OBSERVATIONS

- Markets traded lower last week, with the S&P 500 losing 1.9% and small caps (Russell 2000) losing 0.8% and the yield on the 10-year Treasury falling 8 basis points to end the week at 4.07%.[1]

- August construction spending increased by 0.2% month-over-month (MoM) compared to July’s figure. However, on a year-over-year basis (YoY), total construction spending was 1.6% higher than in Aug-2024, with non-residential construction spending down 4.0% YoY and private residential construction spending also down 2.0% YoY, while public construction spending was up 2.7% YoY.[1]

- The August figures for the US trade deficit came in better than expected at -$59.6 billion, which suggests that trade will be less of a drag on the Q3 GDP when the initial estimate is released later this week. Currently, the Atlanta Fed’s GDPNow estimate is tracking at 4.2% for Q3-2025.[1]

- The Department of Labor released the past six-weeks of initial unemployment claims covering the end of September and October, which showed claims remain low and on par with claims for the same weeks in 2024. Overall, initial unemployment claims year-to-date through the first 45-weeks of 2025 are only 2.2% higher than in the same 45-weeks last year.[1]

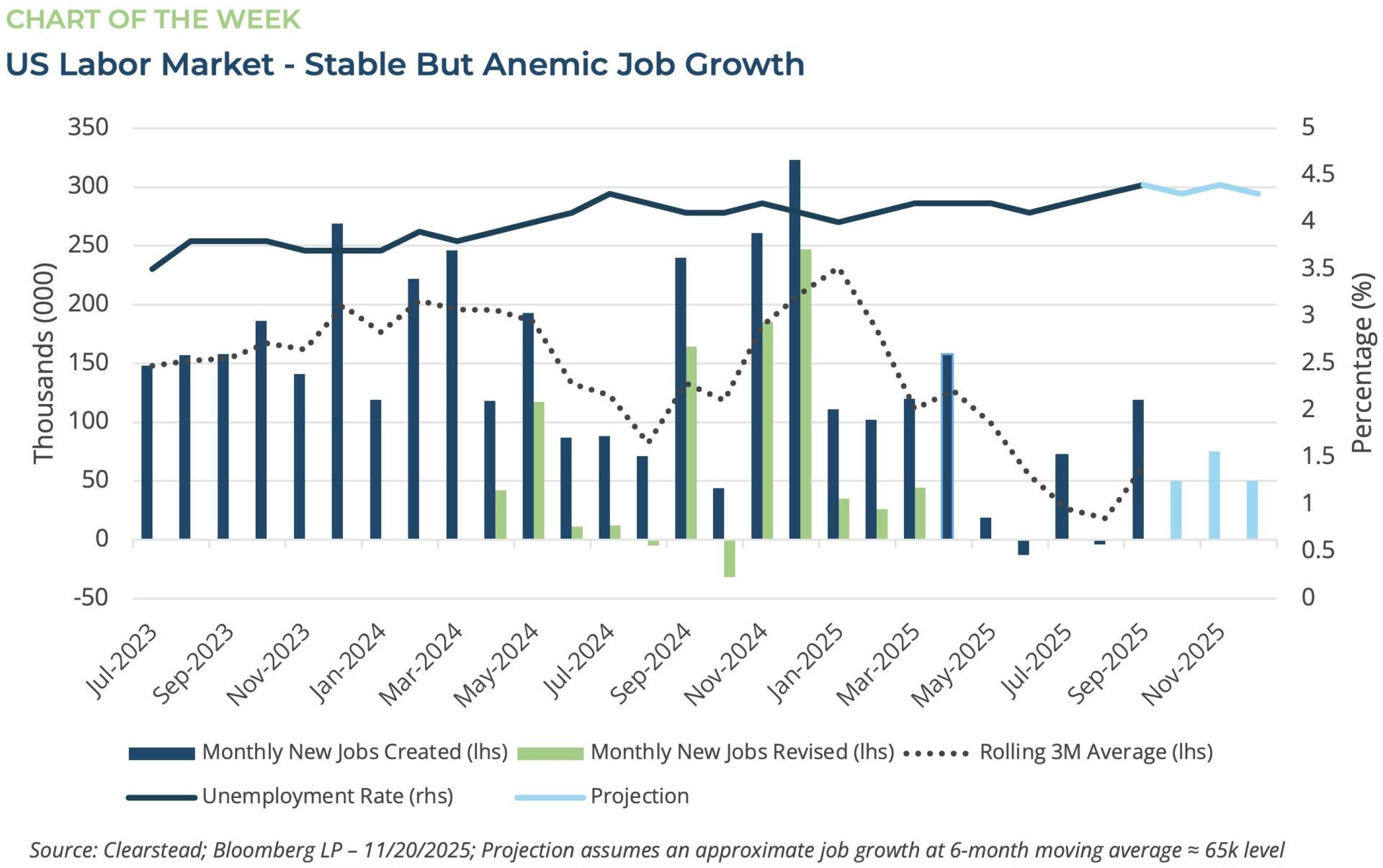

- The long-delayed September job figures were released last week, and they showed that the economy created 119k new jobs, but the estimate for job creation in July was revised down (-7k) to 72k and August’s new job figure was lowered (-26k) and now shows a -4k net job loss for the month.[1]

- Existing home sales increased in October by 1.2% MoM to 4.1 million (annualized rate) and is 2.1% higher YoY than existing home sales in Oct-2024.[1]

EXPECTATIONS

- Walmart, Target and the parent company for TJ Maxx all reported earnings last week and the results suggest generally healthy consumer spending—particularly for higher-income households—but that lower-income households are increasingly skewing purchases towards discounted products and necessities.[1]

- Last week NVIDIA reported earnings that beat expectations—up 65% YoY—and provided positive guidance for the coming quarters. Despite this, NVIDIA’s shares ended the week slightly lower, suggesting a lot of good news had already been priced into NVIDIA’s share value on the eve of its earnings release.

