EQUITY MARKETS CONTINUE TO MAKE GAINS AS AI TRADE TAKES CENTERSTAGE

“That’s the news from Lake Wobegon, where all the women are strong, all the men are good-looking, and all the children are above average.” – Garrison Keillor

Summary

- US economy looks to have accelerated after Q1 and expanded at closer to trend growth (2.5%-3.0%) in Q2 and Q3.

- The status of most US corporates and consumers remains healthy despite the labor market looking more fragile during the quarter.

- Volatility remained muted, and positive momentum—particularly among the AI trade—drove US large cap returns.

- US equities were further buoyed by the expectation that the Fed, which cut rates in September, would lower rates further in Q4.

- Bond markets were also volatile, but the yield on the 10-Year US Treasury ended Q3 lower than it ended Q2.

- Similar to the tranquility in equity markets, corporate credit spreads declined, and credit markets generated positive returns.

Economy

US tariff policy pivot, resilient economy and market sentiment shift

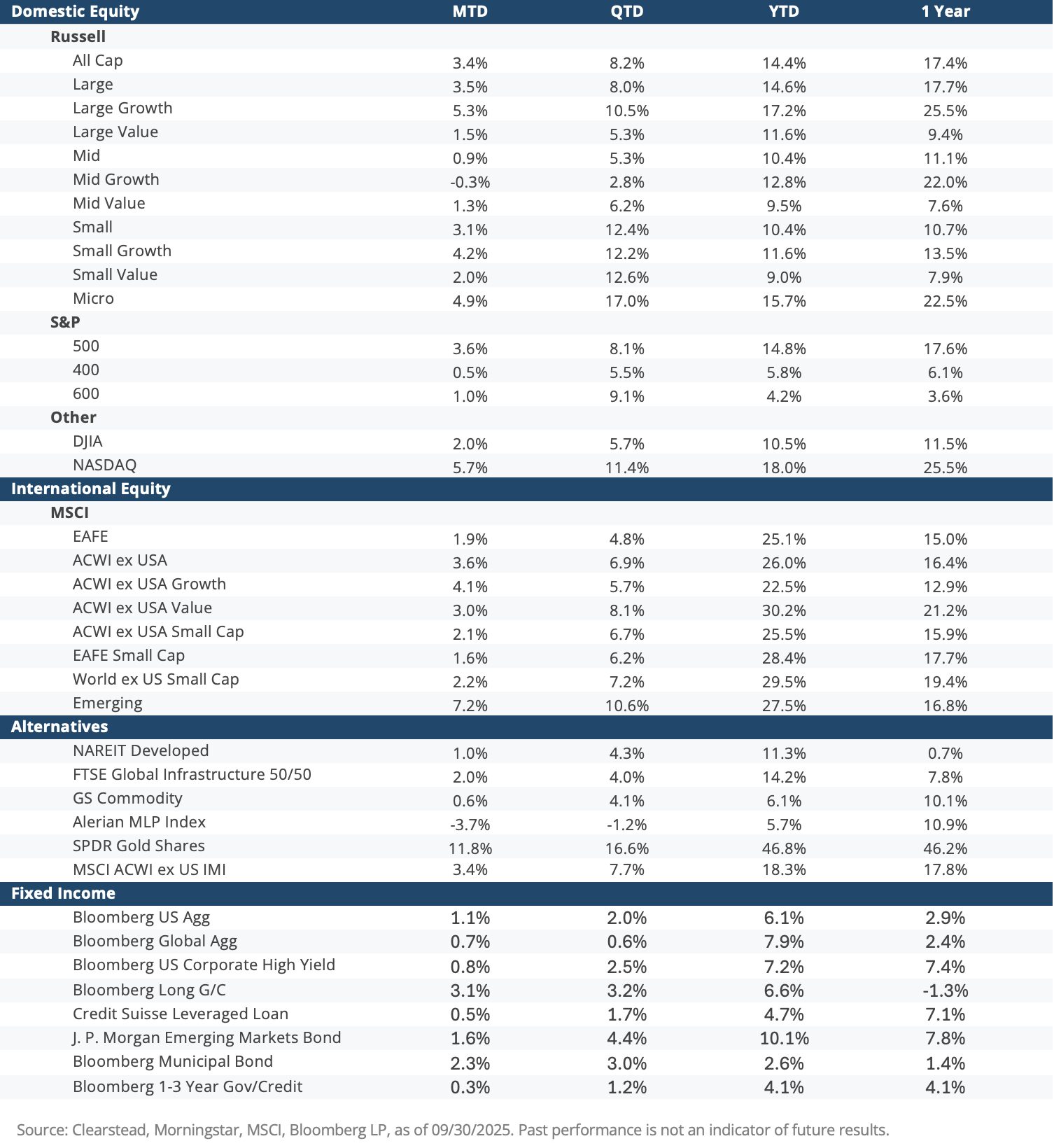

After a weak Q1—which was negatively skewed by a surge in imports—the US economy accelerated in Q2 and Q3 as the impact of the US’s new tariff policy proved to be less disruptive than initially feared. In part, the resilience of the US economy in the face of the new tariff policy seems to be fourfold. First, many firms built up inventory ahead of the announcement of the new tariff policy in early April—hence the negative trade impact on Q1 GDP (-0.6%).[1] Second, the Trump administration suspended many of the tariffs as they worked out a series of trade deals and frameworks that ultimately lowered the tariff levels. Additionally, many firms seemed to be able to source input supplies from lower-tariffed sources and thus while the headline effective tariff rate approached 20% by late summer, the actual tariff rate—the amount of tariff revenue divided by total imports—was only about 12% by the end of Q3, as seen in Chart 1 below. Lastly, while policy uncertainty may have blunted robust investment and hiring in many parts of the economy, the AI-induced buildout of datacenters and the development of AI models continued to surge. The end result was that most of corporate America was able to navigate the new tariff regime reasonably nimbly and both top-line sales as well as corporate profits beat expectations in the first half of the year.

