OBSERVATIONS

- Markets traded higher last week after US-China trade détente—see Expectations. The S&P 500 gained 5.3% while small caps (Russell 2000) gained 4.5% and the yield on the 10-year Treasury rose 10 basis points to end the week at 4.48%.[1]

- Small business optimism declined to 95.8 in April marking the second consecutive month it has been below its 51-year average as business uncertainty continues to be an impediment to both small business hiring plans and investment decisions. Meanwhile consumer confidence hit the second lowest level on record.[1]

- Retail sales increased by 0.1% month-over-month (MoM) in April, which was better than expected. While retail sales numbers for March—which reflected consumers’ attempts to purchase things ahead of any tariffs—was revised higher to 1.7% MoM.[1]

- Headline inflation (CPI) declined in April to 2.3% year-over-year (YoY), which was better than expected and represents a four-year low. Core-CPI—which removes volatile food and energy prices—was unchanged compared to March at 2.8% YoY.[1]

- Producer prices (PPI), meanwhile, declined sharply in April and by more than was expected to 2.4%. Core-PPI, which removes volatile food and energy prices, also declined in April to 3.1% YoY.[1]

- Initial unemployment claims were unchanged last week at 229k and remain low relative to history.[1]

- New housing starts were little changed in April, increasing 1.6% MoM to 1.361 million, while new home building permits fell -4.7% MoM in April to a similar level of 1.416 million.[1]

- Industrial production was flat in April compared to March, while capacity utilization edged down to 77.7%.[1]

EXPECTATIONS

- Just over a week ago, the US and China agreed to a 90-day trade war pause, and each reduced the tariffs on each other’s imports by 115%. This left the average tariff on Chinese goods imported into the US at 30% and the average tariff on US exports to China at 10%. The Trump administration subsequently also reduced the tariff on low-value parcels from China from 120% to 54% and launched a process to continue the dialogue with China to find a permanent bilateral trade solution between the two countries.[1]

- The result of the trade truce with China was a bounce in US equity markets and a significant shift in markets expectations for a possible recession. The Fed Fund Futures, which had in early April priced in four interest rate cuts by the Fed, is now pricing in only two cuts by year’s end.[1]

- With over 92% of the S&P 500 having reported earnings, 78% of firms reported a positive earnings surprise, which is above both the 5-year (77%) and 10-year (75%) average for positive earnings surprises. At present, Q1 earnings growth is 13.6% YoY and only NVIDIA, which reports at the end of the month, is large enough to move the Q1 earnings growth number meaningfully.[2]

ONE MORE THOUGHT: House Makes Progress on One Big Tax and Spending Bill[3]

