OBSERVATIONS

- Markets traded higher last week with the S&P 500 gaining 0.3% and small caps (Russell 2000) gaining 1.0%. Nonetheless, the S&P 500 hit a new record high last Thursday while the yield on the 10-year Treasury fell 14 basis points to end the week at 4.09%.[1]

- The manufacturing sector showed some improvement in August, with the Manufacturing PMI survey improving to 48.7 from July’s 48.0—any number below 50 denotes contracting activity.[1]

- Similarly, the service sector also improved in August, with the Services PMI survey increasing to 52.0, which was an improvement on July’s 50.1 figure. Helping investor sentiment, both surveys—manufacturing and services—saw improvement in the new orders component in August.[1]

- The Job Openings and Labor Market Turnover survey (JOLTS) indicated that there were 7.181 million job openings in July (latest available), which was lower than June’s 7.357 million openings. Quits—a proxy for workers confidence in finding a new job—were unchanged in July at 3.2 million the same as in June.[1]

- Initial unemployment claims rose modestly last week to 237k, which was an increase of 8k from the week prior. Overall, claims remain low and were about 6.5k greater last week when compared to the same week last year.[1]

- Job creation has stalled, despite little evidence of layoffs. The August jobs report showed the economy created only 22k new jobs last month, while the unemployment rate increased marginally to 4.3% from July’s 4.2% level. Furthermore, the final revision to June’s employment numbers showed that the economy actually shed -13k jobs that month, whereas July’s employment figure was little changed at 79k new jobs.[1]

EXPECTATIONS

- Fed Beige Book—a qualitative assessment of the US economy by Fed districts—suggested greater dispersion of economic activity. A few Fed districts noted slight declines or no change in economic activity, but four districts noted modest growth. However, most districts noted that consumer spending was declining as wages failed to keep pace with rising prices.[2]

- Markets are nearly sure—Fed Fund Futures suggest a 100% probability—that the Fed will cut interest rates at its meeting next week (September 16-17), but next week’s Fed meeting will also provide new forecasts for growth, unemployment, inflation as well as the dot-plot projections for each Fed member on their expectations for the rest of the year. Markets currently think that the Fed will cut at least one more time before year’s end and have also priced in an 75% chance of a third cut before January-2026.[1]

