OBSERVATIONS

- Markets moved higher last week with the S&P 500 gaining 1.3% and small caps (Russell 2000) gaining 2.2%—both indices set record highs last week—while the 10-year Treasury yield rose 6 basis points to 4.13%.[1]

- The risk-on sentiment is not just apparent in equity markets, but also in the bond market, as the spread on investment grade bonds (Bloomberg Investment Grade Corporate Bond Index)—the difference in the yield between a treasury and investment grade corporate bond of the same maturity—hit a 27-year low last week at 72 basis points reflecting strong investor demand for high quality corporate bonds.[1]

- Retail sales surprised to the upside in August showing US consumers spent 0.6% month-over-month (MoM) more than in July, and excluding autos and gasoline, retail spending increased 0.7% MoM in August—both headline and ex-auto and gas retail spending numbers were better than expectations.[1]

- Industrial production also came in better than expected, registering a 0.1% MoM gain—consensus was for a 0.1% MoM decline—while capacity utilization ticked down in August to 77.4% from July’s 77.5% rate.[1]

- In contrast, housing starts disappointed in August, falling 8.5% MoM to 1.307 million (annualized rate) from July’s 1.428 million. Year-to-date through August, total new home starts are 0.7% ahead of last year.[1]

- Similarly, homebuilder confidence remains depressed and was unchanged in August at 32—any number below 50 indicates that more builders view sales conditions as poor rather than good.[1]

- After a previous week that was probably skewed by unemployment insurance fraud attempts in Texas, weekly initial unemployment claims reverted back to more muted levels registering 231k new claims—a decrease of 33k from the week prior.[1]

EXPECTATIONS

- The Federal Reserve cut its main policy rates by 25 basis points last week to between 4.0% and 4.25% citing increasing risks to the labor market as the basis for their action. However, Fed Chairman Jerome Powell emphasized that the Fed was not on a predetermined aggressive easing course, and he highlighted the range of viewpoints with nine Fed officials favoring one or fewer cuts by year end whereas the other ten officials favoring two additional cuts by December.[1]

- Similarly, the Central Bank of Canada also lowered its main policy rate last week by 25 basis points to 2.5% as the Canadian consumer pulled back on spending and the Canadian labor market weakened in recent months as Canada grapples with lower trade with the US.[1]

- Congress has yet to fully pass any of the twelve necessary appropriations bills needed to avert a partial (or full) government shutdown at midnight on 30-September. The Kalshi betting market now shows an approximately 65% chance of a government shutdown nearly double the probability from mid-summer. A continuing spending resolution that moves the deadline out four to six weeks is also a possible scenario.[2]