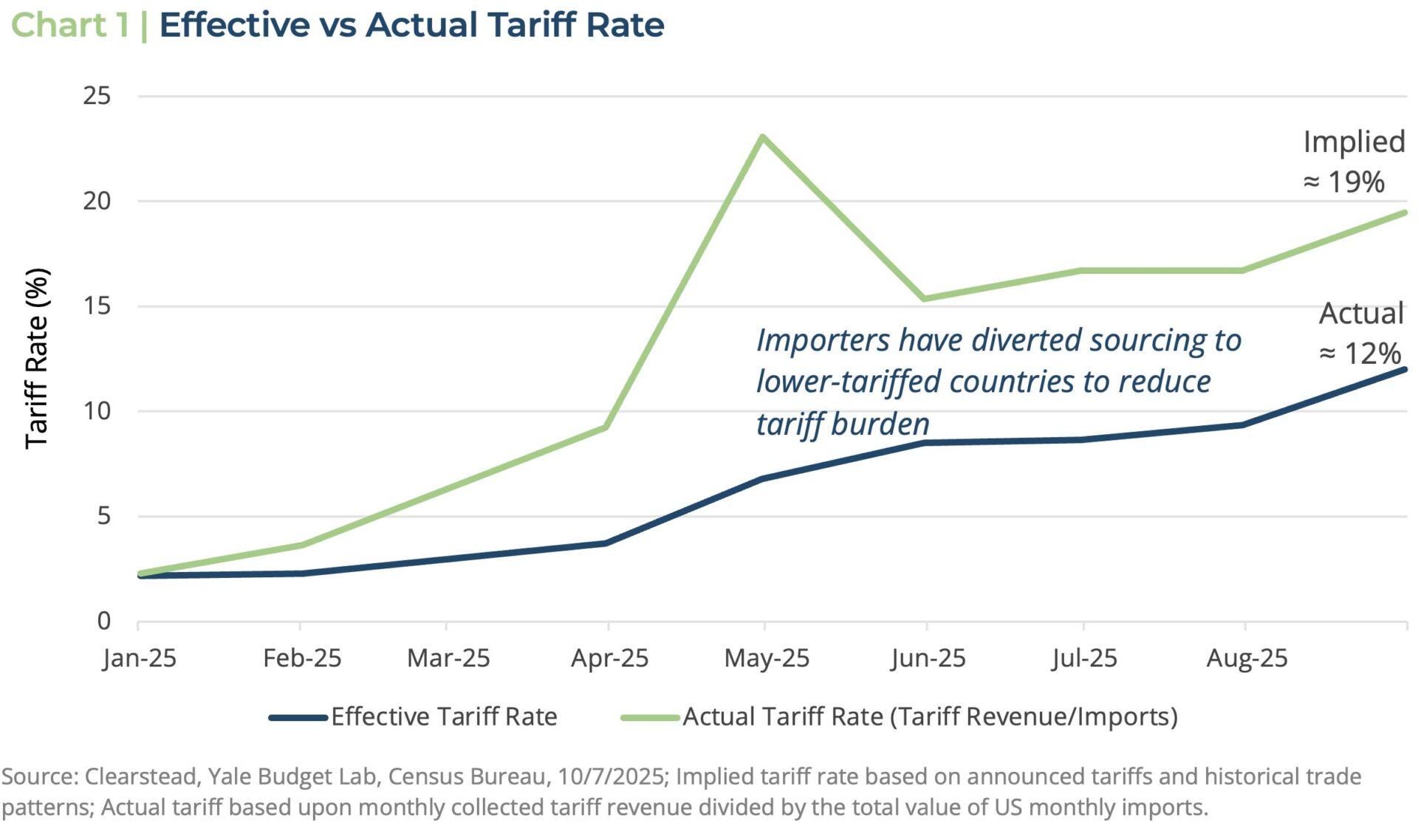

However, while the overall economy fared well in the first three months of the year, the US labor market looked increasingly fragile as summer transitioned into Fall. Job growth which had been averaging 150k during the first four months of the year, fell to less than 30k per month from May to August—the September new jobs number have not been released due to the government shutdown. Normally, such a slowdown in new job creation—recall that government data shows that economy actually lost 13k jobs in June—would be associated with the US economy in or about to enter a recession. However, this may reflect the fact that both the demand for jobs as well as the supply of new workers has been structurally lowered due to a sharp decline in net immigration. It is worth noting that despite the fall in new job creation, the unemployment rate has remained stable at 4.3% and initial unemployment claims remain historically low, as Chart 2 below indicates. Overall, while the US labor market no longer looks robust, it is also not signaling imminent weakness, and a broad variety of retail spending measures suggests that the US economy is stable overall.

