OVERVIEW

After a barrage of tariff news and policy uncertainty in April, headlines were less hostile for stock markets and the rally that started in mid-April continued throughout May, with the S&P 500 having its best May since 1990 and third best May since WWII.1 Sentiment was further boosted in May by the results from Q1 earnings season, which, despite uncertainty over the direction of US trade policy, were solidly ahead of expectations. Additionally in the first weeks of the month, the Trump administration announced the framework for a bilateral trade deal with the United Kingdom (UK) that gave hope to US equity markets that the worst-case scenarios associated with the reciprocal tariff policy could be avoided. Within days of the US-UK trade announcement, Trump also announced a de-escalation of the trade war with China with both countries dropping their tariff rates substantially for an interim period to give time for more bilateral trade talks to bear fruit on a permanent US-China trade deal. The last factor significantly boosting sentiment in May was the passage of a comprehensive tax bill from the House of Representatives that contained numerous measures that should provide incentives for both households and businesses to spend and invest in the coming years. The net result of this change in sentiment from February to early April’s depressed sentiment, to late April and May’s positive sentiment was strong returns among a host of risk-assets.

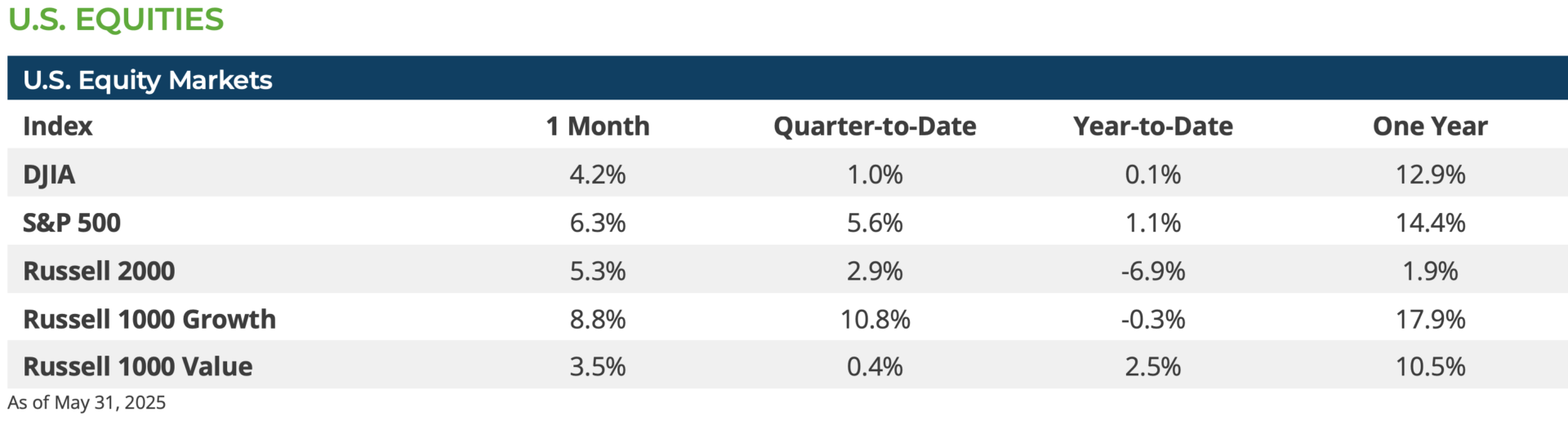

May experienced a risk-on rally across equities. For the month, the S&P 500 gained 6.3%, while mid-caps (Russell Midcap Index) gained 5.7%, and small caps (Russell 2000) gained 5.3%.1 The strong gains for the month moved the S&P 500 into positive territory for the full year-to-date—1.0% YTD.1 Growth-oriented stocks across the market cap spectrum outperformed their value-oriented peers. The growth outperformance was most pronounced in the large cap universe with the Russell 1000 Growth Index beating the Russell 1000 Value Index by 534 basis points (bps).1 There was also a broad dispersion of sector returns in May. The Information Technology sector gained more than 10% in May while the Communication Services and Consumer Discretionary sectors both gained more than 9%.1 In contrast, the Healthcare sector lost nearly 6% in May as United Healthcare, the largest US healthcare company, sold off sharply during the month after its CEO resigned and the US Department of Justice announced an investigation against the firm for Medicare fraud.1

