OBSERVATIONS

- Markets traded lower last week, with the S&P 500 losing 1.6% and small caps (Russell 2000) losing 1.9%. Meanwhile the yield on the 10-year Treasury was volatile last week, but ultimately finished on Friday nearly unchanged—up only 2 basis points to 4.10%.[1]

- The ISM Manufacturing PMI declined in October to 48.7—any number below 50 denotes contracting activity—down marginally from September’s 49.1 reading. Despite the decline in October, both the hiring (46) and new orders (49.4) sub-components increased in October but remain below 50.[1]

- In contrast, the ISM Services PMI improved in October to 52.4 up from September’s 50 figure and both new orders (56.2) and hiring (48.2) sub-components increased in October.[1]

- The private-sector payroll processor ADP employment report suggests that the private sector created 42k new jobs in October an improvement from ADP’s estimate of 29k private-sector job losses in September.[1]

- The Chicago Fed Real-Time Unemployment Rate Forecast estimates that the unemployment rate in October ticked up to 4.4% up from September’s estimated unemployment rate of 4.3%.[1]

- Amid a government shutdown, consumer sentiment (Univ. of Michigan Sentiment Index) fell to 50.3—down from October’s 53.6 reading due to concerns over personal finances and expected business conditions.[1]

EXPECTATIONS

- The Bank of England kept interest rates unchanged at 4.0% last week in a five-to-four vote, while several bank officials favored a 25 basis-point rate cut. Bank Chairman Andrew Bailey voted to keep rates on hold preferring a “wait and see” approach to see if the disinflation process continues in the coming months before taking further action.[1]

- The Senate passed a procedural vote for a continuing budget resolution over the weekend to end the over 40-day US government shutdown—now the longest on record—which would fund the government until January. The Senate will have a final vote on the government reopening perhaps as early as today and the House of Representatives is expected to vote later this week, which would then re-open the government.[2]

- About 91% of the S&P 500 has reported and, thus far, 82% of companies have issued a positive earnings surprise, which is above the 5-year average (77%) and 10-year average (75%). The blended earnings growth for Q3 is currently 13.1% year-over-year.[3]

