OBSERVATIONS

- While markets were close to flat last week with the S&P 500 losing 0.1% and small caps (Russell 2000) gaining 0.2%, the S&P 500 hit a new record high and closed over 6,500 for the first time last Thursday. The yield on the 10-year Treasury fell 3 basis points to end the week at 4.23%.[1]

- Durable goods orders came in better than expected but still registered a 2.8% month-over-month (MoM) decline in July. However, removing the volatile transportation category (planes and cars) durable goods orders increased by 1.1% MoM.[1]

- Housing prices continued their months long trend of slowing, with national home prices (S&P Cotality Case-Shiller Index) showing that home prices increased by 1.9% year-over-year (YoY) in June (latest available), which was a smaller increase than May’s 2.3% YoY figure.[1]

- Initial unemployment claims remain low and decreased last week to 229k new claims, a 5k drop from the week prior and on-par with the number of new claims registered same week last year.[1]

- The second estimate of Q2 real GDP was increased to 3.3% (annualized rate) up from the initial estimate of 3.0% reflecting upward revisions to business investment and consumer spending.[1]

- The Fed’s preferred inflation measure, the PCE Price Index, showed that headline PCE inflation was unchanged in July from June at 2.6% YoY, but core-PCE—which removes the volatile food and energy categories—increased to 2.9% YoY in July, which was higher than June’s 2.8% YoY figure.[1]

EXPECTATIONS

- The Trump administration moved to fire Fed Governor Lisa Cook last week citing possible mortgage fraud as the causal reason for her dismissal. Fed Governor Cook has denied any wrongdoing, refused to resign, and has sought legal action to block her termination. The move leaves Cook’s legal status as uncertain ahead of the Fed’s next voting meeting in mid-September and has widely been interpreted as an attempt by President Trump to gain more influence regarding Fed monetary actions by naming more Fed officials more sympathetic with his policy preferences.[1]

- With almost all the S&P 500 companies having reported—including heavyweight NVIDIA—the number of companies with a positive earnings surprise in Q2 was 81%, which was above the 5-year (78%) and 10-year (75%) averages. Overall, Q2 earnings grew by 11.9% YoY, marking the third consecutive quarter of double-digit earnings growth.[2]

ONE MORE THOUGHT: July’s Feel-Good Vibes Continued in August[1]

