OBSERVATIONS

- Markets were choppy last week but ultimately trading was flat with the S&P 500 losing 0.1% and small caps (Russell 2000) gaining 0.4%, while the yield on the 10-year Treasury lost 2 basis-points to close at 4.38%.[1]

- Retail sales declined by 0.9% month-over-month (MoM) in May, but much of that decline was driven by volatile categories such as gas and autos. Excluding these items, retail sales were only down 0.1% MoM.[1]

- Industrial production, however, also declined in May falling 0.2% MoM—analysts were expecting no change from April—and capacity utilization fell to 77.4% from April’s 77.7% utilization level.[1]

- Homebuilder confidence declined in June falling to 32 from May’s reading of 34 and registered the third lowest reading since 2012—numbers <50 indicates more builders view sales conditions as poor than good.[1]

- Housing starts fell to 1.256 million (annualized rate) in May, which is down nearly 10% MoM from April’s new housing start rate and the lowest rate since June-2020 during the Covid pandemic. Meanwhile, new housing permits also fell in May to 1.393 million—down 2% MoM from April’s permitting rate.[1]

- There were 245k new initial unemployment claims last week, which was down 3k from the week prior. Unemployment claims remain low, but have averaged about 11k more claims each week for the past four weeks compared to the corresponding weeks from 2024.[1]

EXPECTATIONS

- The Fed held interest rates steady last week and noted that the Fed desired to see the extent to which the new tariff policy had on core-inflation prices before making any further adjustments to US monetary policy. Given the significant shift in US tariff policy, Chairman Powell emphasized the Fed should be “humble about our ability to forecast” the impact of the tariff changes on consumer prices and the economy.[1]

- The Senate Finance Committee released a draft of their “One, Big, Beautiful Bill” last week which included larger cuts to Medicaid among several other altered provisions from the House version. At present, there does not seem to be enough votes to pass the bill given the Republican’s three-seat majority in the Senate, so it seems more changes are likely before the Senate attempts a vote before the July 4th holiday recess.[1]

ONE MORE THOUGHT: Little Certainty as to how the Israel-Iran Conflict De-escalates[2]