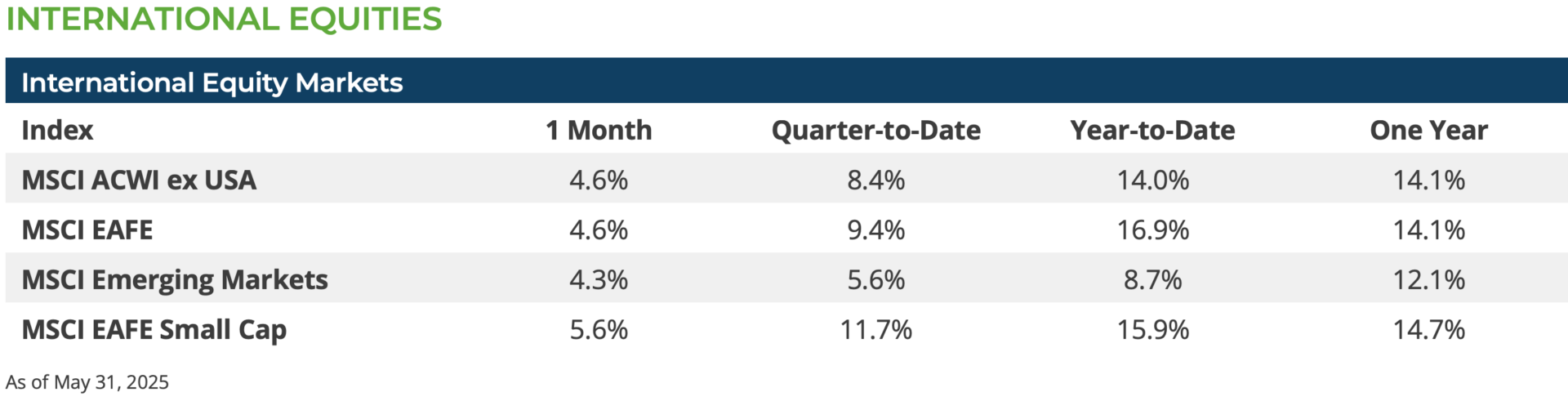

International equities also posted strong gains in May. International development market equities (MSCI EAFE Index) gained 4.6% during the month, while emerging market equities (MSCI EM Index) gained 4.3%.1 The US dollar held steady against most developed market currencies, but weakened against several emerging market currencies during the month and helped boost their returns for US investors. The de-escalation in the US-China trade war in May also helped China equites reverse some of their April losses and the MSCI China Index gained 2.7%.1 Meanwhile, strong gains in US semiconductor stocks in May helped Taiwan Semiconductor (TSMC) as well and propelled the MSCI Taiwan Index to over 12% for the Month.1 Unlike in the US, international small cap equities outperformed their large cap peers—MSCI ACWI ex US Index +4.6% vs MSCI ACWI ex US Small Cap Index +6.5%.1

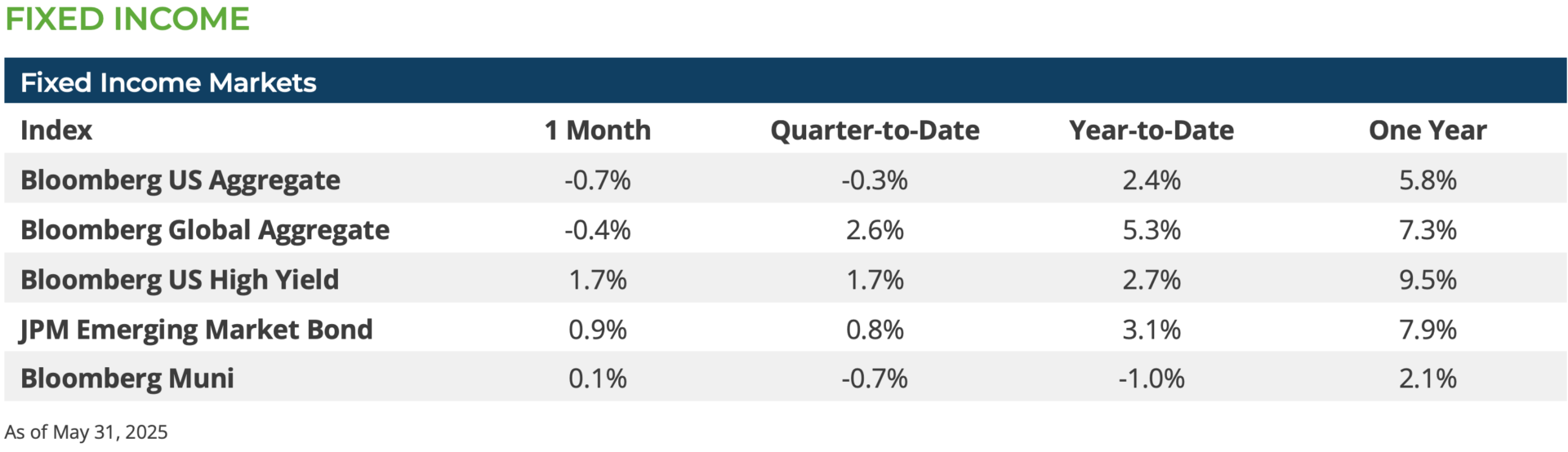

The Federal Reserve continues to appear sidelined given the overall employment and inflation backdrop. With the rally in stock markets, and a generally more sanguine investor mood, expectations for interest rate cuts by the Federal Reserve fell from four 25bps rate cuts by year end 2025 to two 25bps cuts. Overall, in fixed income markets, yields were generally higher across the curve with the 10-Year US Treasury yield rising from 4.16% to 4.40%, while the 2-Year US Treasury rose 30 bps to 3.90%. The rise in interest rates pressured returns in bond markets and the Bloomberg Aggregate Index fell 0.7% for the month.1 Meanwhile, municipal bonds fared better in May with the Bloomberg Municipal Index closing higher by 0.1%. In corporate credit markets, spreads tightened in high yield bonds as equity markets rallied, and the Bloomberg Corporate High Yield Index gained 1.7% in May.1

CONCLUSION & OUTLOOK

As we head into June, the S&P 500 looks expensive on a price-to-earnings basis, but so far earnings have remained strong, the economy is resilient, and gauges of sentiment from households to businesses as well as market indicators of risk appetite have moved in a positive direction. Despite the uncertainty and unknowns that loom this summer—Will tariffs go up or down from here? Will the tax bill pass Congress? Will the labor market remain strong? — we continue to stay the course as it relates to long-run asset allocations, and on the margin, favor things we can control. Risk assets are likely to remain volatile this summer, but as the first five months of the year have shown, investors that do not panic and are focused on their long-run goals usually come out ahead.

[1] Bloomberg LP 5/30/2025

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. The performance data shown represent past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented.