OBSERVATIONS

- Markets traded higher last week with the S&P 500 gaining 1.8% and small caps (Russell 2000) gaining 3.4%, while the yield on the 10-year Treasury increased 7 basis-points to end the week at 4.35%.[1]

- The Manufacturing PMI increased to 49.0 in June—any number below 50 indicates contracting economic activity—an improvement from May’s 48.5 figure. The prices paid sub-component, however, increased to 69.7 from May’s 69.4 figure, which suggests most manufacturers are seeing higher input costs for their raw materials and input components.[1]

- The Services PMI also increased, reaching 50.8 in June, up from May’s 49.9 figure. Similar to the manufacturing sector, the services prices paid component remains elevated at 67.5 suggesting that inflationary pressures are present throughout the services sector as well.[1]

- Construction spending fell in May to an estimated $2.138 billion (annualized rate) which was 3.5% YoY lower than construction in May last year. Both private residential (-6.7% YoY) and non-residential construction (-3.9% YoY) are lower than last year, with only public construction (+3.3% YoY) showing any gains from 2024.[1]

- The Jobs and Labor Turnover Survey (JOLTS) report showed that job openings in May (latest available) increased to 7.759 million up from April’s 7.395 million job openings. Additionally, there were 3.295 million quits in May—quits can be seen as a proxy for how confident workers feel in finding a new job—which increased the quit rate to 2.1% and matching the highest quit rate for the year thus far.[1]

- Initial unemployment claims remain low, registering only 233k new claims last week which were below expectations (241k) and about 7,800 fewer claims than the same week last year.[1]

- Another sign that the US labor market is healthy was the June jobs report which showed that the economy created 147k new jobs last month. The unemployment rate fell to 4.1%, down from May’s 4.2% rate, while average hourly earnings eased to 3.7% year-over-year (YoY).[1]

EXPECTATIONS

- The US negotiated the framework for a trade deal with Vietnam last week, which ensured zero-tariffs for US exports to Vietnam, while tariffing most Vietnamese imports at 20%, but items that are transshipped through Vietnam—goods primarily produced in China and subsequently packaged and/or assembled in Vietnam—will be tariffed at a 40% rate.[1]