Equity Markets

AI Trade Remains Front and Center; Positive Sentiment Continues to Build

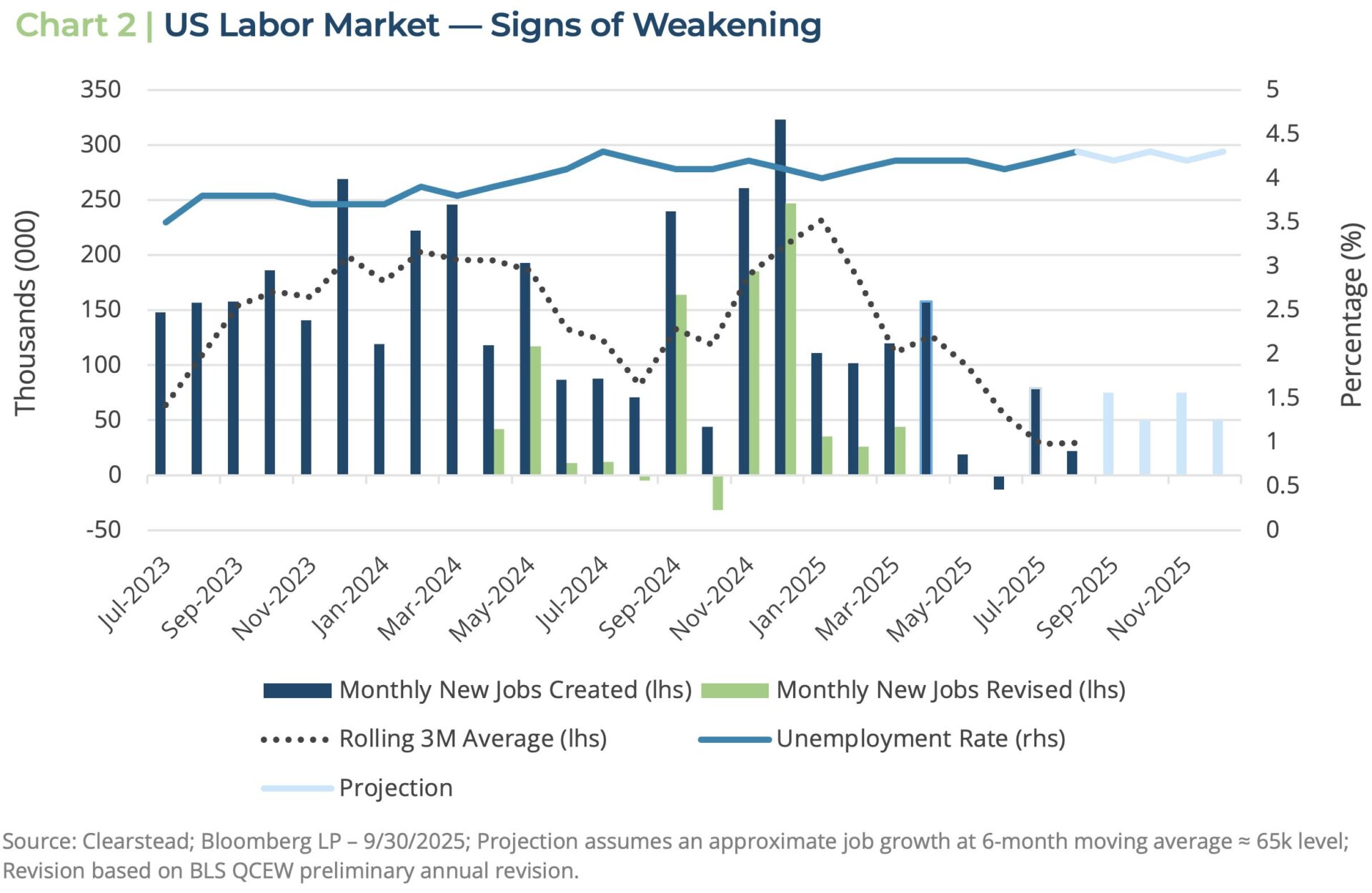

At the very beginning of Q2 investor sentiment was very negative, but by the end of the Q2 investor sentiment had pivoted—not unlike the US tariff policy—to a more positive vector. One of the big questions at the onset of Q3 was whether the positive momentum that had marked US equities in May and June would continue into Q3? The answer was an overwhelming yes. As in Chart 3 below, over the course of Q3, risk-on investor sentiment, positive momentum, and a strong earnings season powered the S&P 500 to 24 separate record highs. By the end of the quarter, the S&P 500, Dow Jones, and NASDAQ were all at record highs, while volatility was well below average and numerous measures of investor enthusiasm for risk assets abounded.

Equity market gains in Q3 were led by the Magnificent 7—Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla—as the AI investing theme dominated headlines. During the quarter the Mag 7 gained 17.6% compared to 8.1% for the S&P 500.[1] Given this, it is easy to see that US growth stocks led value stock for the quarter (Russell 1000 Growth Index +10.5% vs Russell 1000 Value Index +5.3%). Additionally, the Federal Reserve, which had been on the sidelines for most of the year, determined that the slowing jobs market over the summer warranted a rate cut in September. This helped propel the more rate sensitive small cap index to the strongest quarter since Q1-2021—Russell 2000 Index +12.4% during the quarter—as investors began to anticipate further Fed easing in Q4. Every US sector made gains in Q3 except Consumer Staples which saw many firms in this sector squeezed by rising input costs, a more cautious US consumer—especially among lower-income cohorts—and investors increasingly favoring more cyclical, growth oriented stocks.

