OBSERVATIONS

- Markets traded higher last week with the S&P 500 gaining 1.1% and small caps (Russell 2000) gaining 1.8%, while the yield on the 10-year Treasury fell 6 basis points to end the week at 4.12%. The S&P 500, NASDAQ, and Dow Jones each hit a record high last week—the 31st record high of the year for the S&P 500—as investor optimism continues to abound.[1]

- The Jobs Openings and Labor Turnover Survey (JOLTS) indicated that in August (latest available) there were 7.227 million job openings, which was little changed from July’s 7.208 million job openings figure. However, the number of quits—a proxy for how confident workers are in finding a new job—fell slightly to 3.091 million in August down from July’s 3.166 million quits.[1]

- The ISM manufacturing PMI increased to 49.0 in September from August’s 48.7 figure—any number below 50 suggests contracting activity in the sector—and the New Orders sub-component fell to 48.9 from August’s 51.4 reading.[1]

- In contrast, the ISM services PMI fell to 50.0 in September from the August reading of 52.0. This is the second lowest reading of 2025 for the services sector and well below the 10-year average of 55.[1]

- The official unemployment rate as well as weekly initial unemployment claims were not released last week due to the government shutdown (see One More Thought). The private ADP payroll report suggested the private sector shed about 32k jobs in September, and the Chicago Federal Reserve has an unemployment rate estimate based on a variety of “real time” indicators and its model predicted that September’s unemployment rate was unchanged from August at 4.3%.[1]

EXPECTATIONS

In the absence of reliable government data, uncertainty has increased about the state of the US economy, which has prompted the Fed Fund’s Futures market to increase its expectation of an additional 25 basis point Fed rate cut in late October (98% probability) and a second 25 basis point rate cut in December (85% probability).[1]

ONE MORE THOUGHT: Government Shutdown = No Government Data[1]