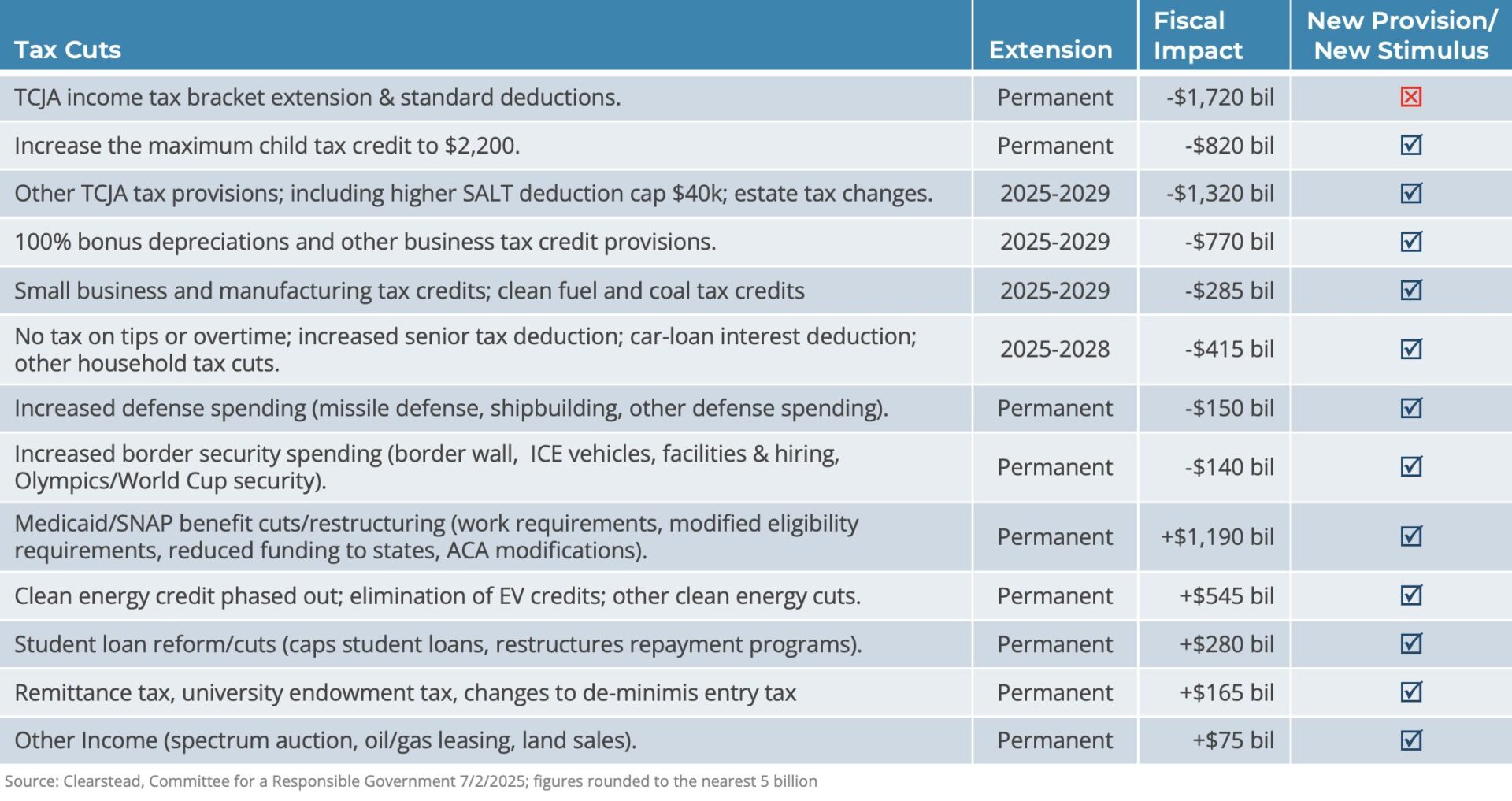

ONE MORE THOUGHT: The One, Big, Beautiful, Bill is Signed into Law[1]

Last week, after narrow votes in both the Senate and the House, Congress passed the One, Big, Beautiful tax and spending bill before the President’s 4th of July deadline. The President subsequently signed the tax bill on the 4th of July holiday providing for sweeping changes to US tax policy—see Chart of the Week. The new tax law extends the 2017 first Trump administration tax cuts but also provides for several new tax breaks for households including no tax on tips and overtime for workers making less than $150k annually. The law increases the child-tax credit, provides an additional tax break to seniors on social security income, and allows for up to $10k in deductions for interest payments for auto loans over the next four years (only for cars or trucks assembled in the US) for most families. The tax deduction for state and local (SALT) taxes also increased to $40k from the current $10k. Most of these tax provisions will be retroactive to cover the current 2025 tax year, so many families—unless they alter their deductions this summer—are likely to receive tax refunds next April which could meaningfully boost consumer spending next Spring. The law also increases defense spending by $150 billion as well as $170 billion for additional border security. In terms of stimulus to businesses, the law allows for accelerated depreciations for investments in new plants or production equipment. The law also makes significant cuts to the Medicaid and food-assistance (SNAP) programs, as well as adding a 1% tax on remittances (wiring money) sent to foreign countries and increases the tax on the largest university endowments to 8%. The law also phases out most of the clean energy tax credits that were passed during the previous Biden administration. While passage of the tax law was contentious and it will unambiguously add to the overall national debt over the next decade, the new law also front-loads several provisions that should be supportive of economic growth and household spending. The Congressional Budget Office—a nonpartisan body charged with scoring tax bills—has yet to provide an analysis of the bill, but because of arcane Congressional rules their analysis will not include any tariff-based revenues from the US’s new (and still evolving) tariff policy. New tariff income may exceed over $2 trillion over the next decade and provide a meaningful offset for the revenue shortfall caused by the new tax bill.

[1] Bloomberg LP, 7/3/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.