OBSERVATIONS

- Markets traded lower last week with the S&P 500 losing -2.6% while small caps lost -3.5% and the yield on the 10-year US Treasury rose to 4.51% as anxiety of US debt levels and deficit spending mounted.[1]

- Existing home sales fell to 4.0 million (annualized rate) in April which is down -2.0% year-over-year (YoY), while new home sales jumped 13.5% in April to 743k, 3.3% higher than one year ago.[1]

- The Architectural Billings Index—a leading indicator of non-residential construction activity—declined to 43.2 in April, an indication that a majority of architectural firms are experiencing a decline in activity consistent with a mild recession. The index has been below 50—denoting weaker activity for a majority of firms—for 28 of the past 31 months with activity particularly depressed for multi-family residential projects.[1]

- Initial unemployment claims remain low and fell 2k last week to 227k, which was better than expected.[1]

EXPECTATIONS

- There was a bevy of Fed speakers last week and they largely reiterated the notion that the Fed was in a good position to wait-and-see how the evolving US tariff policy impacts the economy before changing Fed policy.[1]

- The House of Representatives passed a comprehensive reconciliation bill by one vote last week and the Senate will take up the bill after the Memorial Day holiday and will likely make some changes before it votes. Then a joint House-Senate reconciliation committee will have to bridge any differences in versions between what passed the House and the Senate before a final round of voting expected later this summer.[1]

- About 96% of the S&P 500 has reported thus far. Q1 earnings are set to grow by 12.9% YoY, with about 78% of companies beating earnings estimates which is above the 5-year (77%) and 10-year (75%) averages for earnings beats. This week all eyes will be on Nvidia, which reports results on 28-May.[2]