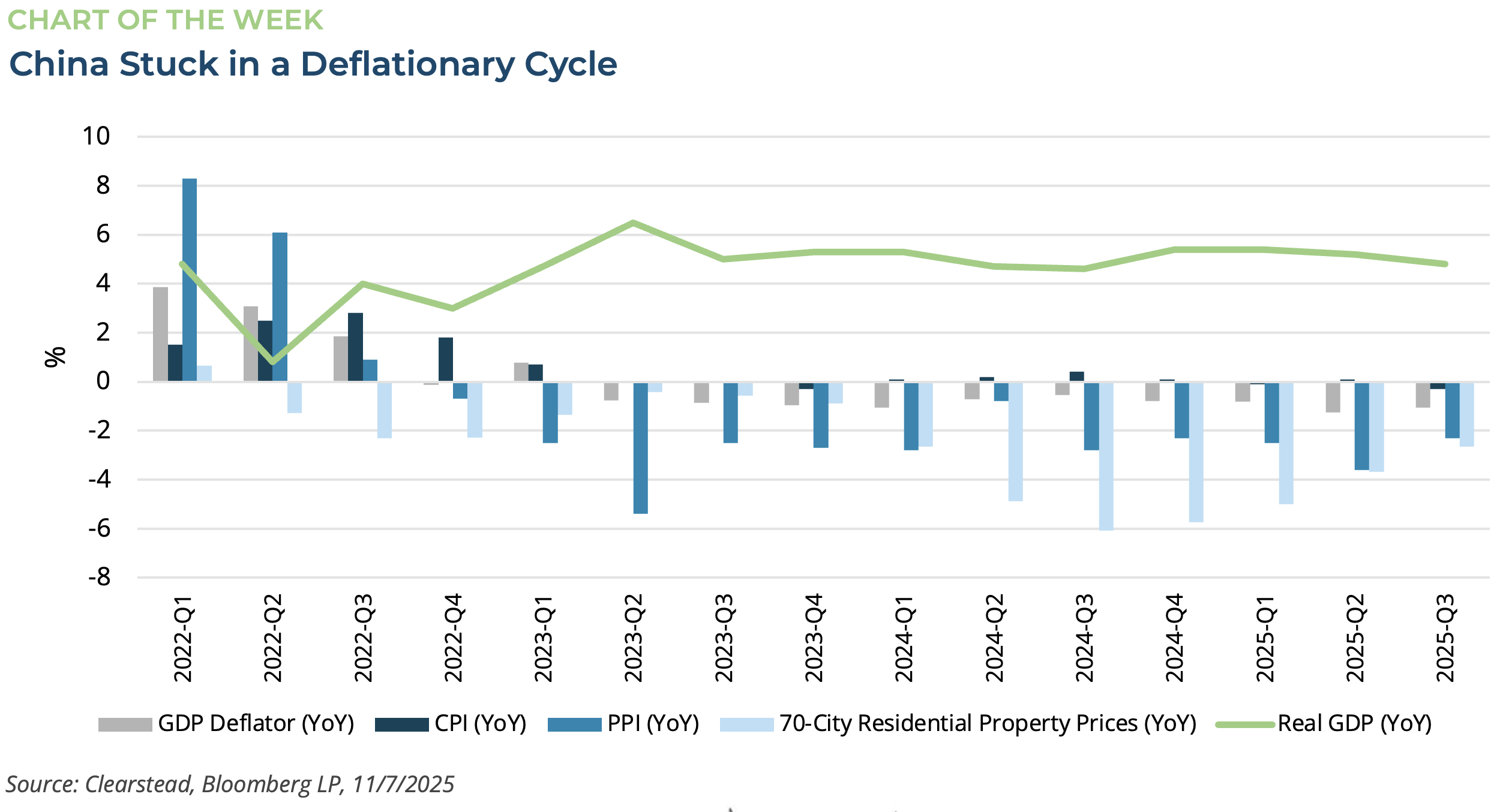

ONE MORE THOUGHT: How Is China’s Economy Doing?[1]

On paper the Chinese economy is doing fine. It has, to no one’s surprise, grown close to its 5% real GDP growth target as specified by Chinese President Xi Jinping for the past several years since the Covid pandemic subsided—see Chart of the Week. However, upon examination of China’s growth in recent years a few abnormalities present themselves. First, nominal GDP growth—which is typically greater than real GDP growth in most economies—is actually lower than real GDP growth in China. This is because since late 2022, China’s GDP deflator—the statistical factor used to adjust for changes (usually) growth in the price level—has been negative. This means that China is experiencing price deflation (falling nominal prices). Indeed, other measures of inflation such as China’s Consumer Price Index and its Producer Price Index have also shown persistent falling prices on a year-over-year basis since Q2-2023. Along with slumping consumer and wholesale prices, China’s property market is still in a multi-year decline. China embarked on a series of reforms 2022-2023 aimed at curbing speculation and over-leverage in its real estate market. However, the result has been a prolonged period of price declines in China’s property market with little evidence of a turnaround in sight. Lastly, despite an economy that is officially growing by nearly 5% year-over-year, China’s total tax receipts have decreased by -1.4% on the trailing 12-month period ending 30-June-2025. Taxes are tied to nominal growth in the economy, and while China’s total tax-base may be disproportionately tied to property taxes it’s hard to square falling tax receipts with a stable and growing economy. China is faced with a similar challenge that plagued Japan for many years in the aftermath of its housing bubble in the 1990s. Once prices start falling and large stores of saving—such as real estate—lose much of their value, households become averse to spending as they rebuild nest eggs and secondarily because why buy something today if you think it will cost less in six-months. Only time will tell if China can reset its policies to stabilize prices and re-invigorate consumption. In the meantime, China, seeing less demand for exporting items to the US, is likely to be exporting lots of cheap goods to the rest of the world for the foreseeable future.

[1] Bloomberg, LP 11/7/2025

[2] https://www.ft.com/content/66869481-4189-438b-9c16-94560861c08f

[3] FactSet Earnings Insight 11/7/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.