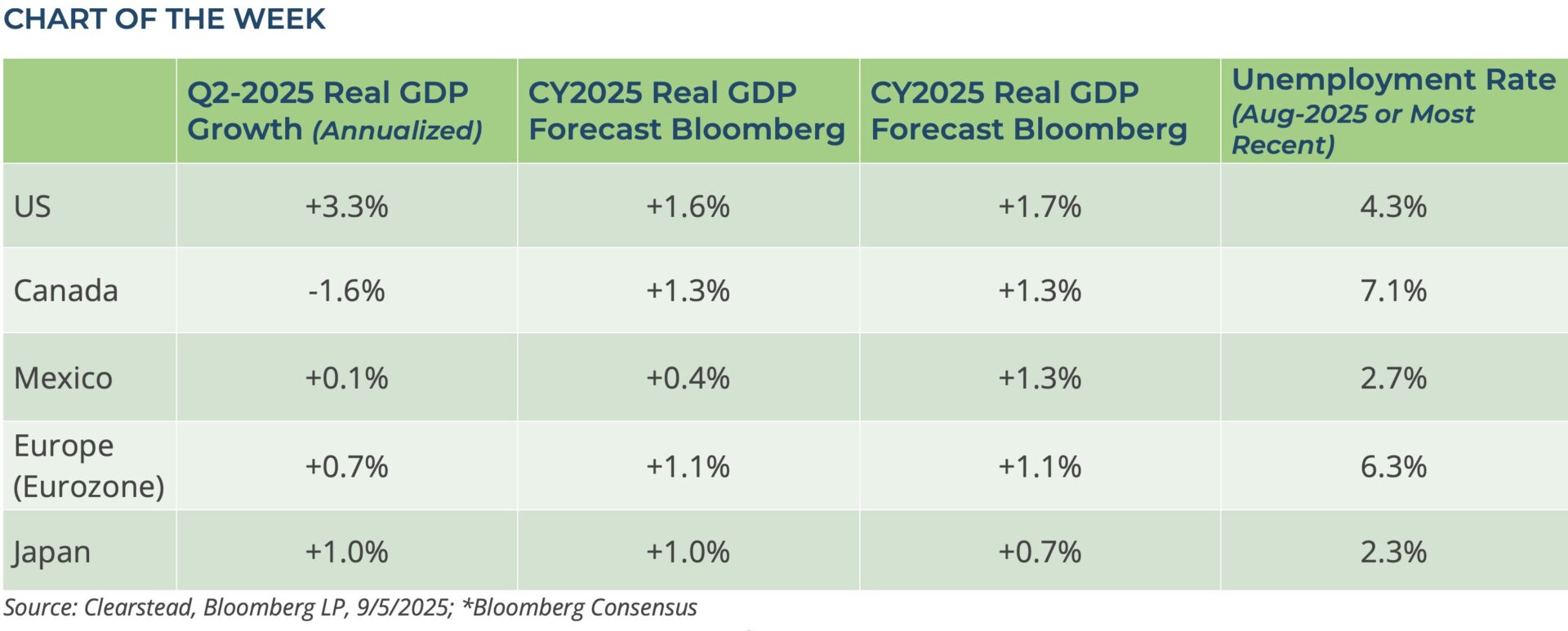

ONE MORE THOUGHT: Economic Growth Here (for now), But Weakness All Around Us[1]

If you just looked at equity markets, you would think there is little problem with the US economy. In 2025 alone, the S&P 500 has hit 21 record highs, the latest occurring just last week. However, bond markets suggest that some angst is building about the state of the US economy. Since mid-2023 to present, the yield on the 10-year Treasury has largely been between 3.75% to 4.75%. In mid-May of this year, the yield on the 10-year Treasury topped 4.6% and as recently as mid-July the yield was near 4.5%, but the yield has moved incrementally lower after the last two jobs reports and is now close to a year-to-date low, presumably due to the prospect of slower economic growth. In contrast, the GDPNow forecast from the Atlanta Fed suggests that Q3 economic growth is tracking to land between 2.5% and 3.0%, which does not indicate a material slowdown in the economy. However, other economic indicators are painting a less rosy picture. For instance, the share of small businesses reporting poor sales as the top problem rose to its highest level in nearly five years. Similarly, a number of prominent retailers have noted in recent earnings calls that several segments of US consumers are skewing their purchases towards discount necessities and eschewing discretionary purchases as higher prices are squeezing their budgets. So far, on balance, the weak data points notwithstanding, the US economy looks resilient, but the broader global economy looks less well positioned. Both of our neighbors to the North and South look troubled. The Canadian economy contracted by 1.6% (annualized rate) in Q2-2025, the unemployment rate moved above 7%, and the Bloomberg consensus forecasts expects only 0.2% growth in Q3. The Mexican economy grew by about 0.9% in H1-2025 compared to H1-2024, but growth for Q3 is expected to slow to 0.1% as both Mexico and Canada struggle with less trade with the US. Similarly, both Europe (H2-2025 ≈1% annualized rate) and Japan (H2-2025 <0.5% annualized rate) are expected to see slower growth in H2-2025 than in the first half of the year as global trade slows. The US economy is largely geared more towards services and the health of the US consumer rather than exports and global trade. Nonetheless, the US economy is healthier when our key trading partners are thriving. Equally, the recent weakness in the labor market historically sets up for a pullback in consumer spending and could foreshadow a weaker-than-expected holiday shopping season. Therefore, we expect coming months will likely test the resilience of the US economy and by proxy the health of the US consumer.

[1] Bloomberg LP, 9/5/2025

[2] https://www.federalreserve.gov/monetarypolicy/beigebook202508-summary.htm

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.