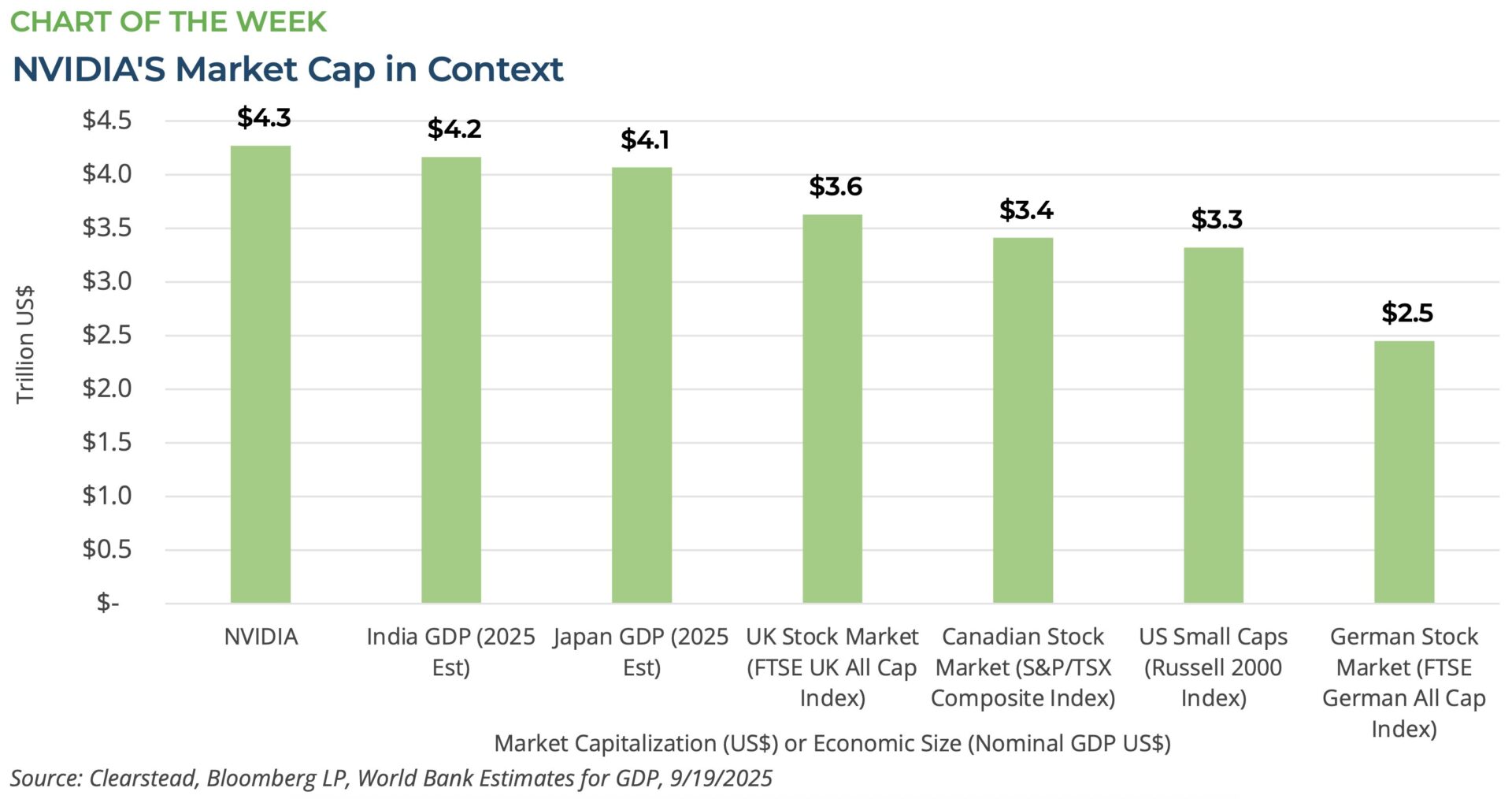

ONE MORE THOUGHT: NVIDIA’s Market Capitalization Topping $4 Trillion [1]

Just how big is NVIDIA? The short answer is really big! Since Jan-2023 to last Friday, NVIDIA has returned almost 1,110% (cumulatively), which has propelled it to the highest weight in the S&P 500—over 7% of the index—as its total market capitalization has reached nearly $4.3 trillion. This incredible growth has made NVIDIA the largest company in the world and the only company, at present, to have a market capitalization—value of all its shares combined—to breach the $4 trillion level. NVIDIA’s growth is due to its chips’ centrality in the emergence of artificial intelligence (AI) models and applications that are driving the AI economic boom. To put this in perspective, NVIDIA, which went public in 1999, now has a market capitalization that is bigger than the combined value of the entire UK stock market (FTSE UK All Cap Index)—see Chart of the Week. NVIDIA’s market capitalization is also about 30% larger than all the US small cap companies combined as well as the entire Canadian stock market (S&P/TSX Composite Index) and 75% larger than the entire German stock market (FTSE German All Cap Index). Similarly, its market capitalization is approximately equal to the entire annual economic output of either Japan or India, which are the fourth and fifth largest economies in the world. NVIDIA’s rise in value over the past three years has been nothing short of remarkable. NVIDIA overtook Microsoft earlier this year to become the most valuable company in the world and this may well prove to future historians as a key marker of a new technological era defined by artificial intelligence and the next major wave of global innovation akin to the industrial revolution of the 19th century or electrification in the 20th century.

[1] Bloomberg, LP 9/19/2025

[2] https://kalshi.com/markets/kxshutdownby/shutdown-by

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.