Outside the US, equities were also quite positive for the quarter. While international developed stocks lagged US equities, emerging market equities (MSCI Emerging Markets Index) gained over 10% for the quarter. Emerging market equities were led by Chinese equities which gained over 20% in the quarter—almost half of that came in September alone.[1] Chinese equities were buoyed in part by a series of policy initiatives in China that are designed to curtail the rampant price wars that are apparent in many sectors and help many sectors improving pricing power and margins among the most competitive firms.

Fixed Income Markets

Lower Rates and Stable Spreads Deliver Solid Q3 Performance

The apparent labor market weakness, which led to a Fed easing of monetary policy, helped drive interest rates lower throughout the quarter as seen by the 10-year US Treasury yield declining 21 basis points from 4.37% on June 30th to 4.16% at quarter end.[1] Solid corporate earnings helped keep corporate spreads (a reflection of the additional risk an investor takes on by lending to a corporation instead of the government) at historically low levels. Also keeping corporate spreads low is the demand for corporate bonds whose absolute yields are at levels not seen in a decade. The end result was solid performance in the fixed income markets.

Year-to-date the fixed income markets have performed well for investors (Bloomberg Aggregate Bond Market Index +6.1%). Looking forward, sticky inflation and the rising supply of US Treasury debt to fund trillion-dollar government deficits are concerns for fixed income investors. Although short term rates have significantly declined in 2025, 30-year US Treasury bonds are lower by only 5 basis points (4.78% as of 12/31/2024 vs. 4.73% as of 9/30/2025).[1] The Federal Reserve via its monetary policy has significant influence on short rates; but stubbornly high inflation and fiscal policy run amok has longer term interest rates stuck at levels we have witnessed for the past three years. The sought after Interest rate relief for home buyers is unlikely to materialize as long as these concerns persist.

