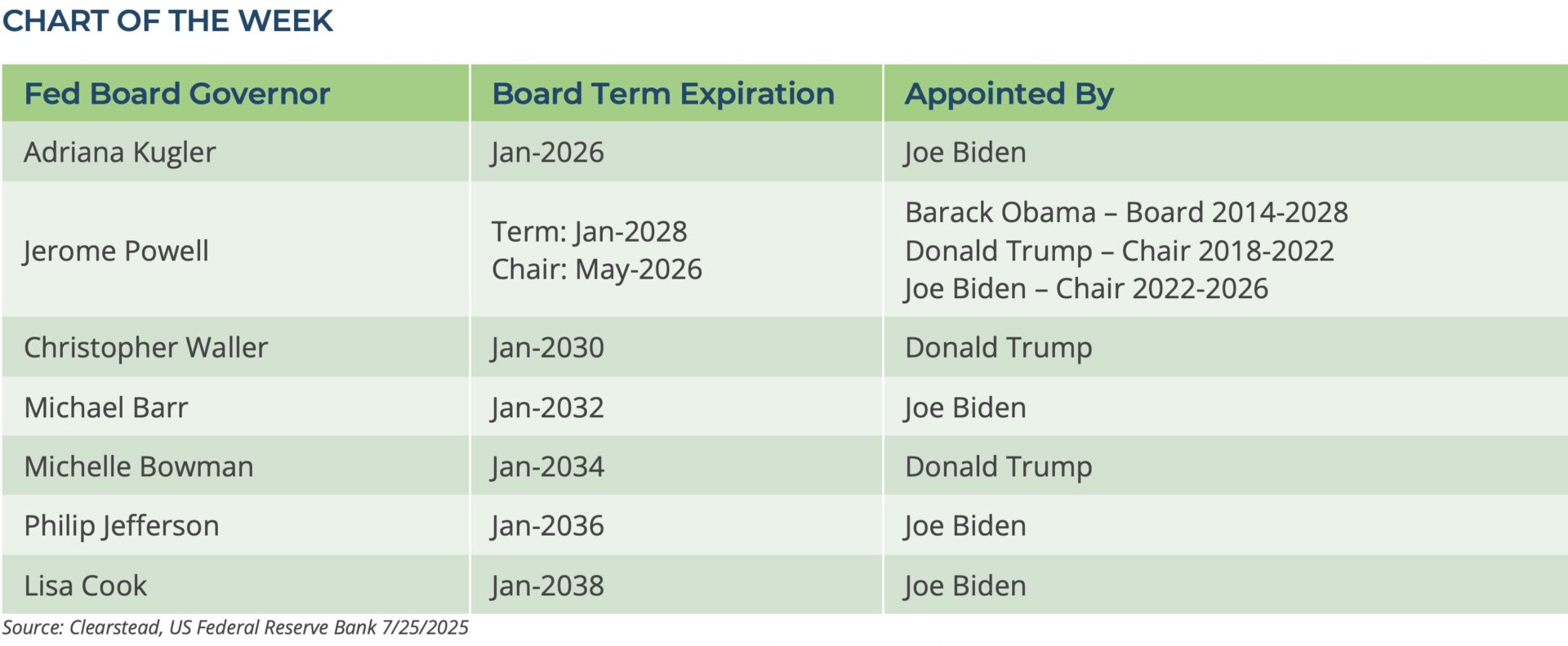

ONE MORE THOUGHT: Fed Governors and FOMC Voting[3]

The Trump administration has recently floated the proposition of firing Jerome Powell, the current Chairman of the Federal Reserve Board of Governors, as well as laying out a vision to restructure the organization. The current administration has made it clear that it believes the Federal Reserve should be cutting rates and has urged Chairman Powell to cut rates and/or resign from the Fed. However, the Federal Reserve Act of 1913 (as amended by the Banking Act of 1935) restricts the ability of the US President to fire a Federal Reserve Governor unless the firing is “for cause”. This is generally interpreted to mean that the President can only remove a Fed Governor or Chairman for reasons related to malfeasance or neglect of duty, but not for policy disagreements. However, even if the Trump administration is successful in removing Powell—either through a firing or his voluntary resignation—it is not clear that the Trump administration would be successful in getting the Fed to reduce rates. That is because decisions of the Federal Open Market Committee (FOMC) need a majority vote to adjust monetary policy. The FOMC consists of the Federal Reserve Board of Governors—see Chart of the Week—plus the vote of the President of the New York Federal Reserve and four votes rotating among the remaining eleven Federal Reserve Regional Branches—Atlanta, Boston, Dallas, Cleveland, Chicago, Kansas City, Minneapolis, Philadelphia Richmond, San Francisco, and St. Louis. For 2025, Fed Presidents from Boston, Chicago, Kansas City, and St. Louis are voting members. It takes seven votes to pass a policy change, and all the Fed FOMC members are likely to want to protect the image that the Fed is an independent body. Currently, the only Fed Governors appointed by the current President are Michelle Bowman and Christopher Waller and even if the Trump administration is able to replace Biden-appointee Adriana Kugler in early 2026 it will only have named three Fed Board Governors. Additionally, unless the Trump administration can find a causal reason to terminate Powell—which does not seem likely at present—it may have to wait to see if he is willing to resign after his Fed Chairmanship ends in May-2026. Once he steps down as Chairman, the Trump administration can select a new Fed Chairman from the existing set of Fed Governors, but, in theory, Powell could remain a Fed Governor until his Board term ends in early 2028. In short, given the voting structure of the FOMC, we judge the pressure being put on the Fed to cut rates is unlikely to have a material impact on US monetary policy. Where the Trump administration may be more successful is in its re-imagining of the functioning of the Fed. In a recent Policy Brief by former Fed Governor Andrew Levin, it noted that the staffing levels at the Federal Reserve have surged by over 20% over the past decade while similar large government agencies have seen headcount decline by nearly 10%. Payroll costs at the Fed increased by over 80% (even after adjusting for inflation) since 2007, well ahead of the 3% inflation adjusted wage gains for the US government as a whole. The policy brief also notes that increasingly the Fed staff and even the selection of the Presidents of the regional Fed branches are controlled by a centralized Fed bureaucracy. Recently, Treasury Secretary Bessent echoed many of these points and noted publicly, he is not sure what all the PhDs at the Fed are doing all day. It is highly likely that the next Fed Chairman will champion many of this policy brief’s findings and seek to reduce the Fed staff headcount and push more autonomy back out to the regional Fed branches.

[1] Bloomberg LP 7/25/2025

[2] FactSet Earnings Insight, 7/25/2025

[3] US Federal Reserve Act of 1913 (https://www.federalreserve.gov/aboutthefed/fract.htm) Banking Act of 1933; Federal Reserve Act of 1977

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.