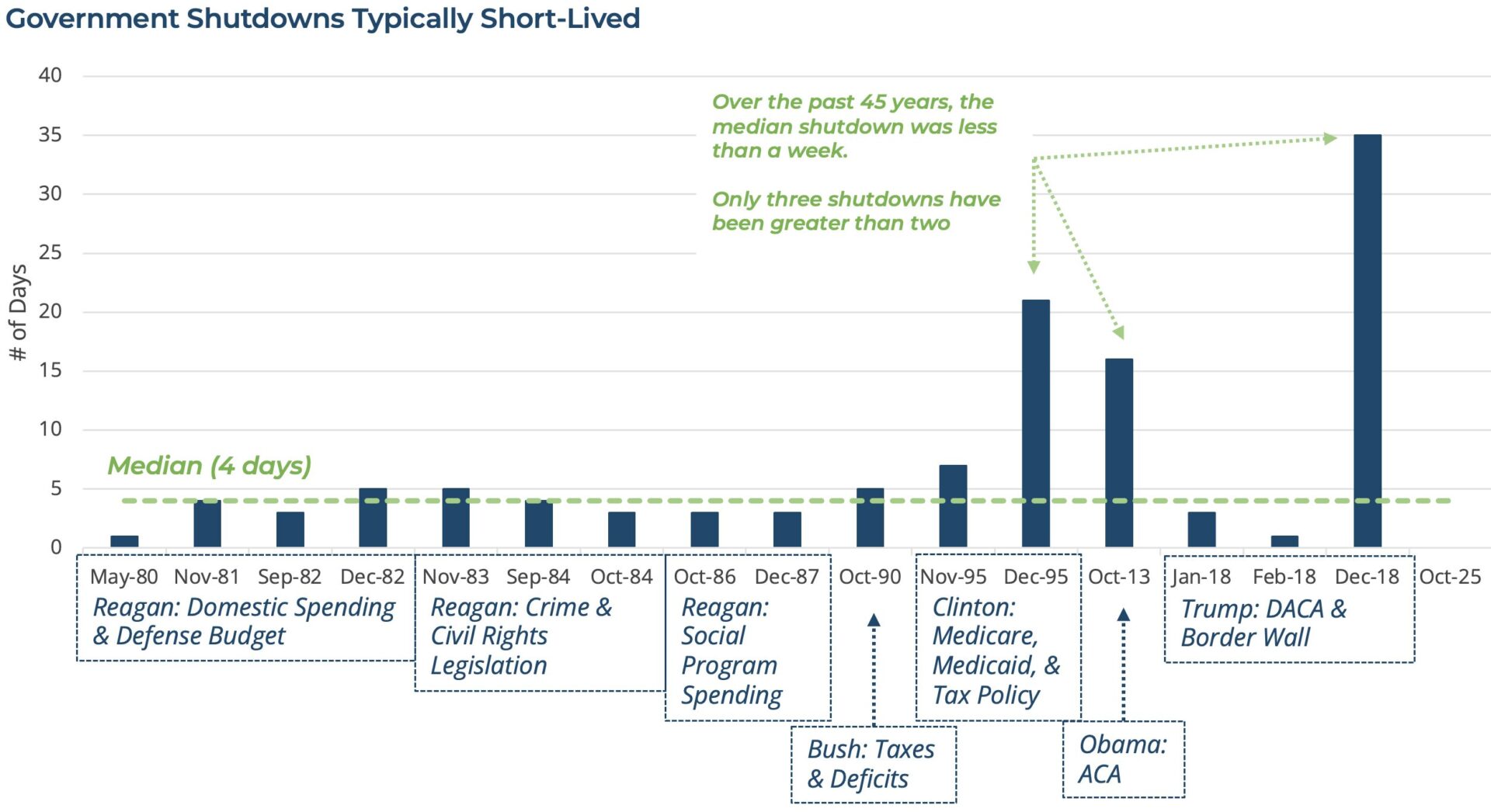

The federal government shut down at midnight on October 1st due to the fact that Congress could not pass any of the 12 appropriations bills needed to fund the government into its new 2026 fiscal year. The result is that about 750,000 to 900,000 federal government workers are now on unpaid leave—about 1/3 of the Federal civilian workforce. Active military personnel are also furloughed, but they still have to report for duty and may be paid out of other Department of War funds if the shutdown is prolonged. In the past, government shutdowns have largely been non-events—in fact markets typically trade higher during shutdowns—and they have also been short-lived events (see Chart of the Week). Asset Manager, PIMCO estimates that annualized real GDP is negatively impacted by 0.1%-0.2% per week, but this impact could increase if the shutdown drags into weeks or months. This is because in the past, government shutdowns were short, all government employees received back pay regardless if they sat at home or worked as unpaid, essential employees (e.g. TSA agents) during the shutdown. Due to government payment policies, all federal employees received their paychecks on 1-October for work performed during the period 7-20 September and they will receive 70% of their normal paycheck for the period 21-30 September in mid-October. However, this shutdown could extend longer than previous shutdowns and if it goes beyond the third week of October, nearly all of the furloughed employees will not receive a paycheck on 29-October—this will prompt a lot of belt tightening and curtailed spending. In addition to potentially missing payrolls in late October, there will be no official data on job creation (3-Oct), inventories (9-Oct), inflation (15-Oct), retail sales (16-Oct), wholesale prices (16-Oct), industrial production (17-Oct), or trade data (17-Oct). In some cases, private sector data can provide reasonable proxies for official government data, but the longer the shutdown goes on, the more uncertainty will increase for investors, as well as the Fed, as to the health of the US economy. Both Republicans and Democrats are likely to posture in the coming days and message about why either side has not yet compromised on its budgetary goals—Republicans want appropriation bills that reflect the One, Big, Beautiful Bill fiscal framework and Democrats seek additional spending to increase Medicaid funding and extend Obamacare (ACA) subsidies. However, by the end of the month if the government remains shuttered, then everyone will be increasingly flying blind. Equity markets are priced-to-perfection, implicitly reflecting that the economy and labor market are stable, the Fed will cut rates at each of its last two meetings this year, and corporate profits will increase as forecasted or better. Any subsequent data that suggests otherwise could roil markets and prompt a reassessment of risk. For the sake of all parties involved, we hope for a quick reopening of Washington.

[1] Bloomberg LP, 10/3/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.