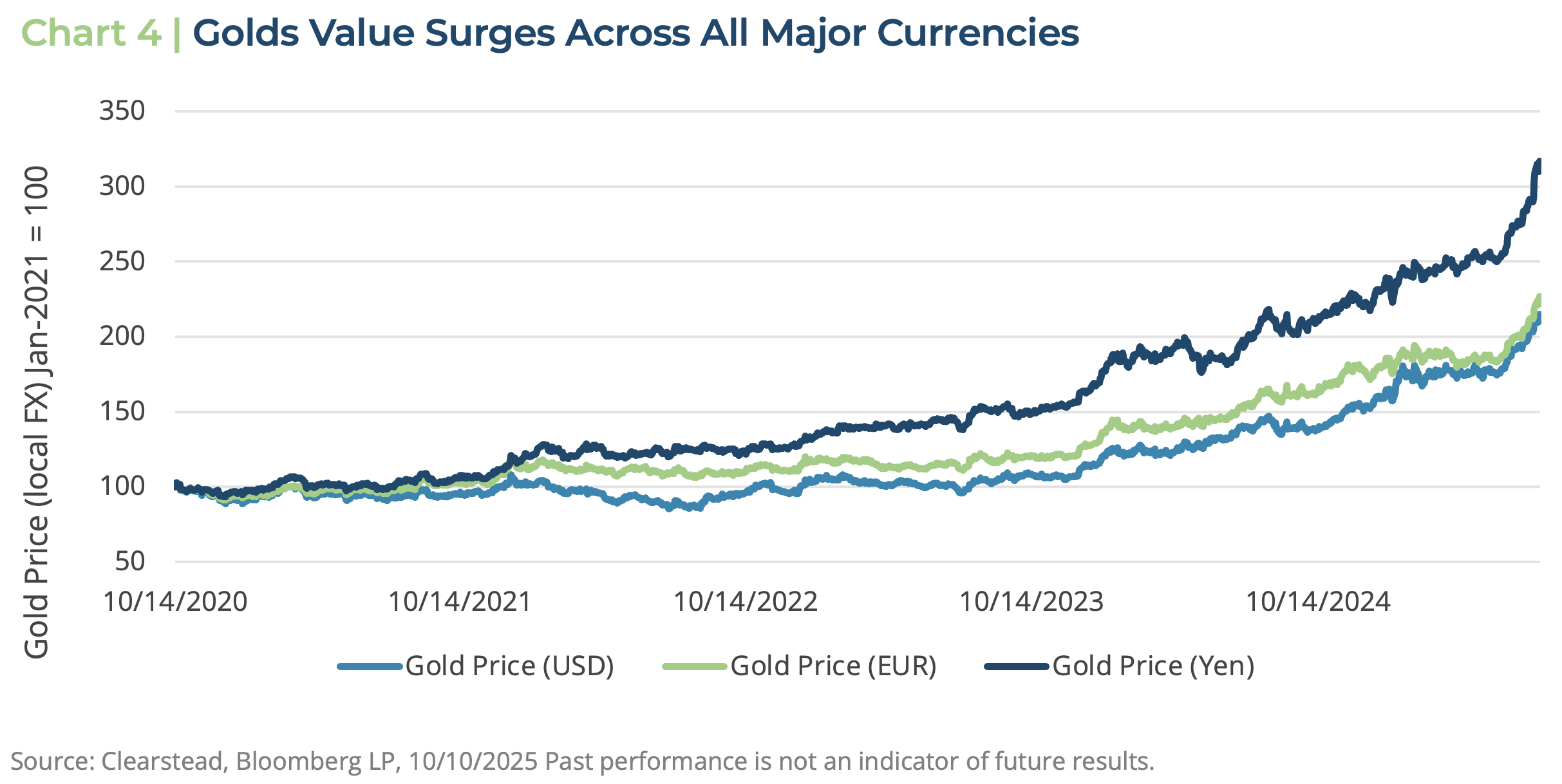

In the context of rising debt levels across most of the globe, gold has also surged in recent months, in part, as a reflection of global sovereign debt levels trending higher as the burden of their debt levels look increasingly unsustainable. In America, this note is likely to be published while the US government is shutdown, and there is little bipartisan effort to put the US budget on trajectory towards balance. In France, its multi-party ruling coalition has recently collapsed prompting early parliamentary elections due to its inability to pass a budget for next year and reduce its own run-away spending. In Japan, a newly elected leader of ruling LDP party has pledged to double-down on more fiscal spending and higher budget deficits. In short, most major economies are increasing debt levels while doing little to increase government revenues in a likewise fashion. In this context, it is easy to see why gold is having its moment.

Summary & Outlook

As we look forward to Q4 there are reasons to be cautiously optimistic. The US economy appears to be more resilient than initially anticipated when US trade policy was enacted earlier this year. Second, the One Big Beautiful Bill which passed this summer provides for a broad set of stimulative measures for both businesses and households that will help buoy growth next year. Additionally, the AI-trade, which may be over-hyped at times, is adding real investment and computing capacity to the economy that should pay dividends in the years to come.