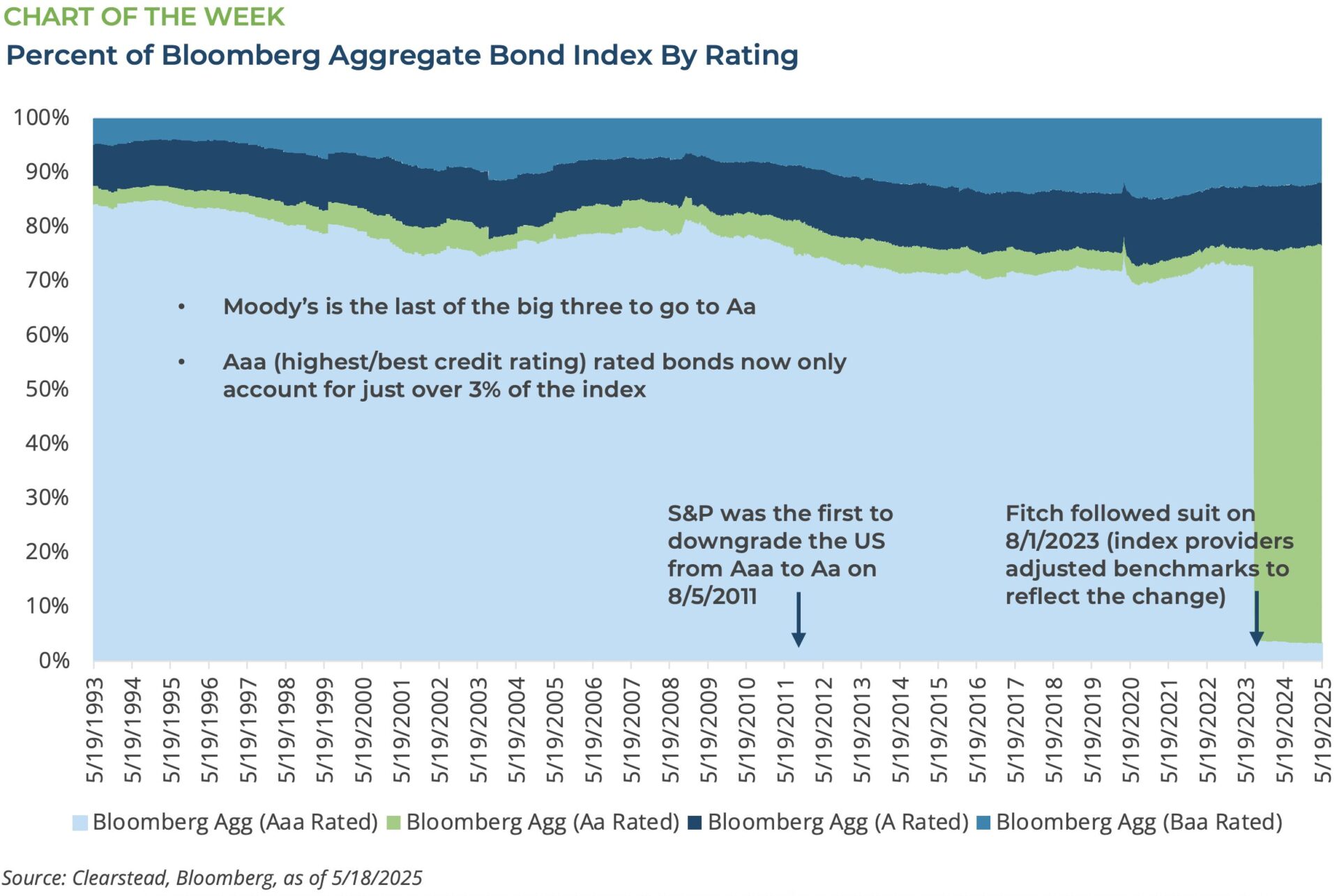

ONE MORE THOUGHT: Moody’s is Late (But Not Wrong)[1]

There is growing angst in the market regarding the US debt levels and fiscal trajectory overall. In recent months, we have seen the US dollar slide against several foreign currencies and the yield on US Treasuries tick higher. Fed Chairman Powell has said on numerous occasions that while the current US government debt level is presently manageable, the trajectory of government spending is on an “unsustainable fiscal path.” Adding to these voices, enter Moody’s—one of the big three global credit agencies, along with Standard & Poor’s (S&P) and Fitch—which downgraded the credit rating of long-term US government debt. Moody’s actions “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” US Treasury Secretary Bessent posited to the media that Moody’s action was a lagging indicator and that the US’s debt levels have been building over decades. In fact, S&P first rang the downgrade bell in August 2011, moving long-term US debt from Aaa to Aa—triple A (Aaa) is the highest credit rating and double-A (Aa) is a notch lower—as US government spending surged in the aftermath of the Great Financial Crisis. Fitch was next to make the move but waited over a decade to see how US debt levels and fiscal policy would evolve. After a series of brinksmanship episodes in Congress over the debt limit, Fitch made the same one notch downgrade in August 2023 citing a growing debt burden and erosion of governance with regard to fiscal matters. With two of three ratings agencies at Aa, benchmark providers moved to re-rate the US from Aaa to Aa in August 2023 within the indexes. As of today, triple-A (Aaa) rated debt is just over 3% of the total index, thirty years ago that figure was 84%. However, over this 30-year period, the US bond market has gone from $4.2tn to $28.8tn over that period (as of 5/19/25). Meanwhile, the S&P 500 index has compounded 14.5% a year since the first debt downgrade in 2011. Nonetheless, it is worth noting that while the credit agencies are often viewed as lagging indicators and nothing cited by Moody’s in its downgrade is novel, the credit agencies are not wrong. The credit risk of the US has steadily increased—it is positively correlated with the level of debt—and the new tax bill (see RC 19-May) that is working its way through Congress (notwithstanding its many pro-business provisions) will unambiguously add to our debt levels over the coming years. We have long noted that the inability of our elected officials from either party to chart a credible path towards a more balanced budget is a cause for concern. While a US debt crisis looks unlikely in the near-term, nor do we judge the US dollar could lose its global reserve currency status, the US will eventually need a reckoning with regard to deficit spending, which puts the country back on a path towards a balanced budget.

[1] Bloomberg LP, 5/23/2025

[2] FactSet Earnings Insight 5/22/2025

DISCLOSURES: Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.