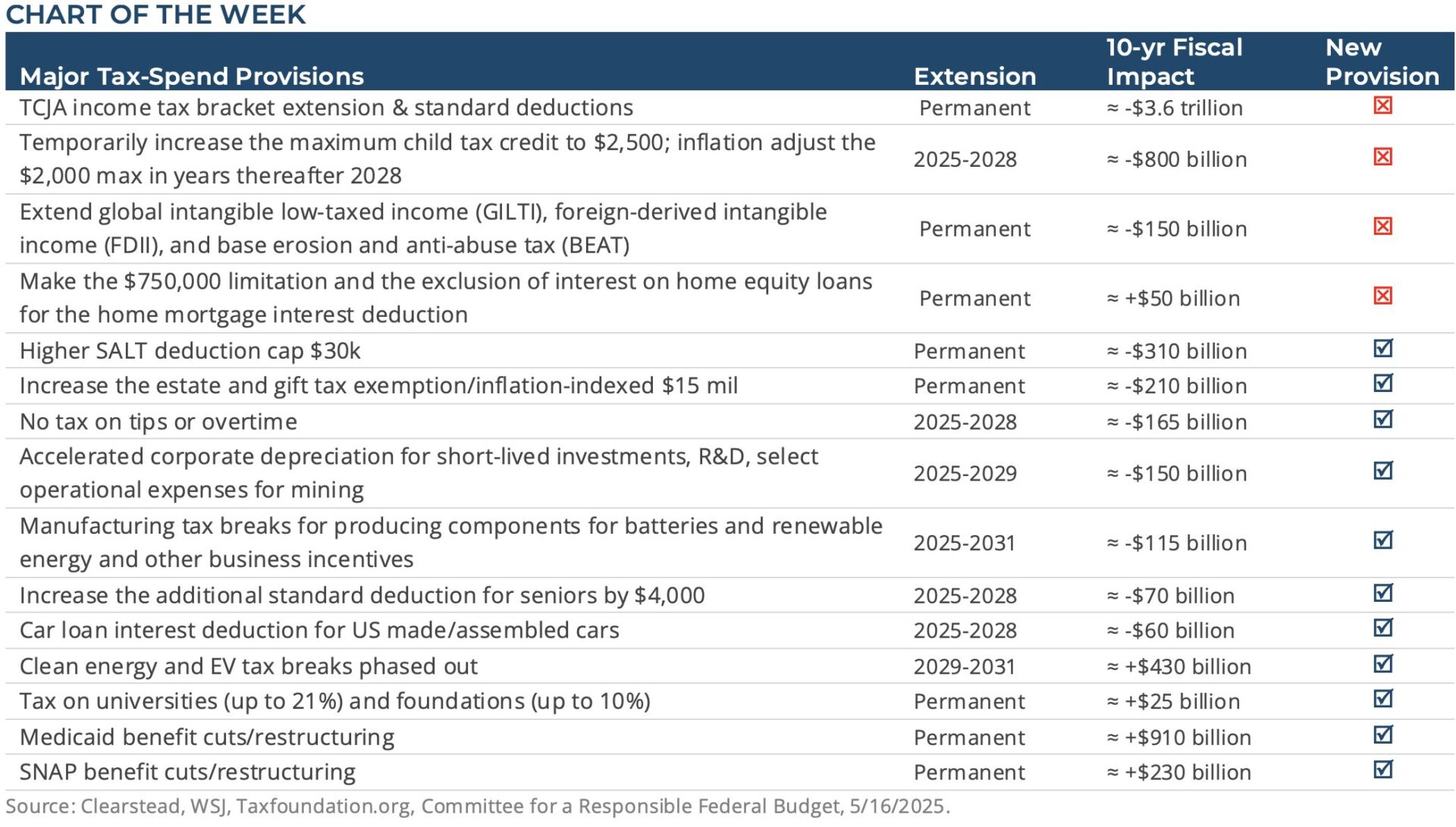

The US House of Representatives’ Ways and Means Committee released a tax plan last week that details how House Republicans plan to extend Trump’s 2017 tax-cuts as well as enact other more recent Trump campaign promises. The release of the draft tax bill kicks off a roughly two-week period of intense negotiations among House Republicans, which will feature real differences around the magnitude of government spending, industrial policy, healthcare subsidies, and other fiscal policies. The bill envisions about $4.0 trillion in reduced government revenue over a decade due to extending the 2017 tax cuts but also including provisions for no taxes on tipped wages, no taxes on overtime, an increase in the SALT deduction to $30k, boosts the child tax credit, and other middle-income and business friendly measures. In order to keep the magnitude of the budget deficits contained, the bill sunsets many of these provisions in 2028 as well as raises new revenues including new or higher taxes on university endowments, remittances sent to foreign countries, and the removal of clean-energy tax credits. Cuts to Medicaid and food assistance (SNAP) benefits also figure into the bill. A vote on the comprehensive reconciliation (tax and spending) bill in the coming weeks could be dicey as House Republicans have only a 220 to 213 majority and therefore can only afford to lose a maximum of three votes. Moderate Republicans may not back the steep cuts to Medicaid and SNAP benefits, while Republican fiscal conservatives are seeking large cuts to overall spending to better calibrate Washington’s deficit spending and blunt the rising levels of national debt. Republicans will look bad if they cannot get a bill over the finish line this summer, and by Memorial Day we should have a sense if the tax bill will get to Trump’s desk for a signature by July or if Congress is in for a long, hot summer.

[1] Bloomberg LP, 5/16/2025

[2] FactSet Earnings Insight 5/16/2025

[3] https://taxfoundation.org/research/all/federal/big-beautiful-bill-house-gop-tax-plan/

Disclosures: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.