- At this point, 95% of the S&P 500 has reported and 83% of companies have issued a positive earnings surprise, which is above the 5-year average (78%) and 10-year average (75%), and the earnings growth for Q3 is 13.4% YoY.[2]

ONE MORE THOUGHT: Data Largely Supports a Stable Economic Picture[1]

With the government reopening a slew of official statistics from the Bureau of Labor Statistics (BLS), Department of Labor (DoL), and Census Bureau were released last week. Of particular interest was the state of the US labor market. When the government shutdown commenced on 1-October, the BLS was almost ready to release the jobs report for September, so this was one of the first reports to be released by the BLS. At question, was whether (or not) the US economy had shed more jobs in September or if hiring had picked up. The September jobs report did include small downward revisions to both the July and August job figures, but it also showed that the economy had created 119k new jobs during the month—more than double the consensus expectations for 53k new jobs. While the unemployment rate increased to 4.4.% from August’s 4.3% rate, this seemed largely due to the increase in the participation rate suggesting that more people began to look for work in September. Overall, the September jobs report signaled a stable US labor market. Additionally, the DoL released the official initial unemployment claims figures covering the entire period of the government shutdown and further reinforced the notion that layoffs were stable and not rising as some had feared. While not robust, the stability of the labor market as well as solid consumer spending may give more ammunition to those Fed officials that would prefer to hold rates steady rather than provide additional policy easing. However, the influential head of the New York Fed, John Williams, noted last Friday that further policy easing in the “near-term” may be warranted to move the Fed’s policy rate closer to the neutral range where it neither spurs nor slows economic activity. Markets took note and re-priced the probability of a Fed rate cut in December at 70%, up from 35% just the day before.

[1] Bloomberg LP 11/21/2025

[2] FactSet Earnings Insight 11/21/2025

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.