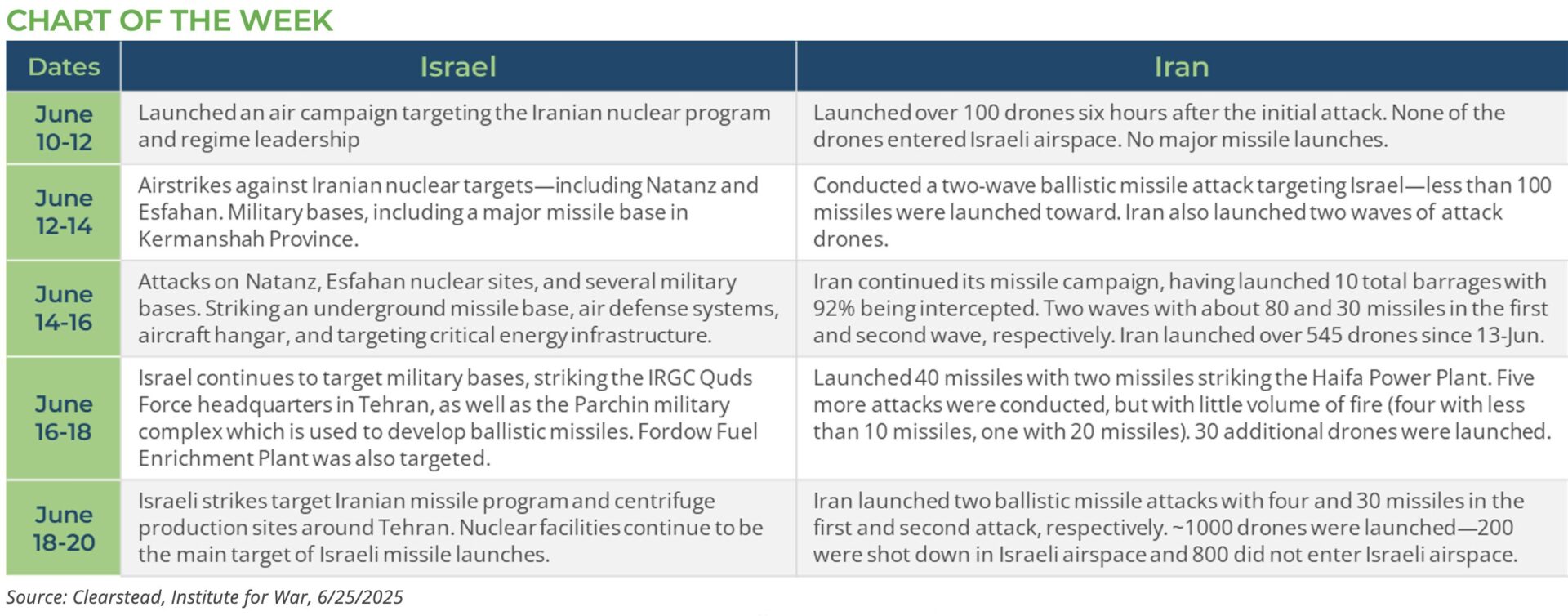

On Friday 13-June, Israel launched a surprise large-scale attack on Iran’s nuclear facilities as well as conventional military targets. This attack came at the tail end of a 60-day push by American negotiators to make a deal with Iranian leaders to fully abandon its nuclear program. As of this publication, the Israel-Iran conflict has gone on for 10-days but will soon reach a crossroads. Initially, Israel targeted time-sensitive targets such as nuclear scientists, senior military commanders including Islamic Revolutionary Guards Corps (IRGC) Commander Hossein Salami and IRGC Aerospace Force Commander Amir Ali Hajizadeh, as well as select air defense systems. Subsequently Israel widened its attacks to include all of Iran’s nuclear facilities that it is able to target given the limitations of its air force—Israel currently lacks long-range, heavy bombers. In addition to the nuclear sites targeted by Israel, the Israeli air force has likely destroyed at least half of all of Iran’s medium-range missile sites—these are the missile systems designed to target Israel—as well as destroying about half of Iran’s medium-range missile supplies and a large portion of its air-defense capabilities. This has resulted in Israeli air superiority in most of the western portion of Iran and has significantly limited Iran’s ability to attack Israel. In the coming days and weeks, it is likely that Israel will be able to extend its air superiority through much of the rest of the country and destroy much of Iran’s remaining stockpiles medium-range missiles as well as their launch sites. In short, in the coming weeks Israel will run out of top-priority targets to hit. Iran, for its part, in the same few weeks will be unlikely to muster much of a response to Israeli fighter jets beyond launching drones. This then leaves Iran’s remaining (known) fortified nuclear facility in Fordow—a nuclear weapons site dug into the side of a mountain about an hour south of Iran’s capital Tehran. Initially President Trump indicated he would give a few weeks to see if a diplomatic process could emerge before acting against the Fordow site, but over the weekend the US Air Force used about a dozen bunker-busting bombs to destroy the Fordow facility as well as a few other nuclear facility sites in Iran. Thus far Iran has remained defiant, with Iranian leadership vowing not to surrender and warned of “irreparable repercussions” if the US joins the fight against them. Iran seems to have begun to take initial steps to close the Straits of Hormuz by deploying their navy but have not yet deployed naval mines to force a full closure. This is significant as about 20% of all oil consumed globally is exported through this seaway. The full closure of this sea route could send the price of crude oil well over $100 per barrel, which would likely further slow global growth. So far, Iran has not signaled it is ready to make significant concessions but escalating the conflict by attacking US bases in the region or closing the Straits of Hormuz, which may invite further actions by the US. History has not been kind to authoritarian regimes that lose wars, and a diplomatic solution seems to be a safer path for Iran’s ayatollahs to remain in power rather than to see if they can weather attacks by both the US and Israel. Nonetheless, the path to de-escalate the conflict does not seem likely in the near-term and the strains on the global economy look set to build over the coming weeks.

[1] Bloomberg LP, 6/20/2025

[2] Institute for the Study of War: Iran Updates 13-June to 22-June

Information provided in this article is general in nature, is provided for informational purposes only, and should not be construed as investment advice. These materials do not constitute an offer or recommendation to buy or sell securities. The views expressed by the author are based upon the data available at the time the article was written. Any such views are subject to change at any time based on market or other conditions. Clearstead disclaims any liability for any direct or incidental loss incurred by applying any of the information in this article. All investment decisions must be evaluated as to whether it is consistent with your investment objectives, risk tolerance, and financial situation. You should consult with an investment professional before making any investment decision. Performance data shown represents past performance. Past performance is not an indicator of future results. Current performance data may be lower or higher than the performance data presented. Performance data is represented by indices, which cannot be invested in directly.