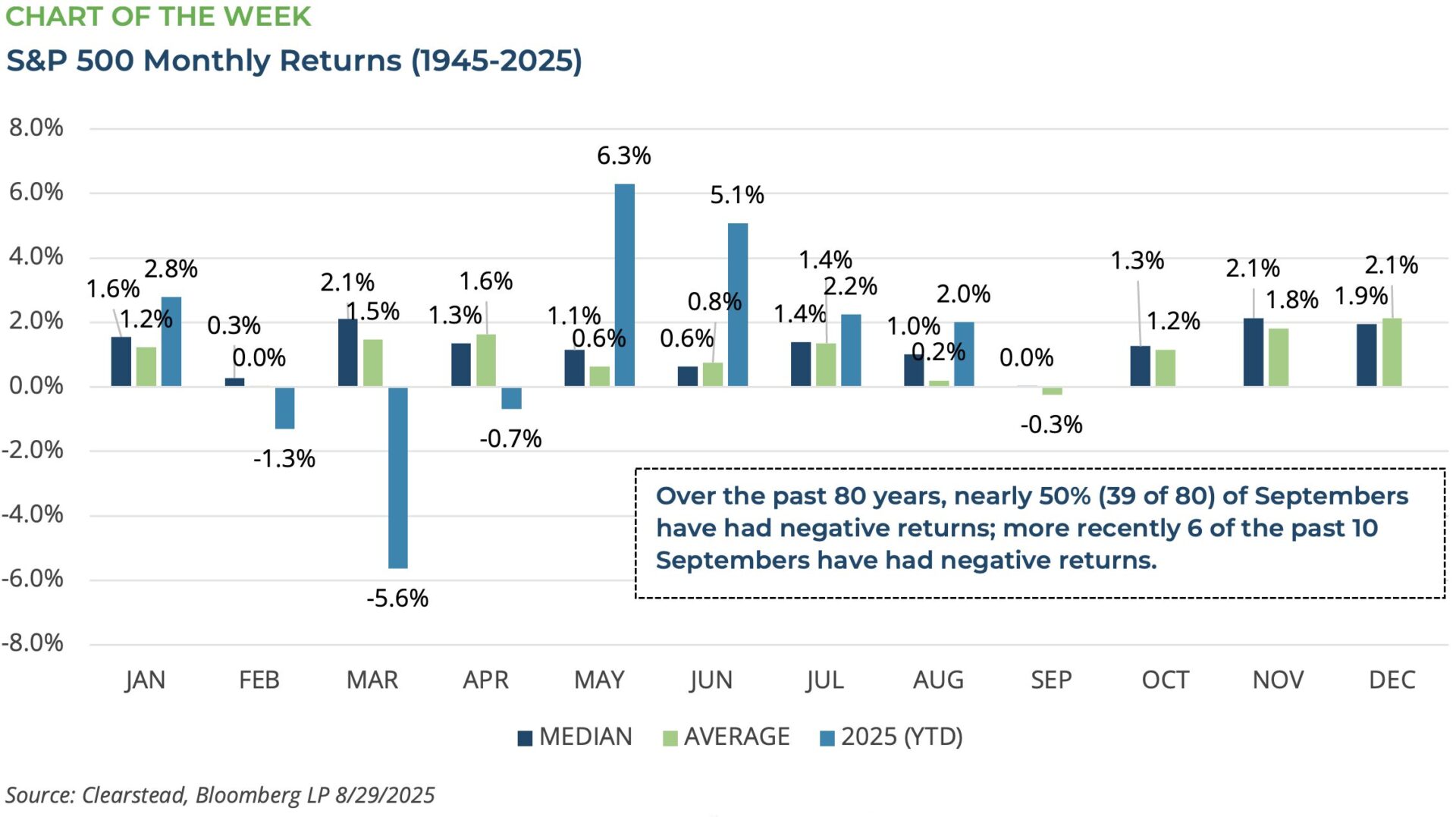

Equity markets entered August with positive momentum and optimistic investor sentiment continued throughout the entire month. August trading started with a thud. On Friday 1-August, the July jobs report showed that only 73,000 new jobs had been created in that month and what was worse, large negative revisions largely wiped out all the estimates of jobs created in May (revised down to 19k new jobs) and June (revised down to 14k new jobs). In the aftermath of this jobs report, equities sold off. But investors soon coalesced around the notion that the weaker than expected jobs report would compel the Fed to cut rates at their next meeting in September. Additionally, Q2’s strong earnings season continued (see Expectations above) to show that corporate America, thus far, had been able to weather the US’s new tariff policies and grow revenues and profits. The result of anticipated rate cuts, strong earnings, and at least decent macroeconomic data for the remainder of the month helped markets move steadily higher. The S&P 500 registered gains in each of the first three weeks in August and by month’s end there were four separate record highs along with muted volatility. Overall, while trading volumes faded with the setting summer sun, investor optimism flourished. As we have been noting in this publication, this trend may not last into the final months of the year and we expect market volatility to reassert itself. Time will tell if this viewpoint is correct or if the positive summer vibes that have been front-and-center in the past few months continue this Fall. In September alone, one is likely to see risks associated with Congress’ attempts to pass twelve appropriations bills before the 31-September deadline—the failure of this could result in a partial government shutdown—as well as fights over Fed independence. A further negative trade surprise, particularly with China, could always emerge and Q3 will be a key test to see if the current tariff policy is pressuring corporate earnings or sales. September is traditionally a tricky month for equity markets to navigate—see Chart of the Week—and our baseline assumption is that this September is likely to fit that profile.

[1] Bloomberg LP, 8/29/2025

[2] FactSet Earnings Insight 8/29/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.