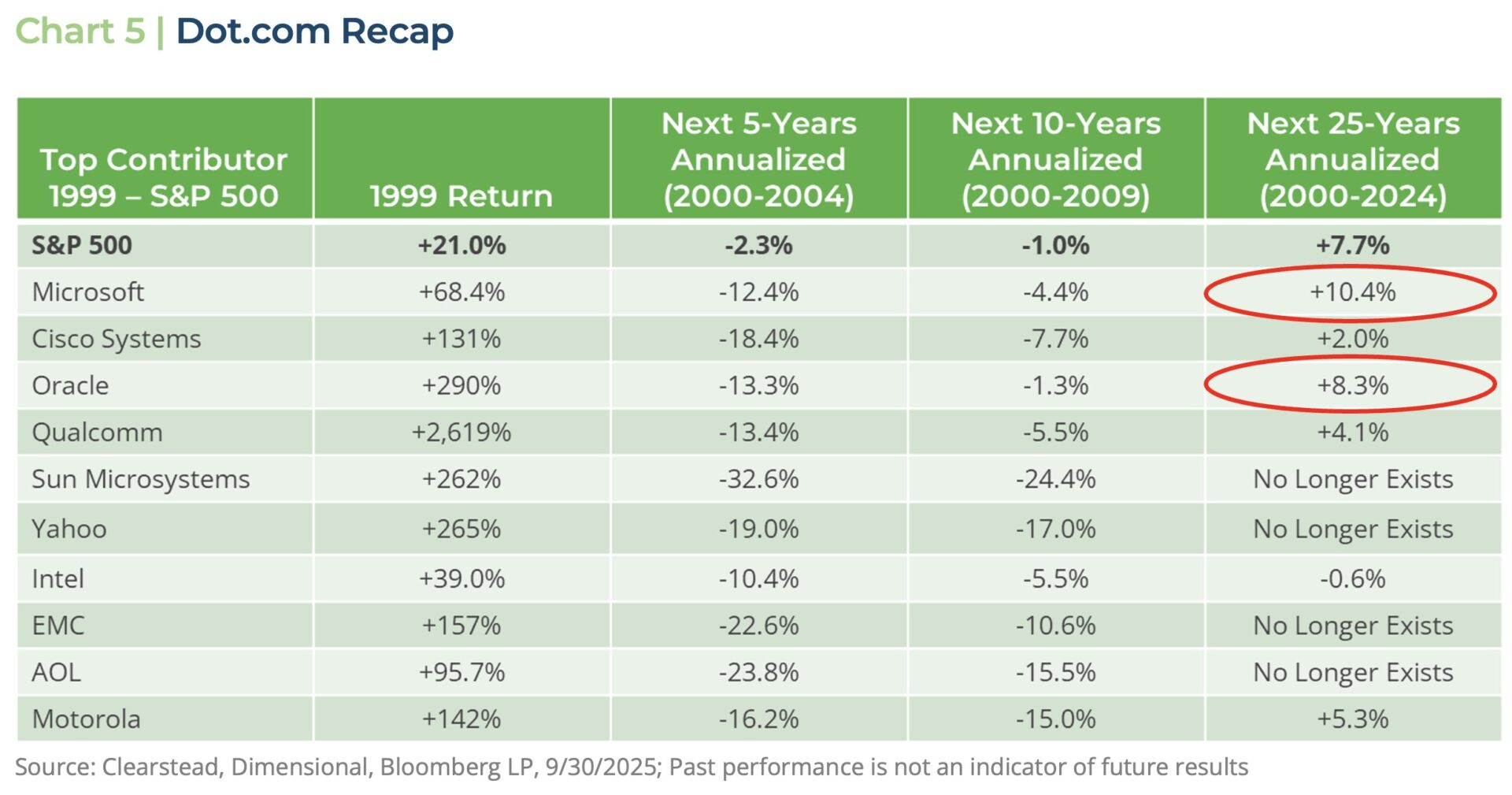

On the flip side, markets are increasingly focused on good news and seem a little indifferent to the risks that are lurking in the background. For instance, we know from the dot.com days that many of the firms that rose the most in the late 1990s were not the ultimate winners in the new internet economy. As seen in Chart 5 below, the firms that contributed the most to the stellar returns of the S&P 500 in 1999 ended up lagging the index over the next five years as the dot.com euphoria ended. Over the next 25 years only two tech companies from the late 1990s—Oracle and Microsoft—went on to return more than the index, while many prominent dot.com tech companies—such as Yahoo, EMC, AOL, and Sun Microsystems—ceased to exist in their previous corporate structure. In 1999, almost no one could have predicted that companies like Amazon—in its infancy in the late 1990s—or Alphabet (Google) and Meta (Facebook)—which did not exist during the dot.com boom—would prove to be some of internet-age’s biggest winners for shareholders. AI is likely to be a transformational technology akin to electrification but that many of the ultimate winners of this new technology are likely yet to be discovered.

This leads us back to the current market environment where volatility is low, valuations are stretched, and lots of positive scenarios with regard to the economy and corporate earnings are likely already baked into the S&P 500 current level. This leads us back to the quote by Garrison Keillor at the beginning of this note and his fictious and idyllic Minnesota town of Lake Wobegon. In effect, markets may have reached a moment where it seems like everything is above average and all the markets see is the possibility related to the emerging AI technologies. While many benefits are likely to be real, markets may be likely under appreciating the creative destruction that must go with it. There will certainly be winners and losers in the new age of AI and in the end we cannot all be above average. Given this, one should not be surprised if volatility re-emerges in the coming months despite the strong momentum currently present in the market.

[1] Bloomberg LP, 9/30/2025

DISCLOSURES

Information provided is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.